Narratives are currently in beta

Key Takeaways

- Acquisitions and expansions in Peru and Chile boost growth potential, enhancing Plaza's regional presence and revenue streams.

- Strategic alliances and omnichannel enhancements drive footfall and tenant sales, while maintaining strong net margins through economies of scale.

- Rising administrative costs, integration risks from an acquisition, and exchange rate fluctuations pose threats to Plaza's margins and financial stability.

Catalysts

About Plaza- Develops, builds, administers, manages, exploits, leases, and sublets premises and spaces in shopping centers.

- Mallplaza's acquisition of Falabella Perú's malls is set to consolidate its presence in Peru, potentially increasing revenue and enhancing its leadership position in the Andean region through significant expansions in GLA and market presence.

- High occupancy rates and robust demand for spaces, especially in new markets like Peru and established ones like Chile, are expected to drive revenue growth through increased lease revenues and improved same-store rent figures.

- The ongoing organic growth plans, which include adding significant scale to key urban centers and expanding experiential offerings, are likely to impact future revenue and contribute to maintaining or enhancing net margins through economies of scale.

- The company's strategic alliances with well-known global brands and expansion of omnichannel capabilities, like Click&Collect services and digital parking solutions, are set to not only boost footfall but also drive higher tenant sales, ultimately increasing revenue.

- Despite current low leverage, expected leverage post-acquisition aligns with historical levels, suggesting room for further acquisitions and capital investments to fuel growth and potentially enhance earnings due to greater market share and operational efficiencies.

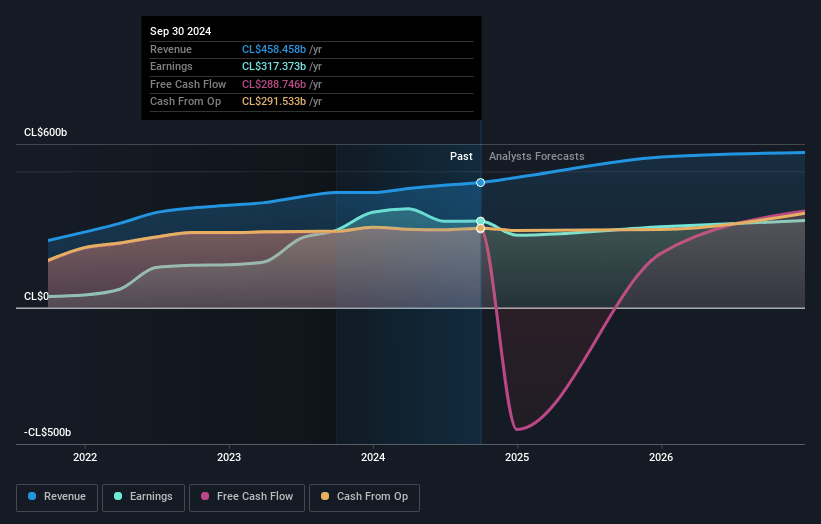

Plaza Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Plaza's revenue will grow by 10.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 69.2% today to 52.1% in 3 years time.

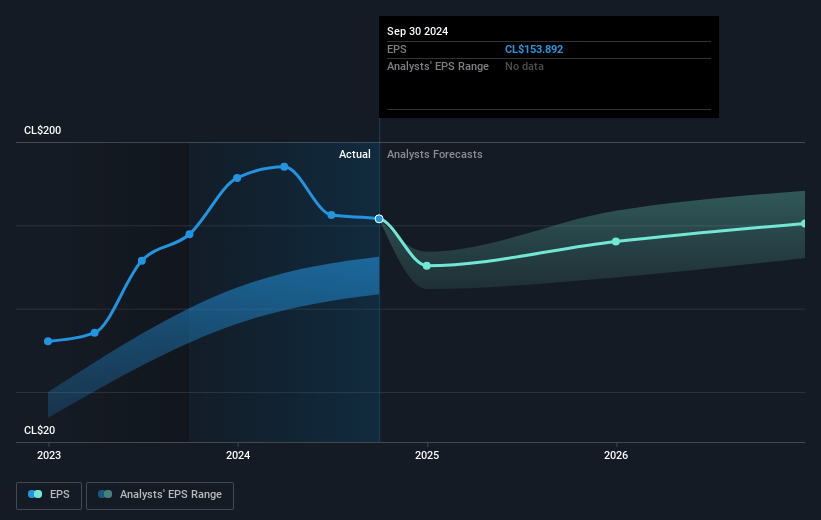

- Analysts expect earnings to reach CLP 324.0 billion (and earnings per share of CLP 152.17) by about January 2028, up from CLP 317.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CLP 373.9 billion in earnings, and the most bearish expecting CLP 285.6 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.4x on those 2028 earnings, up from 11.2x today. This future PE is lower than the current PE for the CL Real Estate industry at 27.4x.

- Analysts expect the number of shares outstanding to decline by 0.93% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.99%, as per the Simply Wall St company report.

Plaza Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in administrative expenses, partly due to higher personnel costs, legal expenses, and bad debt provision, could potentially impact net margins if these costs continue to rise without a proportional increase in revenues.

- The decrease in the same-store rent growth rate from the previous quarter raises concerns about the sustainability of rental income growth, which could affect future revenue stability.

- The pending acquisition of Falabella Perú S.A.A., while strategically advantageous, involves integration risks and increased leverage (projected to increase to 3.5x), which might strain financial stability and impact net earnings if not managed carefully.

- Exchange rate fluctuations causing higher expenses in foreign currency pose a risk to net income as it could lead to unfavorable financial outcomes in international operations.

- While there are plans for large-scale growth through organic projects and acquisitions, execution risks and market saturation in the Andes region could hinder revenue and profit expectations if expansion plans do not deliver the anticipated returns.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP 1884.56 for Plaza based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP 2200.0, and the most bearish reporting a price target of just CLP 1546.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CLP 621.8 billion, earnings will come to CLP 324.0 billion, and it would be trading on a PE ratio of 17.4x, assuming you use a discount rate of 12.0%.

- Given the current share price of CLP 1630.1, the analyst's price target of CLP 1884.56 is 13.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives