Last Update14 Jul 25Fair value Increased 45%

Analyst sentiment on Grupo Argos has shifted markedly, with the consensus price target raised to COP26,100 despite a sharp decline in revenue growth outlook and a steep rise in the future P/E ratio, indicating increased optimism on valuation drivers beyond near-term earnings.

VALUATION CHANGES

Summary of Valuation Changes for Grupo Argos

- The Consensus Analyst Price Target has significantly risen from COP17960 to COP26100.

- The Future P/E for Grupo Argos has significantly risen from 7.33x to 77.45x.

- The Consensus Revenue Growth forecasts for Grupo Argos has significantly fallen from 22.8% per annum to -18.6% per annum.

Key Takeaways

- The strategic shift towards construction materials and infrastructure, complemented by a focus on financial flexibility, aims to enhance Grupo Argos's operational efficiency and growth potential.

- Investments in high-value geographies and renewable energy strengthen growth prospects, while reducing debt risks, positioning the company for improved profitability.

- Grupo Argos's strategic investments and market expansions in infrastructure and energy position it for increased revenues, profitability, and shareholder returns through improved operational execution and financial flexibility.

Catalysts

About Grupo Argos- An infrastructure holding company, engages in cement business.

- The planned split-off agreement with Grupo Sura aims to allow Grupo Argos to focus on the construction materials and infrastructure sectors. This strategic move is expected to enhance operational efficiency, which could positively impact future earnings as the company narrows its focus (Net margins, earnings).

- Cementos Argos is expected to reinvest proceeds from its Summit disinvestment into the construction materials sector, considering potential investments in the U.S. This capital reallocation is aimed at driving growth in high-value geographies, which can boost revenue and profitability (Revenue, net margins).

- Odinsa's expansive project portfolio, including major infrastructure projects in Colombia like the El Dorado Airport expansion and new airport developments, if approved, represents a significant growth opportunity, potentially increasing future revenue and earnings (Revenue, earnings).

- Celsia's continued investment in nonconventional renewable energy, including solar and wind projects in Colombia and abroad, signals a strong growth trajectory in the energy sector, which could stabilize and increase future EBITDA and net profits (EBITDA, net margins).

- The company's strategic focus on reducing net debt and maintaining a strong capital structure post-disinvestments enhances financial flexibility. This solid foundation is likely to support sustained growth and possibly improve net margins and earnings due to reduced financial costs (Net margins, earnings).

