Last Update06 Sep 25Fair value Decreased 4.10%

The consensus analyst price target for DKSH Holding has been revised downward, reflecting modest declines in both revenue growth forecasts and the future P/E ratio, resulting in a new fair value of CHF74.00.

What's in the News

- DKSH Consumer Goods has partnered with Nextfood Global to launch premium breakfast cereals and freeze-dried fruit snacks in Singapore, targeting health-conscious, urban consumers.

- DKSH will provide end-to-end market expansion services for Nextfood’s products, which will initially be available at FairPrice and RedMart, strengthening DKSH’s presence in health and wellness categories.

- DKSH Performance Materials has entered an agreement to distribute Sunrise’s pigments, pastes, and specialty chemicals in Austria, Germany, and Switzerland, expanding its portfolio in high-performance industrial and consumer formulations across the DACH region.

- DKSH has issued earnings guidance indicating Core EBIT for 2025 is expected to be higher than 2024.

Valuation Changes

Summary of Valuation Changes for DKSH Holding

- The Consensus Analyst Price Target has fallen slightly from CHF77.17 to CHF74.00.

- The Consensus Revenue Growth forecasts for DKSH Holding has fallen slightly from 2.2% per annum to 2.1% per annum.

- The Future P/E for DKSH Holding has fallen slightly from 20.47x to 19.96x.

Key Takeaways

- Strong organic and inorganic growth is driven by Asia-Pacific demand, strategic partnerships, commercial outsourcing trends, and an accelerated M&A pipeline.

- Enhanced digitalization and ESG leadership improve operational efficiency, client retention, regulatory compliance, and establish DKSH as a preferred, future-ready partner in core markets.

- Persistent weak consumer sentiment, market disruption, currency volatility, sluggish organic growth, and risky M&A reliance threaten margin stability and long-term performance.

Catalysts

About DKSH Holding- Provides various market expansion services in Thailand, Greater China, Malaysia, Singapore, rest of the Asia Pacific, and internationally.

- DKSH is directly positioned to benefit from the rapid expansion of the Asia-Pacific middle class, which is fueling greater demand for healthcare, consumer goods, and specialty materials-core markets where DKSH is growing both organically (notably Healthcare above-GDP growth) and through new client partnerships (like Bayer and Kronos), likely supporting long-term, sustainable revenue growth.

- The company is capitalizing on the sustained trend of manufacturers outsourcing distribution and commercial activities in Asia, which has driven commercial outsourcing deals (e.g., Healthcare partnership with Bayer and full agency/outsourcing surpassing 50% EBIT contribution), leading to structurally higher-margin business and recurring net margin expansion.

- Ongoing investment in digitalization (such as DKSH Discover and AI-enabled sales process improvements) is enhancing operational efficiency, client retention, and lead generation-evident in margin gains and working capital optimization-indicating potential for future margin expansion and robust free cash flow generation.

- DKSH's accelerated M&A strategy, supported by a near debt-free balance sheet and a strong deal pipeline, underpins inorganic growth, network expansion, and access to higher-margin service offerings, all of which are expected to drive earnings growth over the coming years.

- Recognition for ESG standards, sustainability commitments, and supply chain compliance (e.g., EcoVadis gold medal, global ISO certificates) positions DKSH as a preferred partner in a region where regulatory complexity and sustainability demands are rising, thus supporting client acquisition, protecting margins, and strengthening the company's long-term competitive moat.

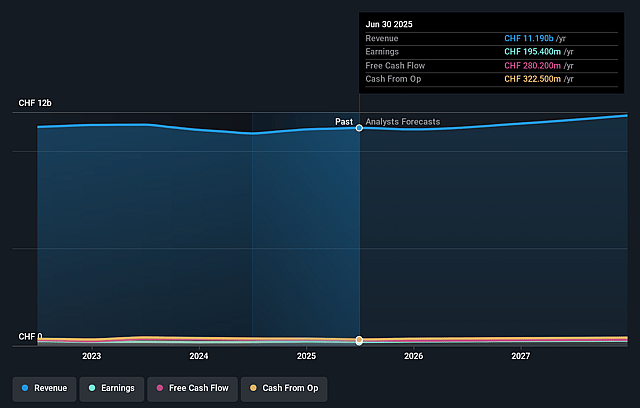

DKSH Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming DKSH Holding's revenue will grow by 2.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 1.7% today to 2.4% in 3 years time.

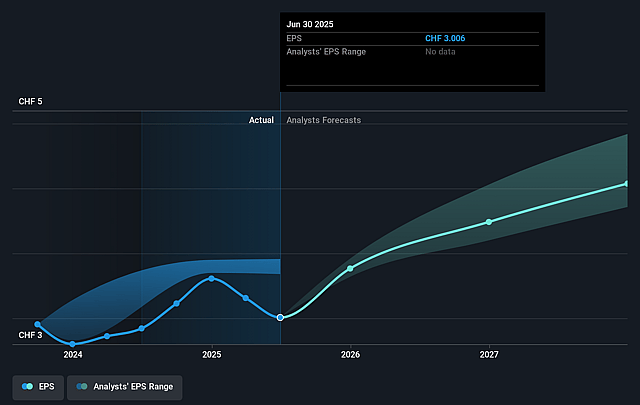

- Analysts expect earnings to reach CHF 286.1 million (and earnings per share of CHF 4.09) by about September 2028, up from CHF 195.4 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CHF251.1 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.5x on those 2028 earnings, up from 19.3x today. This future PE is greater than the current PE for the GB Trade Distributors industry at 19.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.29%, as per the Simply Wall St company report.

DKSH Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The Consumer Goods segment is experiencing pressure from persistently low consumer confidence and reduced consumer spending across Asia Pacific, combined with a strategic shift to low and mid-tier products and industry-wide soft retail sales, leading to margin compression and the risk of prolonged revenue stagnation if demand does not recover.

- The core Fast Moving Consumer Goods (FMCG) industry faces significant consolidation, restructuring, and layoffs among major clients (e.g., Kraft Heinz, Kellogg's, P&G), signaling broader market disruption and uncertainty that may negatively affect DKSH's key client base and reduce both revenue and margin stability.

- FX headwinds-specifically, the recent appreciation of the Swiss franc against other major currencies-have already caused a 10.3% decline in core profit after tax despite operating margin gains, and further currency volatility could continue eroding reported earnings for the foreseeable future.

- Organic growth has shown signs of weakness in certain segments and geographies (e.g., negative organic growth in Performance Materials in the U.S. and Europe, slightly negative organic growth in Consumer Goods for H1), indicating that DKSH's ability to drive sustainable top-line growth is vulnerable to regional economic trends and cyclical downturns.

- Management expects to accelerate M&A as a growth lever, but cautions about ongoing uncertainty in deal closure and the modest scale of recent acquisitions; an overreliance on bolt-on deals to drive performance in a low-growth environment introduces execution risk and could impact the quality and sustainability of long-term earnings if integration or value creation falls short.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CHF77.167 for DKSH Holding based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CHF11.9 billion, earnings will come to CHF286.1 million, and it would be trading on a PE ratio of 20.5x, assuming you use a discount rate of 5.3%.

- Given the current share price of CHF57.9, the analyst price target of CHF77.17 is 25.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.