Key Takeaways

- Expanding access to private markets and innovative product launches are set to drive sustained management fee and earnings growth as client demand shifts.

- Enhanced distribution efforts and improving performance are likely to increase market share and support above-market revenue and asset growth over time.

- Shifting fee structures, rising competition, underperformance risks, higher distribution costs, and regulatory pressures threaten growth, margins, and expansion prospects for Partners Group Holding.

Catalysts

About Partners Group Holding- A private equity firm specializing in direct, secondary, and primary investments across private equity, private real estate, private infrastructure, and private debt.

- The rapid expansion of private market access for defined contribution (DC) pension plans and retail/wealth channels, supported by early-stage adoption and recent partnerships (e.g., Empower, BlackRock, Generali, Lincoln), points to a significantly larger future addressable market; as allocations grow from current low levels, this is poised to drive structural AuM and recurring management fee growth in coming years.

- Persistent low allocations to alternatives among both retail and institutional clients, coupled with the firm's leading track record and increasingly tailored mandate/evergreen solutions, suggest ongoing inflows and expanding market share as client demand shifts towards private markets to enhance returns-positively impacting overall revenue and future performance fee potential.

- Partners Group is successfully launching a diverse pipeline of new evergreen and bespoke products, with strong early take-up across six out of seven recent launches, indicating product innovation is capturing incremental wallet share; this supports scalable fee income and improves long-term earnings visibility.

- Exit activity and performance in legacy vintages have already begun to rebound following headwinds from rising rates, with management expecting performance to normalize back to 10-12% target returns and vintage mix exposures to continue improving-a dynamic likely to boost both near-term performance fees and future client inflows as returns improve.

- Ongoing investments in distribution capacity, especially in the U.S. wealth segment, and deepening relationships with global insurance clients and pension DC plans position Partners Group to fully capture secular shifts toward private market investing, translating into sustained, above-market AuM and revenue growth over the medium to long term.

Partners Group Holding Future Earnings and Revenue Growth

Assumptions

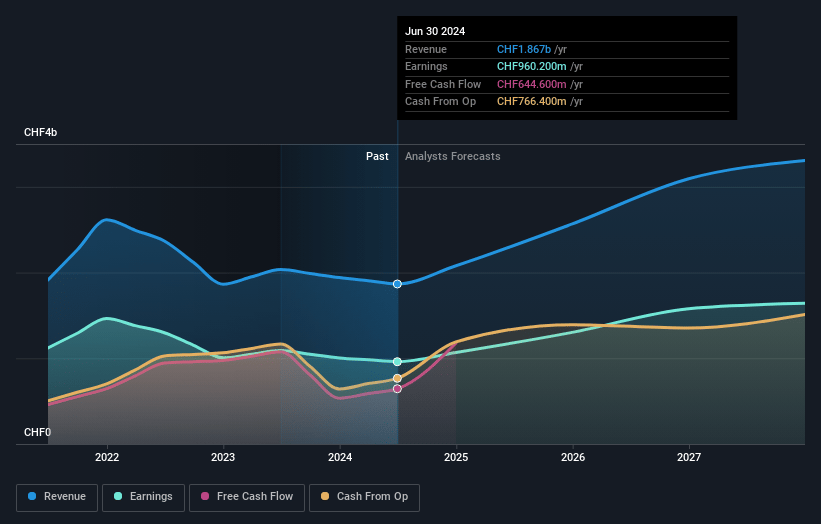

How have these above catalysts been quantified?- Analysts are assuming Partners Group Holding's revenue will grow by 13.9% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 53.1% today to 51.5% in 3 years time.

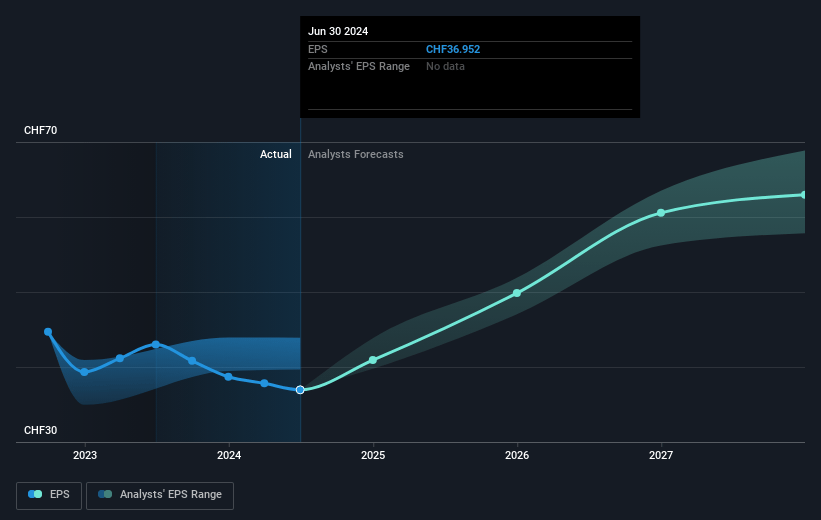

- Analysts expect earnings to reach CHF 1.6 billion (and earnings per share of CHF 62.1) by about July 2028, up from CHF 1.1 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CHF1.8 billion in earnings, and the most bearish expecting CHF1.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.9x on those 2028 earnings, down from 25.6x today. This future PE is greater than the current PE for the GB Capital Markets industry at 15.6x.

- Analysts expect the number of shares outstanding to decline by 0.78% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.23%, as per the Simply Wall St company report.

Partners Group Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increasing tilt toward lower-fee-paying asset classes like private credit and the growing prominence of customized mandates and insurance mandates may put downward pressure on Partners Group's recurring management fee margin, limiting revenue growth and potentially eroding net margins over the long term.

- Heightened competition in the private wealth segment, with new entrants and alternative providers taking significant market share, is reducing Partners Group's ability to dominate new money flows as it once did, which threatens future growth in assets under management and may result in increased client churn and lower net inflows.

- Short-term underperformance of major evergreen programs (7–8% annualized over three years versus the 10–12% target) alongside evidence that performance recency is closely linked to net inflows could dampen demand from new investors or cause redemptions, especially if these programs do not return quickly to their long-term targets, negatively impacting revenue and fee growth.

- The fiercely competitive landscape for distribution talent, particularly in key growth markets like the U.S., is driving up costs to attract and retain skilled personnel; sustained higher compensation and investment in distribution capabilities may raise the company's operating expenses and suppress profit margins over time.

- Ongoing regulatory uncertainties (e.g., changing DoL guidance, tariff-related market volatility, and stricter compliance demands across jurisdictions) and the need for tailored regional solutions increase operational complexity, create execution risks, and could raise compliance costs, all of which may burden earnings and slow expansion in strategic growth channels.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF1215.857 for Partners Group Holding based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF1500.0, and the most bearish reporting a price target of just CHF1090.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF3.1 billion, earnings will come to CHF1.6 billion, and it would be trading on a PE ratio of 21.9x, assuming you use a discount rate of 5.2%.

- Given the current share price of CHF1114.5, the analyst price target of CHF1215.86 is 8.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.