Last Update09 Apr 25Fair value Increased 0.38%

Key Takeaways

- Strategic focus on economic growth and competitiveness underpins future revenue expansion amidst energy transition efforts.

- Increased investments in networks and operational efficiencies anticipate strong earnings and margin improvements due to favorable regulatory conditions.

- Geopolitical risks and regulatory uncertainties, alongside rising costs and market volatility, could hinder E.ON's revenue growth, profitability, and capital investment strategies.

Catalysts

About E.ON- Operates as an energy company in Germany, the United Kingdom, Sweden, the Netherlands, rest of Europe, and internationally.

- The recent federal election in Germany and the EU Commission’s clean industrial deal are expected to renew focus on economic growth and competitiveness, providing impulses for the energy transition, likely driving future revenue growth.

- E.ON is intensifying its investments, with a significant CapEx increase aimed at strengthening its energy networks and infrastructure, which is likely to enhance future earnings.

- Standardization, digitization, and automation are being prioritized within E.ON's operations, increasing operational efficiency and potentially improving net margins.

- There is strong demand for E.ON’s energy retail products and infrastructure solutions, which, combined with the right investment conditions, could lead to higher CapEx and long-term revenue growth.

- Regulatory improvements in depreciation of gas grids and commitment to attractive returns on investments are expected to lead to significant increases in EBITDA and net income, supporting earnings growth.

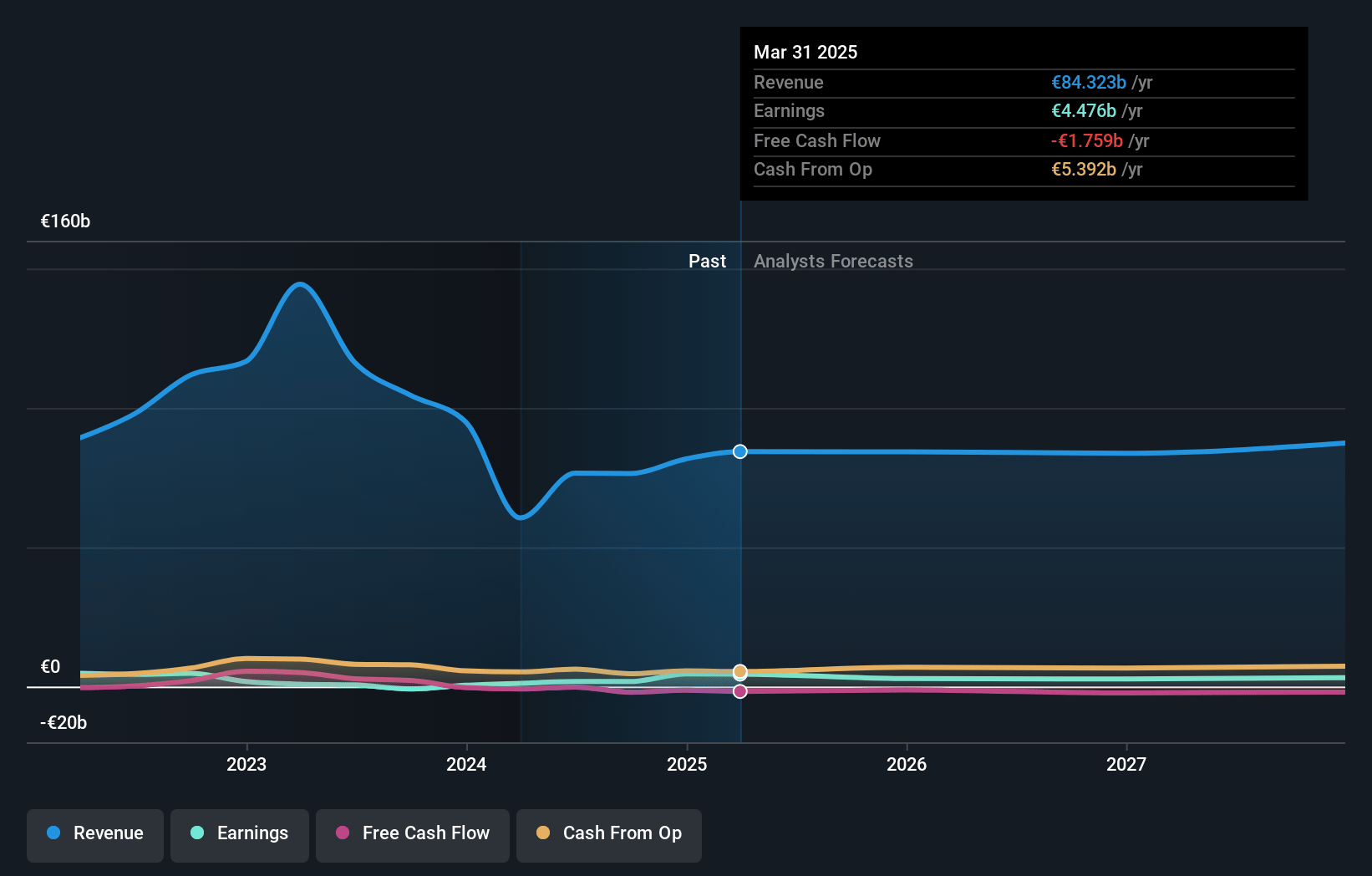

E.ON Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming E.ON's revenue will grow by 4.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.5% today to 3.4% in 3 years time.

