Last Update 05 Sep 25

Fair value Decreased 0.034%Middle-Class Expansion And Digital Transformation Will Reshape Markets

China Merchants Bank's key valuation metrics, including Discount Rate and Future P/E, were virtually unchanged, resulting in a negligible decrease in the consensus analyst price target from CN¥52.13 to CN¥52.11.

What's in the News

- Board meeting scheduled to approve interim results for H1 2025 and consider interim dividend.

- Approved by regulators to prepare for establishment of CMB Financial Asset Investment Co., Ltd. as a wholly-owned subsidiary focused on debt-to-equity swaps and equity investments.

- Approved final dividend of RMB 2 per share for FY 2024.

- Board meeting held to elect new chairman, vice chairpersons, appoint senior management, and reconstitute board committees.

- Approved revision of Articles of Association at Annual General Meeting.

Valuation Changes

Summary of Valuation Changes for China Merchants Bank

- The Consensus Analyst Price Target remained effectively unchanged, moving only marginally from CN¥52.13 to CN¥52.11.

- The Discount Rate for China Merchants Bank remained effectively unchanged, moving only marginally from 8.39% to 8.51%.

- The Future P/E for China Merchants Bank remained effectively unchanged, moving only marginally from 9.97x to 10.00x.

Key Takeaways

- Growth in wealth management and diversified income streams, supported by a rising middle class, is enhancing earnings quality and reducing reliance on traditional interest income.

- Investments in digital transformation, prudent risk management, and focus on high-growth sectors are improving operational efficiency and stabilizing asset quality.

- Slowing retail growth, intensifying competition, and rising credit risk threaten net margins, non-interest income, and future profitability, while regulatory pressures may limit expansion.

Catalysts

About China Merchants Bank- Provides various banking products and services.

- The ongoing expansion of China's middle class and rising affluence continues to drive new customer acquisition and record-high growth in assets under management (AUM), supporting future increases in fee-based income, wealth management revenues, and retail banking profit contribution.

- Accelerated investments in AI, digital transformation, and an integrated People + Technology model have begun to improve operational efficiency, enable product innovation in wealth management and payments, and are positioned to further reduce operating expenses and strengthen net margins over time.

- The transition to a business mix with a greater emphasis on wealth management and diversified non-interest income streams-evidenced by the strong recovery in wealth management fees and expanding customer base-is likely to sustainably boost earnings quality and reduce sensitivity to net interest margin (NIM) compression.

- CMB's prudent risk management framework and industry-leading asset quality, combined with strategic focus on high-growth segments like technology, green industries, and high-quality corporate lending, should help contain credit costs and stabilize provisioning, supporting future profit growth.

- Ongoing urbanization and infrastructure investment in key economic regions, coupled with CMB's leading position in corporate, retail, and cross-border financial services, are expected to drive loan growth and diversified revenue contributions as China's economy continues its gradual recovery.

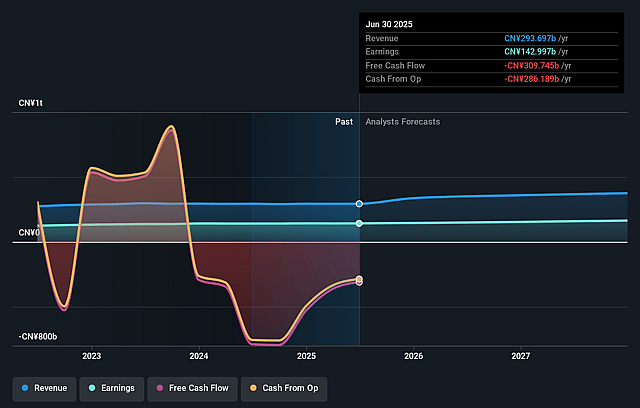

China Merchants Bank Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming China Merchants Bank's revenue will grow by 11.6% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 48.7% today to 41.1% in 3 years time.

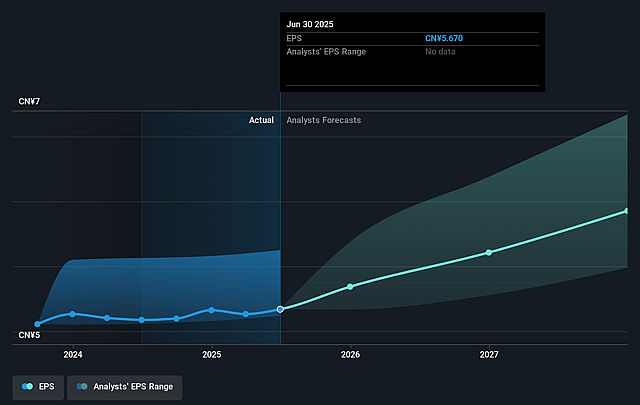

- Analysts expect earnings to reach CN¥167.8 billion (and earnings per share of CN¥6.5) by about September 2028, up from CN¥143.0 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CN¥149.7 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.0x on those 2028 earnings, up from 7.6x today. This future PE is greater than the current PE for the CN Banks industry at 6.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.39%, as per the Simply Wall St company report.

China Merchants Bank Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent downward pressure on net interest margin (NIM), due to CMB's already industry-leading low funding costs and high demand deposit ratio, means there is limited room to further reduce funding costs; as market asset yields continue to decline with a low interest rate environment, this is likely to drive ongoing NIM compression and weaken net margins over time.

- Sluggish demand in retail lending, reflective of slowing demographic growth, an aging population, and declining resident incomes in China, is pressuring both loan growth and fee income from core segments such as mortgages, credit cards, and consumer loans, thereby constraining revenue and potentially profitability.

- Intensified competition from non-traditional financial institutions (such as third-party payment providers and fintechs) and government-driven fee and rate reductions are eroding fee-based and payment-related income, particularly in credit card and settlement businesses, weighing on non-interest revenue growth and net margins.

- Deterioration in retail asset quality, with persistent or rising non-performing loan (NPL) ratios in segments like credit cards and microfinance, signals heightened credit risk exposure for CMB's large retail book; if macroeconomic headwinds persist, this could increase provisions and impair earnings.

- The potential culmination of rapid historic asset growth-especially as CMB shifts focus to corporate lending to counter weak retail demand-may limit future asset expansion opportunities; coupled with tighter regulatory capital requirements and the challenges of maintaining high capital adequacy ratios, this could constrain CMB's top-line growth and long-term return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CN¥52.128 for China Merchants Bank based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CN¥60.0, and the most bearish reporting a price target of just CN¥38.68.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CN¥408.2 billion, earnings will come to CN¥167.8 billion, and it would be trading on a PE ratio of 10.0x, assuming you use a discount rate of 8.4%.

- Given the current share price of CN¥42.9, the analyst price target of CN¥52.13 is 17.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.