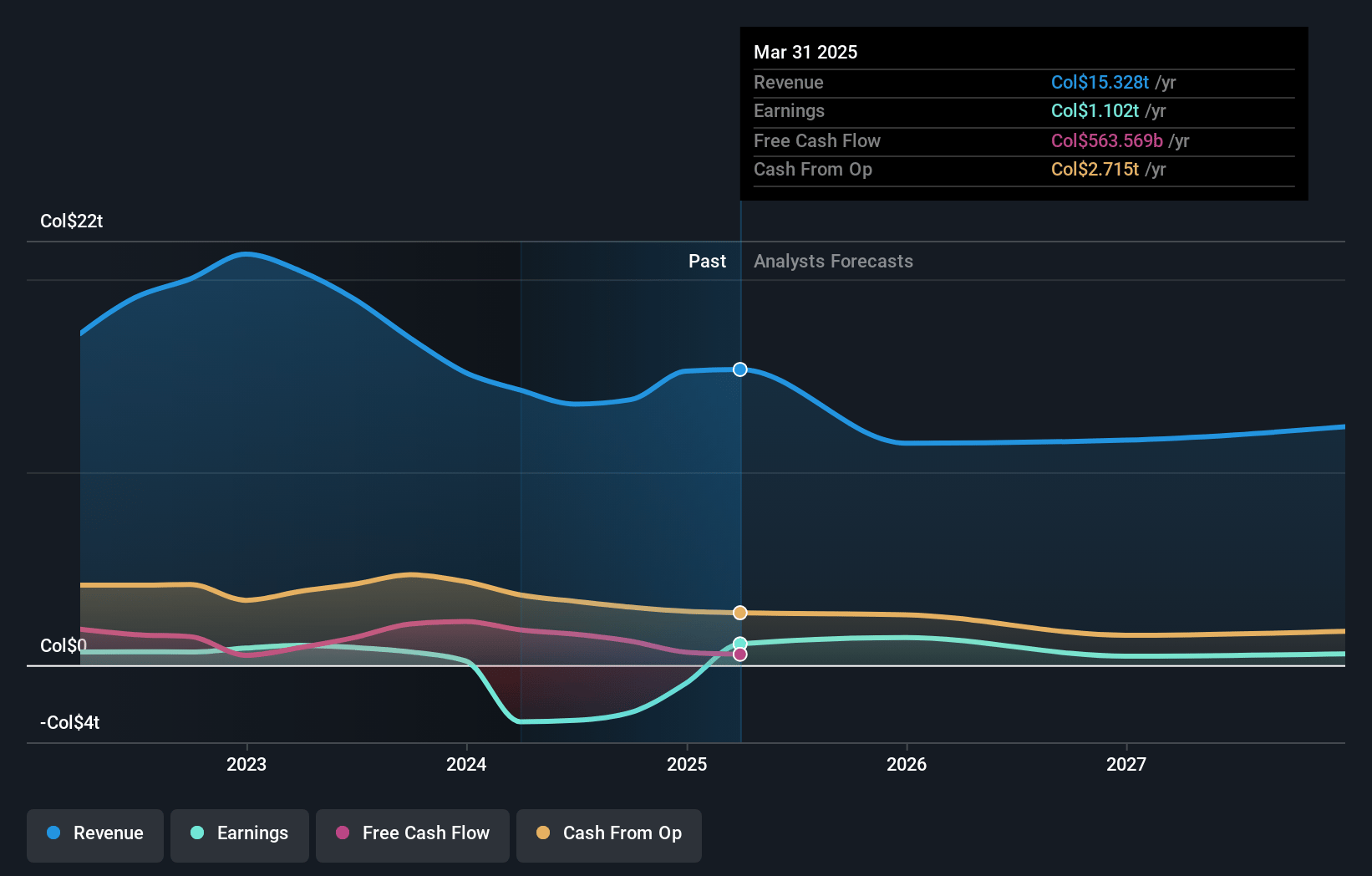

Grupo Argos Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Grupo Argos's revenue will grow by 22.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -6.2% today to 10.9% in 3 years time.

