Key Takeaways

- Strong demand in reinsurance, disciplined pricing, and advanced digital capabilities are driving sustained revenue growth and improved margins.

- Conservative reserving and prudent capital management support earnings stability and long-term investor benefits.

- Softening reinsurance market, rising catastrophe losses, Life & Health challenges, reliance on reserves, and currency volatility could pressure profitability, earnings growth, and capital strength.

Catalysts

About Hannover Rück- Provides reinsurance products and services in Germany, the United Kingdom, France, Europe, the United States, Asia, Australia, Africa, and internationally.

- Strong underlying revenue growth in Property & Casualty (P&C) reinsurance—driven by robust demand, diversified new business, and double-digit premium increases—positions Hannover Rück to benefit from the ongoing global rise in insurance penetration, particularly in high-growth regions. This is likely to sustain top-line expansion over the coming years, supporting future revenue gains.

- Persistent structural increases in climate-driven catastrophe losses are fueling demand for reinsurance and enabling disciplined rate adequacy, as evidenced by healthy new business margins and prudent reserve builds. This supports long-term pricing power and is likely to enhance net margins and earnings resiliency despite current market softening.

- Hannover Rück’s conservative and resilient reserving policy, marked by higher-than-average reserve build-up and robust risk adjustment levels, positions it to cushion future volatility and maintain stable combined ratios, providing visibility on future earnings and supporting premium valuation over the long term.

- Advanced digitalization and data analytics initiatives continue to improve underwriting accuracy and operational efficiency, which should drive further margin expansion and expense ratio improvement, supporting sustainable growth in net margins.

- Prudent capital management—with a strongly capitalized balance sheet, high solvency ratios, and a flexible approach to leverage (including hybrid debt reduction)—reinforces Hannover Rück’s capacity to fund growth, secure regulatory advantage, and deliver stable/increasing dividends, ultimately benefiting long-term investor returns and earnings stability.

