Key Takeaways

- Optimistic market expectations may overlook operational challenges, cost pressures, and risks tied to regulatory, environmental, and global supply dynamics.

- Anticipated revenue and margin growth could disappoint if modernization benefits are slow and if exposure to iron ore cycles and ESG demands constrain profitability.

- Diversification, operational improvements, and sustainability initiatives position the company for long-term growth, resilience, and margin enhancement amid a shifting industry landscape.

Catalysts

About CAP- Engages in iron ore mining, steel production, steel processing, and infrastructure businesses in Chile and internationally.

- Investor expectations are buoyed by the recent surge in rare earth (dysprosium) prices outside China, supported by CAP's advancing Aclara project; this optimism may be leading the market to overestimate future revenue growth from specialty metals driven by the energy transition and global demand for magnets in EVs, wind, and electronics.

- The persistent narrative around iron ore price resilience and long-term demand-thanks to population growth, infrastructure spending, and green energy-may mean the market is materially overlooking recent operational disruptions (e.g., Los Colorados contingency and phased production setbacks) and understating ongoing revenue/margin risks from CAP's significant exposure to iron ore cycles and supply volatility.

- Current valuation could price in anticipated improvements in profitability from operational upgrades, modernization, and mining automation, despite evidence of rising structural/fixed costs and only gradual realization of these efficiencies; this could lead to disappointing EBITDA/margin expansion in reality versus optimistic forecasts.

- CAP's significant bets on environmental permitting, expansion (Los Colorados Stage 6), and regulatory compliance (Aclara environmental reviews, water management projects) expose it to execution and timeline risks, which may constrain near-term free cash flow and earnings, especially if long-term secular tailwinds (infrastructure, green transition) are slower/more volatile than forecast.

- The market appears to discount potential downside from increasing ESG requirements, resource nationalism, and competitive pressures from global low-cost producers-which could increase compliance costs and erode margins over time-while baking in high long-term revenue/margin growth rates bolstered by currently favorable industry narratives.

CAP Future Earnings and Revenue Growth

Assumptions

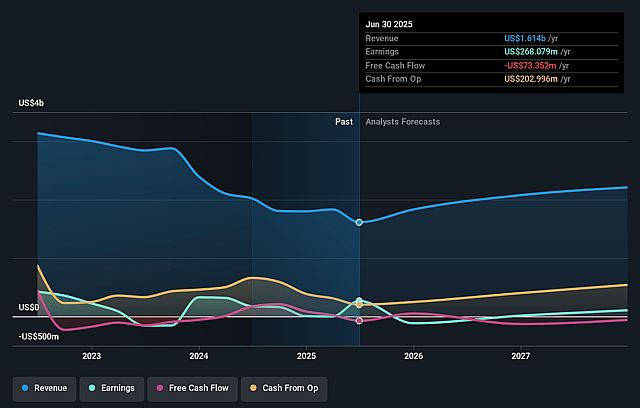

How have these above catalysts been quantified?- Analysts are assuming CAP's revenue will grow by 14.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.6% today to 1.3% in 3 years time.

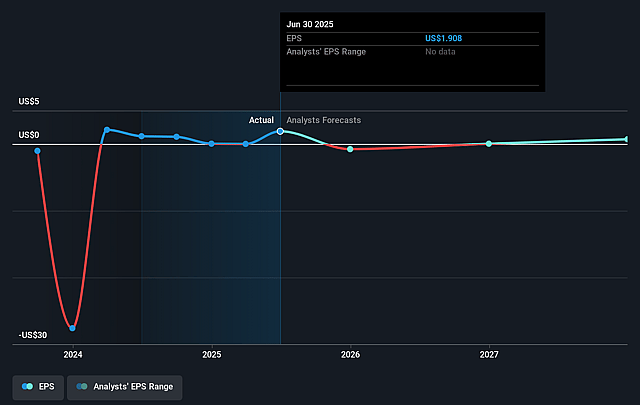

- Analysts expect earnings to reach $30.8 million (and earnings per share of $0.71) by about September 2028, down from $268.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 30.8x on those 2028 earnings, up from 3.1x today. This future PE is greater than the current PE for the CL Metals and Mining industry at 8.7x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.74%, as per the Simply Wall St company report.

CAP Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is actively diversifying its business beyond traditional mining and steel, with significant investments in modular infrastructure, logistics, water management (Aguas CAP), and rare earth projects (Aclara), which could create new revenue streams and long-term growth opportunities, potentially supporting future revenue and earnings.

- Operational improvements are being seen in the industrial segment, particularly in Cintac and Huachipato, with rising margins, volume increases, administrative cost reductions, and a clear drive towards sustainable and value-added product lines, which could result in improved net margins and a stronger overall bottom line.

- There is a clear medium

- and long-term strategic focus on high-quality iron ore and rare earth elements, both of which are likely to see secular demand growth due to the global energy transition, electrification, and increased technological development, suggesting support for stable or growing revenues and pricing power.

- The company remains financially resilient, maintaining a strong cash position with careful liquidity and debt management, and has demonstrated the ability to secure sustainable financing at lower structural costs, reducing risk to net income and enabling continued investment in growth projects.

- CAP is making distinct progress toward ESG-linked goals (such as water management and green steel development), restructuring operations to enhance sustainability and compliance, which aligns with increasing industry and investor preference for responsible producers, potentially granting access to new markets and capital, thereby supporting long-term margins and earnings quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CLP5615.032 for CAP based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CLP6269.39, and the most bearish reporting a price target of just CLP4124.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.4 billion, earnings will come to $30.8 million, and it would be trading on a PE ratio of 30.8x, assuming you use a discount rate of 10.7%.

- Given the current share price of CLP5360.0, the analyst price target of CLP5615.03 is 4.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.