Key Takeaways

- Streamlining through divestments and mergers aims to enhance profitability, boost margins, and improve net income potential.

- Strategic focus on sustainable automation and green technologies aligns with global trends, offering growth in revenue and demand.

- The sale of a high-performing business and macroeconomic challenges could dilute Dürr's margins, limiting growth and impacting future profitability.

Catalysts

About Dürr- Operates as a mechanical and plant engineering company worldwide.

- Dürr's strategy of focusing on sustainable automation by selling non-core operations and consolidating divisions aims to streamline its structure, potentially driving higher profitability and improving net margins.

- The company plans to leverage operational improvements, such as synergies from division merges and cost-saving measures (like HOMAG's capacity reduction), which could enhance earnings resilience and contribute to margin growth.

- Increasing demand for automation solutions, driven by the shortage of skilled labor, presents a revenue growth opportunity for Dürr, particularly in its Industrial Automation division.

- Dürr's strategic investments in green technologies and efforts to reduce its clients' CO2 emissions are aligned with global sustainability trends, potentially leading to increased demand for its products and influencing long-term revenue growth.

- The divestment of the Environmental business and reinvestment into core operations could free capital for growth initiatives, boosting the company's return on capital employed and enhancing net income potential.

Dürr Future Earnings and Revenue Growth

Assumptions

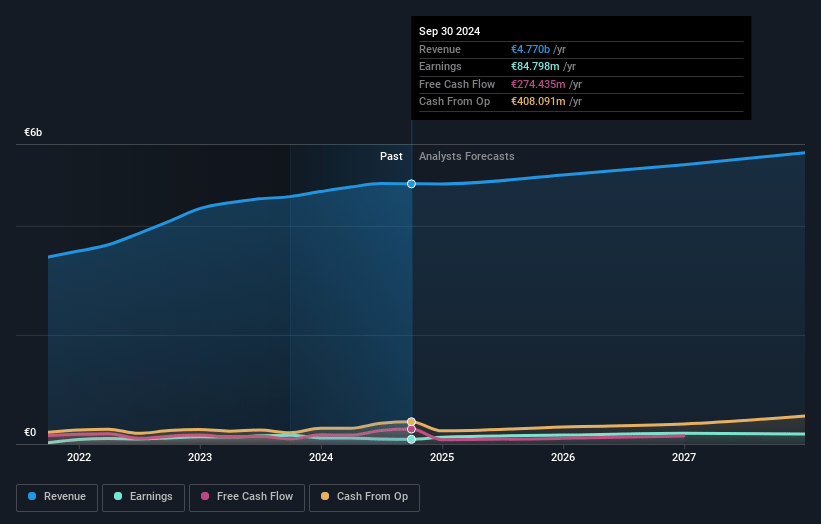

How have these above catalysts been quantified?- Analysts are assuming Dürr's revenue will grow by 6.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.4% today to 4.1% in 3 years time.

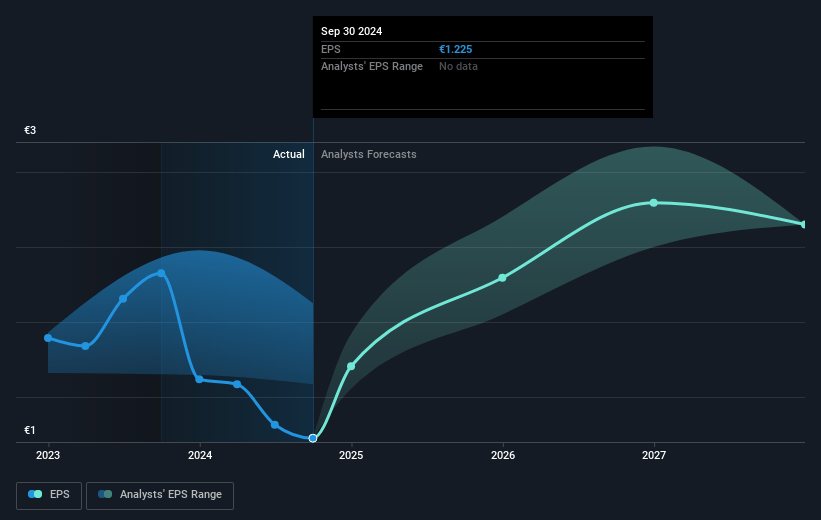

- Analysts expect earnings to reach €209.0 million (and earnings per share of €3.02) by about May 2028, up from €61.8 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting €244 million in earnings, and the most bearish expecting €170 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.2x on those 2028 earnings, down from 23.2x today. This future PE is lower than the current PE for the GB Machinery industry at 18.7x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.26%, as per the Simply Wall St company report.

Dürr Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The sale of the Environmental business, which has been achieving strong growth and good margins, could lead to a dilution of the overall group margin, impacting future profitability and earnings.

- The expectation of only moderate growth in sales revenues and the potential for a slowdown in the global economy could limit revenue growth and negatively impact earnings.

- The higher interest and tax expenses have already negatively impacted net income, and with interest expenses expected to remain flat and tax rates anticipated to be between 30% and 35%, net margins could be constrained.

- Risk of project delays and weaker demand in production automation, particularly in the HOMAG division, which experienced a 13% decline in sales, could impact revenue growth and net margins if the market does not recover as expected.

- The potential impact of trade tariffs and macroeconomic uncertainties on global operations, particularly in high-labor cost regions such as the U.S. and Europe, could affect revenues and profits due to increased operational costs.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of €29.875 for Dürr based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of €40.0, and the most bearish reporting a price target of just €22.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be €5.1 billion, earnings will come to €209.0 million, and it would be trading on a PE ratio of 12.2x, assuming you use a discount rate of 7.3%.

- Given the current share price of €20.75, the analyst price target of €29.88 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.