Hannover Rück Future Earnings and Revenue Growth

Assumptions

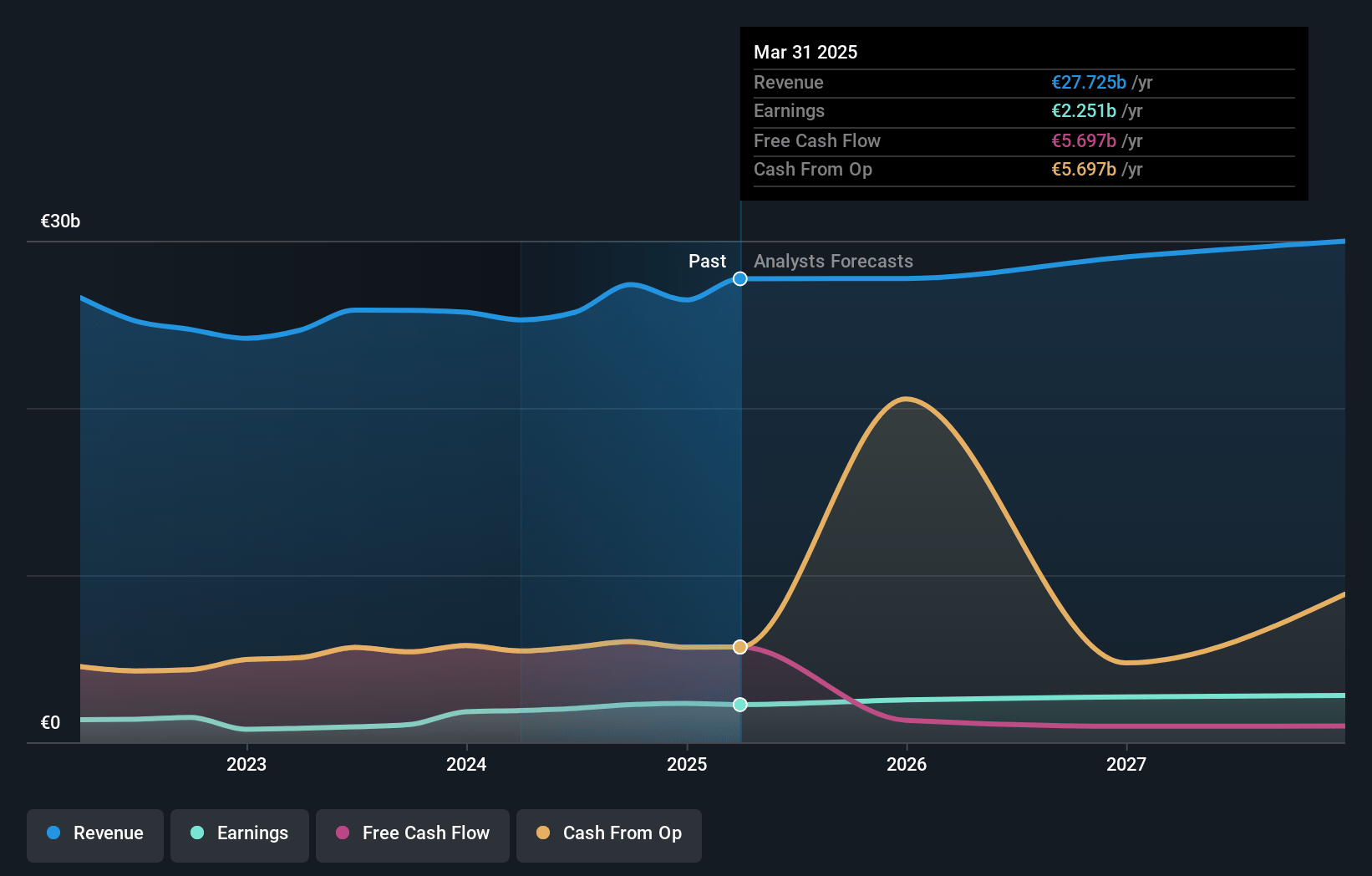

How have these above catalysts been quantified?- Analysts are assuming Hannover Rück's revenue will grow by 3.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 8.1% today to 9.4% in 3 years time.

