Key Takeaways

- Strong growth in emerging markets and innovation in sustainable, natural ingredients are driving organic revenue gains and margin potential.

- Strategic investments, acquisitions, and productivity improvements position the company for higher margin, expanded customer reach, and resilience against macroeconomic headwinds.

- Margin pressure, negative cash flow, demand softness, regulatory risks, and reliance on recent market share gains all threaten future earnings stability and growth momentum.

Catalysts

About Givaudan- Manufactures, supplies, and sells fragrance, beauty, taste, and wellbeing products to the consumer goods industry.

- Givaudan is experiencing robust volume-driven sales growth across high-growth regions (notably India, Brazil, Middle East and China) and is gaining market share through strong momentum with local and regional clients, reflecting a rising global middle class and accelerating urbanization in emerging markets; this dynamic supports sustained organic revenue growth.

- The company continues to outpace industry peers, in part due to its innovation pipeline: launches of sustainable, natural ingredients (e.g., FDA-approved color solutions, algae-derived beauty actives) directly align with consumer shifts toward health, wellness, and clean label products, supporting both top-line growth and potential margin expansion.

- Strategic investments in biotechnology, digital product creation tools (like MYROMI), and the expansion of natural flavor and fragrance capabilities position Givaudan to capture higher-margin, value-added business, bolstering future gross and EBITDA margins.

- Recent and prospective acquisitions, such as the majority stake in Vollmens Fragrances to boost Latin American exposure, are set to broaden Givaudan's portfolio and customer base, enhancing cross-selling, revenue scalability, and possible margin accretion through operational synergies.

- Execution on pricing to offset input cost/tariff inflation, combined with an improving product mix and ongoing efficiency in working capital management, is expected to protect or improve net margins and free cash flow in the face of persistent macro and FX headwinds.

Givaudan Future Earnings and Revenue Growth

Assumptions

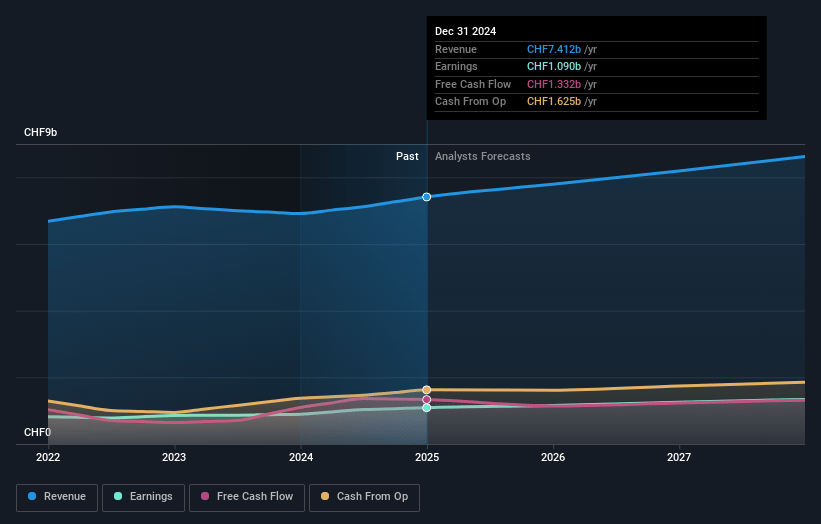

How have these above catalysts been quantified?- Analysts are assuming Givaudan's revenue will grow by 4.9% annually over the next 3 years.

- Analysts assume that profit margins will increase from 14.5% today to 15.4% in 3 years time.

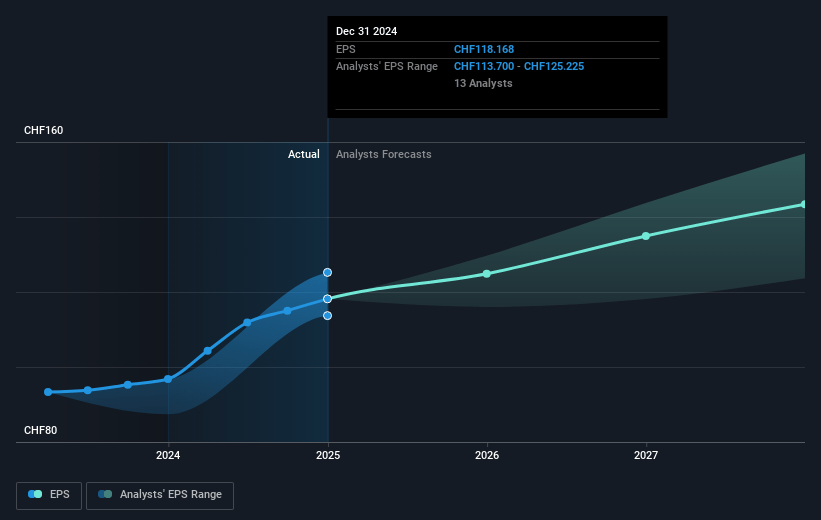

- Analysts expect earnings to reach CHF 1.3 billion (and earnings per share of CHF 144.35) by about July 2028, up from CHF 1.1 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 31.9x on those 2028 earnings, up from 30.8x today. This future PE is greater than the current PE for the GB Chemicals industry at 28.2x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 4.63%, as per the Simply Wall St company report.

Givaudan Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Givaudan continues to experience margin pressure from higher input costs and global trade tariffs, with price increases only minimally offsetting these costs so far, suggesting ongoing risk to gross margins and net earnings if inflation and tariffs persist.

- Free cash flow was negative in the first half of 2025, and although management attributes this to timing effects, sustained higher capital expenditures, tax payments, or lumpy non-recurring items could impair cash generation and potentially constrain future investments or shareholder returns.

- The Fragrance Ingredients business is seeing softer demand and a slight decline, attributed to broader market softness and exposure to competitor demand-if commoditization intensifies or competitors shift sourcing, this could further erode divisional revenues and margins.

- The company faces significant ongoing risks from antitrust investigations across multiple jurisdictions, with unknown timing or financial impact; adverse findings could lead to substantial fines, legal costs, or reputational damage, negatively impacting net income and possibly leading to future earnings volatility.

- Despite strong recent growth, much of the upside in certain segments such as Fine Fragrances and Southeast Asia is supported by high previous comparables and market share gains; any slowdown in underlying consumer demand, loss of competitive wins, or normalization in regional growth rates could decelerate sales and hinder top-line growth momentum.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF4149.526 for Givaudan based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF5040.0, and the most bearish reporting a price target of just CHF3200.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF8.7 billion, earnings will come to CHF1.3 billion, and it would be trading on a PE ratio of 31.9x, assuming you use a discount rate of 4.6%.

- Given the current share price of CHF3647.0, the analyst price target of CHF4149.53 is 12.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.