Key Takeaways

- Shift to higher-margin digital services and sustainable solutions drives margin expansion, strong earnings, and positions GEA to benefit from industry decarbonization and regulatory trends.

- Operational excellence, strong order pipeline, and diversified global backlog enable resilient long-term growth, cash generation, and flexibility for future investment.

- Overreliance on volatile large orders, sector concentration, and inability to offset rising costs threaten long-term growth, margin stability, and resilience to external shocks.

Catalysts

About GEA Group- Produces and supplies systems and components to the food, beverage, and pharmaceutical industries worldwide.

- Structural shift toward higher-margin recurring service revenues—now at a record 41.7% of sales and growing in all divisions—reflects increased digitalization, predictive maintenance, and connected equipment offerings, supporting continued EBITDA margin and net earnings improvement.

- Sustained order momentum and new large contracts in dairy processing, food, and healthcare demonstrate strong long-term demand visibility driven by global population growth, urbanization, and stricter food/pharma safety standards, underpinning mid-to-high single-digit organic revenue growth potential.

- Rising customer adoption of energy-efficient and sustainable processing solutions, evidenced by strength in Heating & Refrigeration and continued investment in project and portfolio optimization, positions GEA to benefit from decarbonization trends, fueling both sales growth and margin expansion.

- Ongoing operational excellence initiatives—visible in improved working capital efficiency, reduced operating costs, and strong cash conversion ratios—are structurally supporting higher ROCE and free cash flow generation, enabling continued investment and potential future buybacks.

- Strong execution in automation, digital services, and plant-based/new food verticals, coupled with limited tariff/pass-through risk and a robust, diversified global backlog, reduce macro/geopolitical downside and provide multiple long-term growth catalysts likely to increase both revenues and profitability.

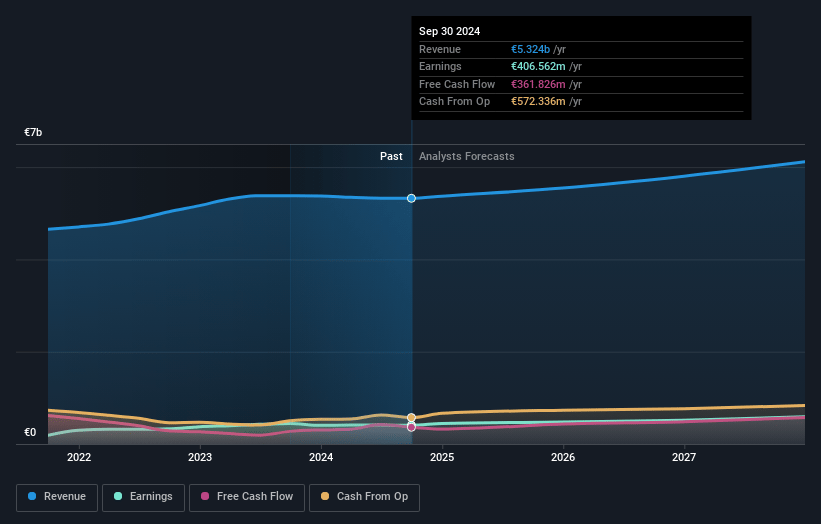

GEA Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming GEA Group's revenue will grow by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 9.2% in 3 years time.

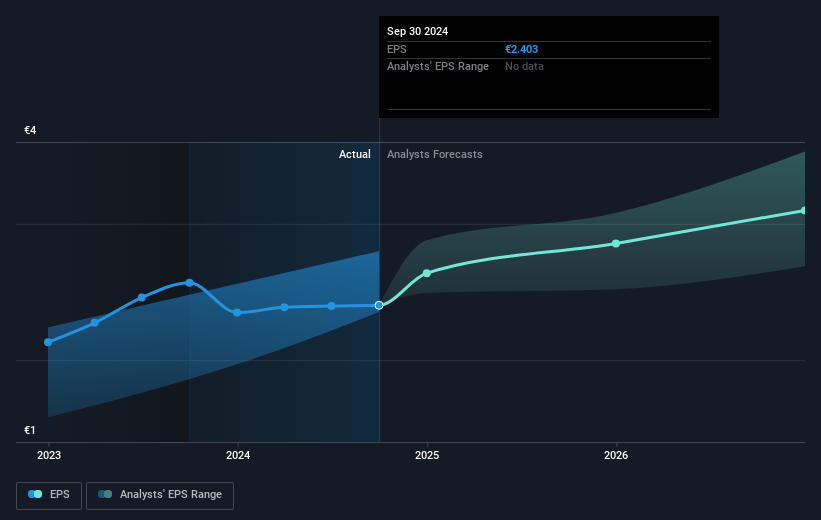

- Analysts expect earnings to reach €565.3 million (and earnings per share of €3.5) by about May 2028, up from €402.3 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as €504.2 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 16.2x on those 2028 earnings, down from 23.3x today. This future PE is lower than the current PE for the GB Machinery industry at 17.7x.

- Analysts expect the number of shares outstanding to decline by 3.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.57%, as per the Simply Wall St company report.

GEA Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Organic new machine sales declined by 4.9% year-over-year and the company’s overall new equipment sales have underperformed compared to strong service sales growth, suggesting a potential long-term risk if core machinery demand does not recover; this could hinder long-term revenue growth and installed base expansion, eventually impacting recurring service revenues as well.

- Management noted that the extraordinary spike in large orders towards the end of 2024, which buoyed order intake, is not sustainable or a new normal; future lulls in large orders could result in volatile revenue streams and expose the company to lower earnings in periods without such lump-sum wins.

- GEA’s performance is heavily concentrated in the dairy processing and related food segments, especially within Europe and North America, making the company's revenue vulnerable to cyclical downturns in these specific sectors and leaving it exposed to sector-specific disruptions that could suppress both revenue and margin growth.

- The outlook references ongoing geopolitical uncertainty—specifically, tariff regimes between the US and Europe. While currently “limited,” the risk of worsening protectionism, new tariffs, or deglobalization could harm GEA’s largely export-driven business model, reducing future sales and squeezing net margins if costs cannot be fully passed onto customers.

- Management expects to only recover about 50% of input cost inflation via pricing in 2025, indicating persistent margin pressure; inability to fully offset rising costs could erode net margins and earnings quality, especially in a market environment characterized by greater commoditization and price competition in industrial machinery.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €53.387 for GEA Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €65.0, and the most bearish reporting a price target of just €45.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €6.1 billion, earnings will come to €565.3 million, and it would be trading on a PE ratio of 16.2x, assuming you use a discount rate of 5.6%.

- Given the current share price of €57.5, the analyst price target of €53.39 is 7.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.