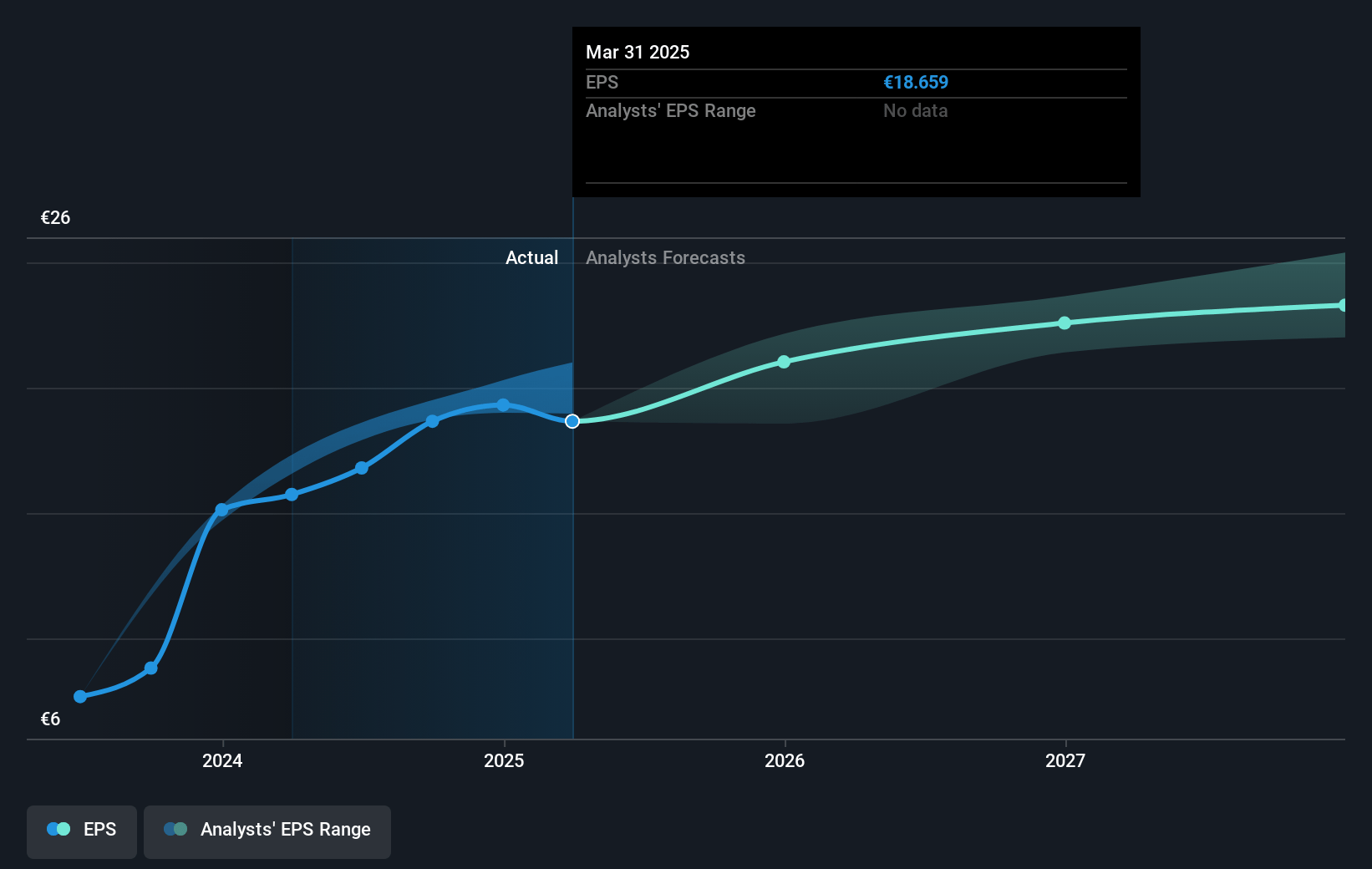

- Analysts expect earnings to reach €2.9 billion (and earnings per share of €23.9) by about May 2028, up from €2.3 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.7x on those 2028 earnings, down from 14.8x today. This future PE is lower than the current PE for the GB Insurance industry at 15.1x.

- Analysts expect the number of shares outstanding to grow by 0.16% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.55%, as per the Simply Wall St company report.

Hannover Rück Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing abundance of reinsurance capacity and limited new capital inflows are contributing to property premium rate declines (e.g., a 2.4% risk-adjusted price decrease in recent renewals), signaling softening market cycles that may pressure Hannover Rück’s top-line revenue growth and underwriting margins if softening persists.

- Heightened volatility and frequency of large natural catastrophe events, as evidenced by the significant L.A. wildfire loss that exceeded budget, increases the risk of further earnings volatility and higher combined ratios; if cat losses outpace risk-adjusted pricing and reserving buffers, profitability and net earnings could decline.

- Declining revenues in the Life & Health reinsurance segment (e.g., -4.1% Q1 YoY on USD mortality and regulatory headwinds in China) and selective participation in longevity deals due to unattractive profitability, signal possible structural challenges to segment growth and diversification, potentially impacting future earnings resilience.

- Increased reliance on prudent reserve releases and resiliency build to stabilize results during adverse market cycles indicates dependency on past reserve strength; this strategy may mask potential underlying profitability deterioration, exposing net margins and earnings to risk if adverse claims developments or market shocks persist.

- Persistent currency volatility and a strong Euro relative to other major currencies can erode reported shareholder equity and investment returns, impacting capital adequacy metrics and dampening investment income—thus limiting overall growth in earnings and book value.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €284.0 for Hannover Rück based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €330.0, and the most bearish reporting a price target of just €220.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €30.4 billion, earnings will come to €2.9 billion, and it would be trading on a PE ratio of 13.7x, assuming you use a discount rate of 4.6%.

- Given the current share price of €276.0, the analyst price target of €284.0 is 2.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.