Last Update 03 Nov 25

Fair value Decreased 50%Analysts have increased their price target for Idorsia by CHF 1.00 to CHF 2.00. They cite improved revenue growth projections and a more favorable future price-to-earnings outlook, despite a slightly higher discount rate and modestly lower profit margin expectations.

Analyst Commentary

Bullish Takeaways

- Bullish analysts have raised the price target for Idorsia, which reflects increased confidence in the company’s growth prospects.

- Expectations for revenue growth have improved and support a higher valuation compared to previous forecasts.

- Market sentiment appears to be stabilizing, although there were earlier concerns about the company’s pathway to profitability.

- The upward adjustment in the price target suggests analysts see potential for positive execution in Idorsia’s upcoming operational phases.

Bearish Takeaways

- Some analysts maintain a cautious outlook and note that modestly lower profit margin expectations could impact bottom-line growth.

- The application of a slightly higher discount rate suggests continued uncertainty around execution risks and future cash flows.

- Concerns persist regarding the sustainability of improved revenue projections, particularly in a competitive market environment.

What's in the News

- Idorsia reaffirmed its 2025 earnings guidance, projecting continued QUVIVIQ sales growth to around CHF 130 million, a US-GAAP operating loss of CHF 220 million, and partnership-driven EBIT of approximately CHF 165 million. This results in a global operating loss of about CHF 55 million. (Corporate Guidance)

- Simcere Pharmaceuticals launched QUVIVIQ (daridorexant) in China. The new insomnia treatment is available without psychotropic control labeling and demonstrates a differentiated clinical profile. (Business Expansion)

- Swissmedic granted marketing authorization to JERAYGO (aprocitentan) for treating resistant hypertension in adults. This marks a key approval for a therapy targeting patients with uncontrolled blood pressure despite standard treatment. (Product-Related Announcement)

- Idorsia completed a CHF 65.6 million follow-on equity offering by issuing 16.4 million common shares at CHF 4 each. (Follow-on Equity Offering)

- The company announced a strategic alliance with Stanford Hypertension Center and Duke Heart Center to launch IMPACT-HTN, a multi-phase program leveraging AI to transform management of difficult-to-control hypertension. (Strategic Alliance)

Valuation Changes

- Fair Value: The consensus analyst price target for Idorsia was reduced by half, falling from CHF 4.00 to CHF 2.00.

- Discount Rate: The applied discount rate rose slightly, moving from 6.34% to 6.72%.

- Revenue Growth: Projections for annual revenue growth increased moderately, from 15.3% to 16.1%.

- Net Profit Margin: Expected profit margin decreased marginally, shifting from 20.0% to 19.6%.

- Future P/E: The estimate for the future price-to-earnings ratio dropped significantly, from 18.0x to 9.1x.

Key Takeaways

- Market optimism for rapid revenue growth may be premature, with unvalidated access, uncertain drug uptake, and regulatory outcomes adding risk to earnings expectations.

- Longer-term valuation appears inflated by pipeline commercialization hopes, while rising costs and increasing pricing scrutiny threaten future margins and profitability.

- Expanding global market access, product launches, and strategic partnerships are set to drive sustained growth, improved profitability, and reduced financial risk for Idorsia.

Catalysts

About Idorsia- A biopharmaceutical company, engages in the discovery, development, and commercialization of drugs for unmet medical needs in Switzerland, the United States, Japan, Europe, and Canada.

- The prospect of QUVIVIQ achieving widespread public reimbursement and rapid market uptake in Europe, combined with ongoing expansion to China, Latin America, and MENA, may be encouraging expectations of continued steep sales growth, leading investors to price in accelerating top-line revenue before access or demand is fully validated.

- Anticipation around the potential U.S. descheduling of the DORA class is driving enthusiasm that QUVIVIQ's U.S. prescriptions and gross margins will significantly increase; however, this outcome, its timing, and the extent of benefit remain uncertain, which injects risk around near-term and medium-term earnings.

- The assumption that the new drug TRYVIO will quickly capture a large share of the resistant hypertension market-based on recent approval, label updates, and payer receptiveness-could be leading the market to overestimate addressable revenue growth before partnership, real-world uptake, or payer access are proven.

- Optimism regarding the accelerated advancement and eventual commercialization of a broad pipeline (including Fabry disease, chemokine antagonists, and the C. diff vaccine) may be inflating valuation through expectations of long-term multi-asset revenue streams, even though increased cost controls and funding needs persist until 2027 profitability.