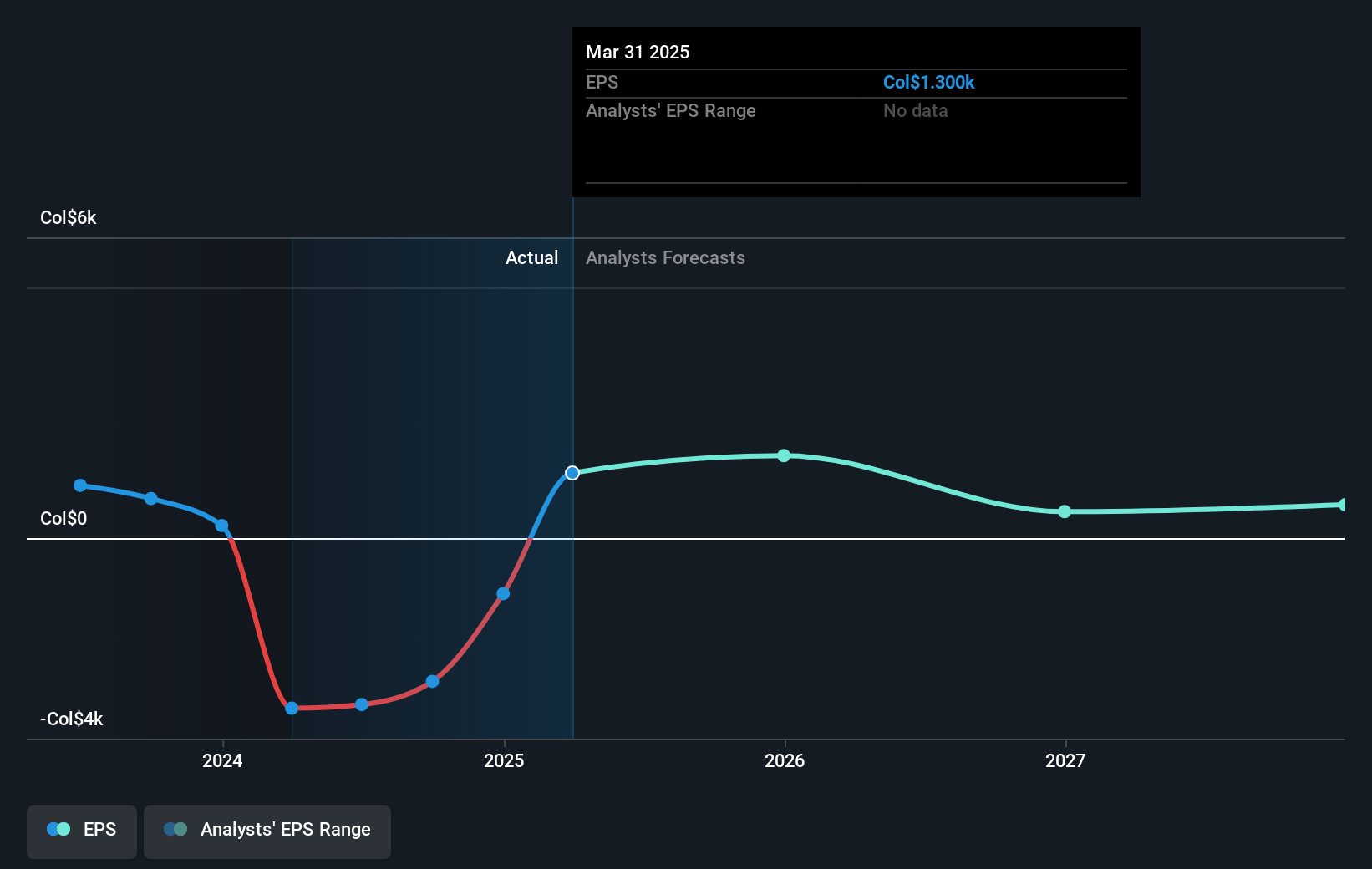

- Analysts expect earnings to reach COP 3070.2 billion (and earnings per share of COP 3535.39) by about April 2028, up from COP -944.6 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 7.3x on those 2028 earnings, up from -18.7x today. This future PE is lower than the current PE for the CO Basic Materials industry at 216.8x.

- Analysts expect the number of shares outstanding to decline by 2.47% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.48%, as per the Simply Wall St company report.

Grupo Argos Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Grupo Argos is focusing on infrastructure and construction materials, supported by an ambitious investment plan estimated at COP 4 trillion. This strategic focus and investment have the potential to boost revenues and profit margins as the company capitalizes on its 90-year expertise and expanded infrastructure projects.

- Cementos Argos saw an 82% increase in its preferential stock and a 67% rise in its ordinary share during 2024, indicating strong investor confidence and potential continued gains in share value, positively impacting net profit and earnings.

- Celsia’s entry into the Peruvian market and the continued expansion of renewable energy projects, such as solar and wind installations, indicate a diversification of revenue streams and long-term growth potential, which could support stable or improved net margins.

- Odinsa's portfolio, including the expansion of El Dorado Airport and other significant infrastructure projects, represents a potential pipeline of high-value contracts, likely to increase revenue and EBITDA as infrastructure demand grows.

- Grupo Argos has improved its debt position substantially, moving towards a net debt-positive status with more cash than debt, which increases financial flexibility and could sustain profitability and shareholder returns through dividend growth and strategic reinvestment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of COP17850.0 for Grupo Argos based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of COP23500.0, and the most bearish reporting a price target of just COP12200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be COP28244.8 billion, earnings will come to COP3070.2 billion, and it would be trading on a PE ratio of 7.3x, assuming you use a discount rate of 17.5%.

- Given the current share price of COP21000.0, the analyst price target of COP17850.0 is 17.6% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.