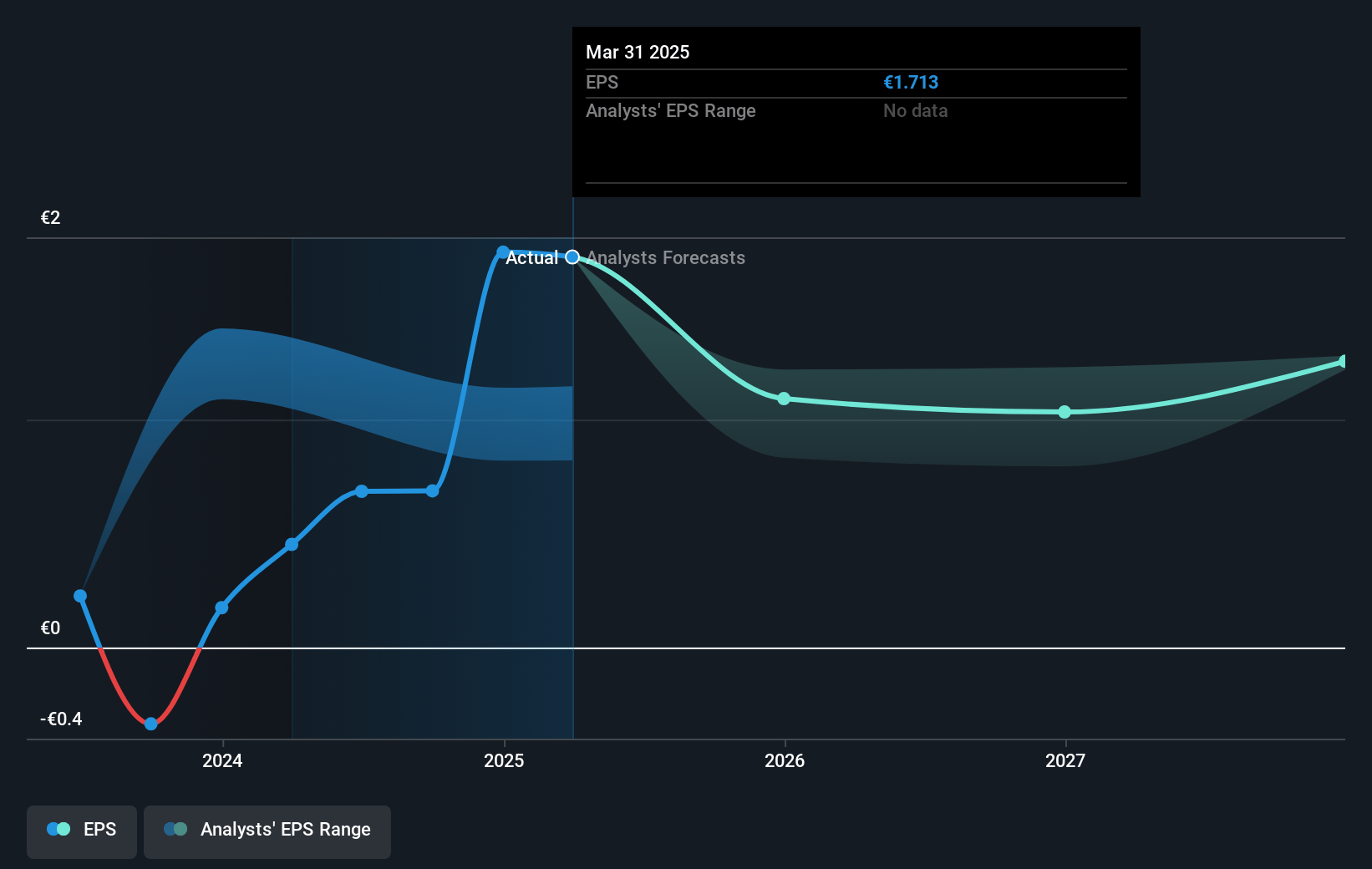

- Analysts expect earnings to reach €3.2 billion (and earnings per share of €1.24) by about April 2028, down from €4.5 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.6x on those 2028 earnings, up from 8.1x today. This future PE is greater than the current PE for the GB Integrated Utilities industry at 14.0x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.55%, as per the Simply Wall St company report.

E.ON Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sustained geopolitical risks, such as the ongoing war in Ukraine, could continue to lead to economic weakness and volatility in energy prices, potentially affecting revenue stability and overall earnings.

- Rising interest rates and energy price volatility, combined with a weak economy, could create a challenging financial environment that impacts borrowing costs and capital expenditure, ultimately affecting net margins and profitability.

- Regulatory uncertainty in Germany and other jurisdictions could limit E.ON's ability to secure attractive returns on capital investments, impacting the company's capacity to increase CapEx as planned, thus affecting long-term earnings growth.

- The possibility of regulatory interventions on electricity grid fees and build-out costs under the new German government could constrain revenue growth and affect the financial attractiveness of future investments.

- Supply chain challenges and workforce demographics, compounded by the need for digitization and infrastructure upgrades, could increase operational costs and complexity, impacting net profit margins and the efficiency of capital allocation.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €15.515 for E.ON based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €18.0, and the most bearish reporting a price target of just €13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €93.7 billion, earnings will come to €3.2 billion, and it would be trading on a PE ratio of 14.6x, assuming you use a discount rate of 4.6%.

- Given the current share price of €14.05, the analyst price target of €15.51 is 9.4% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.