- Expectations that growing healthcare spending and rising chronic disease prevalence will provide "automatic" tailwinds for prescription volumes and pricing power may be overstated, especially in the context of intensifying global scrutiny over drug pricing and tightening payer controls, potentially squeezing future net margins and overall earnings.

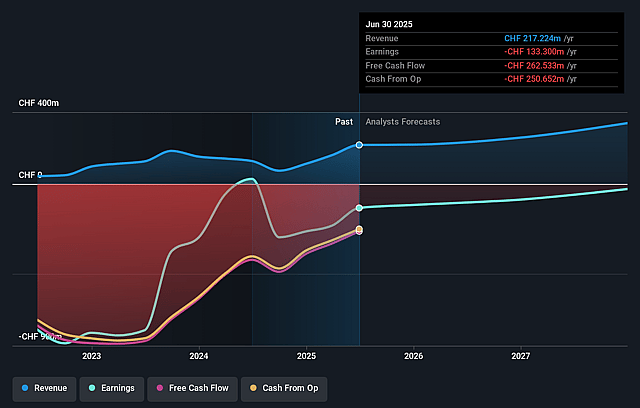

Idorsia Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Idorsia's revenue will grow by 17.8% annually over the next 3 years.

- Analysts are not forecasting that Idorsia will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Idorsia's profit margin will increase from -61.4% to the average GB Biotechs industry of 20.5% in 3 years.

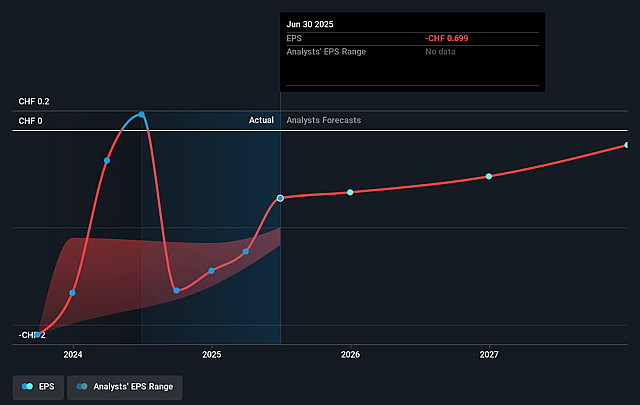

- If Idorsia's profit margin were to converge on the industry average, you could expect earnings to reach CHF 72.6 million (and earnings per share of CHF 0.28) by about September 2028, up from CHF -133.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.7x on those 2028 earnings, up from -4.8x today. This future PE is greater than the current PE for the GB Biotechs industry at 7.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.22%, as per the Simply Wall St company report.

Idorsia Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rapid commercial momentum and more than doubling of QUVIVIQ sales (CHF 23 million to CHF 56 million YoY), coupled with improved operating results and expanding global access (including imminent entry into China and ongoing reimbursement gains in Europe), could drive sustained top-line revenue growth and profitability.

- Multiple major upcoming catalysts-including the potential FDA descheduling of the DORA class in the U.S. (currently not included in company guidance), expansion into untapped international markets, and positive real-world and clinical data-could unlock significant upside in revenues and margins.

- Approval and launch readiness of TRYVIO (aprocitentan) in resistant hypertension, with broadened label and key differentiation in high-need populations (e.g., chronic kidney disease), positions Idorsia to capitalize on a >$12 billion market with strong payer and prescriber receptivity-potentially boosting future revenue and cash flow.

- Strategic partnerships and out-licensing deals (e.g., with Viatris, Simcere, and Menarini), as well as a robust pipeline (including Fabry disease, synthetic glycan vaccine, and multiple chemokine antagonists), provide diversified sources for new milestones, contract revenues, and reduced financial risk, supporting net margin improvement and earnings quality.

- The company's demonstrated operational turnaround-evidenced by extensive cost rationalization (CHF 50 million in savings YoY), extension of cash runway to end-2026, and a clear trajectory to commercial profitability (2026) and overall profitability (2027)-signals an improving financial profile and may attract investor interest, thereby supporting the share price.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF2.0 for Idorsia based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF354.7 million, earnings will come to CHF72.6 million, and it would be trading on a PE ratio of 8.7x, assuming you use a discount rate of 7.2%.

- Given the current share price of CHF3.07, the analyst price target of CHF2.0 is 53.5% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.