Catalysts

About Shenzhen Inovance TechnologyLtd

Shenzhen Inovance TechnologyLtd provides industrial automation solutions and power electronics systems for new energy vehicles and smart manufacturing.

What are the underlying business or industry changes driving this perspective?

- Intensifying global competition in industrial automation, particularly from entrenched European and Japanese incumbents with stronger software stacks, may cap Inovance’s ability to win higher value projects abroad and slow revenue growth from overseas markets that management is counting on to scale beyond the CNY 40 billion level. This could pressure long term top line expansion.

- Escalating price wars and customer insourcing in China’s new energy vehicle supply chain, combined with lower margin electric powertrain products gaining mix, risk a structural deterioration in automotive gross margins even if volumes grow. This may compress group level gross margin and limit net margin improvement.

- Heavy and rising research and development investment into intelligent robots and digital energy management, before clear commercialization pathways or repeatable use cases are proven, could lead to prolonged periods where new business units consume cash without meaningful contribution. This may depress earnings growth and returns on invested capital.

- Ambitious overseas capacity buildout in Europe and Southeast Asia, including new plants and localized research and development for compliance, may outpace actual demand if brand acceptance lags. This could leave utilization low and add depreciation and fixed costs that dilute operating margins.

- Dependence on cyclical capital expenditure in process industries, semiconductors and lithium batteries for high margin PLC and servo growth leaves the automation segment vulnerable to a downturn in global manufacturing investment. This could flatten revenue and stall the recent improvement in core profit rate and earnings.

Assumptions

This narrative explores a more pessimistic perspective on Shenzhen Inovance TechnologyLtd compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

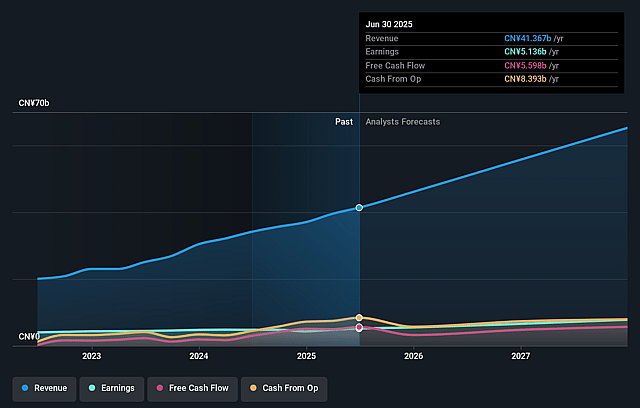

- The bearish analysts are assuming Shenzhen Inovance TechnologyLtd's revenue will grow by 13.7% annually over the next 3 years.

- The bearish analysts are assuming Shenzhen Inovance TechnologyLtd's profit margins will remain the same at 12.0% over the next 3 years.

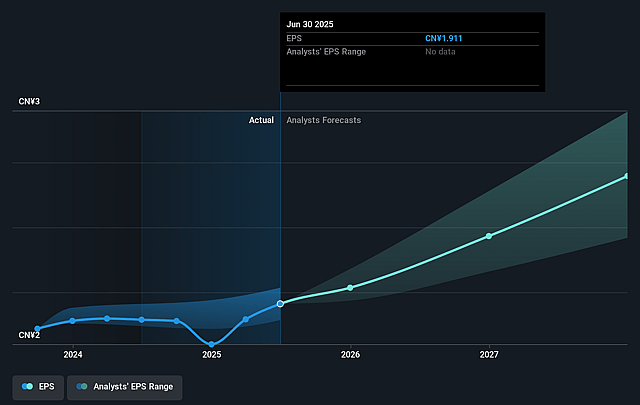

- The bearish analysts expect earnings to reach CN¥7.6 billion (and earnings per share of CN¥2.83) by about December 2028, up from CN¥5.2 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as CN¥10.4 billion.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 29.2x on those 2028 earnings, down from 38.5x today. This future PE is lower than the current PE for the CN Machinery industry at 47.0x.

- The bearish analysts expect the number of shares outstanding to decline by 0.49% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.31%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- Management continues to describe Industrial Automation and New Energy Vehicles as golden tracks, and the business has already exceeded CNY 40 billion in annual revenue with 25 percent year on year growth in the first three quarters of 2025. This suggests secular demand and scale benefits that could support sustained revenue and earnings growth rather than a prolonged share price decline.

- The company is rapidly expanding into overseas markets where the automation total addressable market is two to three times larger than China. It has already built local teams of around 700 staff with new plants in Thailand, Hungary and North America, so rising international penetration and diversification could offset domestic pricing pressure and support long term revenue expansion.

- Heavy and rising R&D investment of roughly CNY 3 billion in the first three quarters of 2025, equal to 9.5 percent of revenue, is being directed into higher value software, intelligent robots, digital platforms and intelligent automotive chassis. This could create new high margin growth engines that lift future net margins and earnings.

- Within Industrial Automation, higher margin products such as PLCs, servos, industrial robots and precision machinery are growing faster than the segment average and have already helped improve core profit rate. This means product mix upgrades and cost efficiencies could stabilize or expand group level gross margin and support healthier net profit growth.

- The company is positioning Intelligent Robots and Digital Energy Management as new strategic business units alongside its two existing core segments. Early customer interest plus long term trends in AI, humanoid automation and dual carbon energy transition could add incremental, secular revenue streams that reduce cyclicality and strengthen long term earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Shenzhen Inovance TechnologyLtd is CN¥66.22, which represents up to two standard deviations below the consensus price target of CN¥87.5. This valuation is based on what can be assumed as the expectations of Shenzhen Inovance TechnologyLtd's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥104.41, and the most bearish reporting a price target of just CN¥56.0.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be CN¥63.6 billion, earnings will come to CN¥7.6 billion, and it would be trading on a PE ratio of 29.2x, assuming you use a discount rate of 8.3%.

- Given the current share price of CN¥73.9, the analyst price target of CN¥66.22 is 11.6% lower. Despite analysts expecting the underlying business to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Shenzhen Inovance TechnologyLtd?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.