Key Takeaways

- Integration of advanced ERP and AI systems, plus accelerated synergy from acquisitions, could structurally expand margins and drive transformative operational efficiency beyond current expectations.

- Strong positioning in automation, supply chain resilience, and sustainability enables long-term revenue diversification, premium business capture, and greater gross profit stability.

- Mounting trade barriers, weak end markets, cost pressures, and shifting industry dynamics threaten profitability, revenue growth, and Bossard's traditional distributor positioning.

Catalysts

About Bossard Holding- Provides industrial fastening and assembly solutions in Europe, the United States, and Asia.

- While analyst consensus expects the Microsoft Dynamics 365 ERP rollout to drive incremental efficiency, the full impact may be vastly underestimated: as Bossard achieves near-complete ERP integration across 67% of its business by 2026 and layers AI automation on top, the company could see a step change in operational leverage, leading to outsized margin expansion and structural reduction in overhead over the next several years.

- Analyst consensus holds that recent acquisitions will broaden Bossard's base and support revenue; however, the accelerated synergy extraction across procurement and sales-including from Ferdinand Gross and Aero Negoce-has the potential to drive not only immediate cross-selling but also create strategic vertical integration in key sectors like railway and aerospace, unlocking new multi-year revenue streams well above forecasts and structurally higher gross margins.

- Bossard's leadership in Smart Factory Logistics and fast-growing Smart Factory Assembly services is uniquely positioned to capture surging, recurring revenues as global manufacturing rapidly shifts toward higher automation and data-driven processes, enabling Bossard to secure long-term contracts and significantly increase gross profit stability.

- With manufacturing supply chains diversifying due to tariff, geopolitical, and currency risks, Bossard's global footprint and deep customer relationships in fast-growing Asian markets like India, Malaysia, and China make it a natural beneficiary of the trend toward supply chain resilience and localization, supporting above-market sales growth and durable revenue diversification.

- The intensifying focus on sustainability by OEMs is creating a first-mover advantage for solution-oriented, eco-friendly suppliers; Bossard's early investments in ESG initiatives and ability to deliver digitalized, resource-efficient solutions positions it to capture premium business with leading global industrial partners, helping lift net margins and increase pricing power in an evolving regulatory landscape.

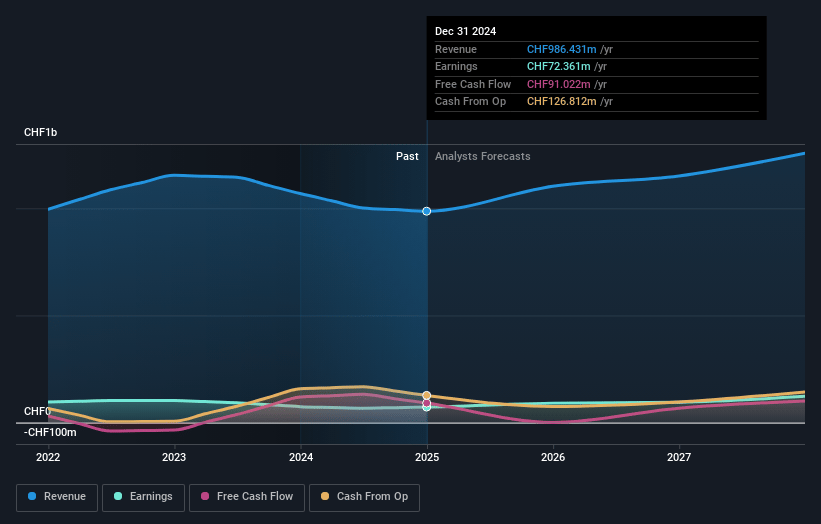

Bossard Holding Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Bossard Holding compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Bossard Holding's revenue will grow by 10.9% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 7.3% today to 9.5% in 3 years time.

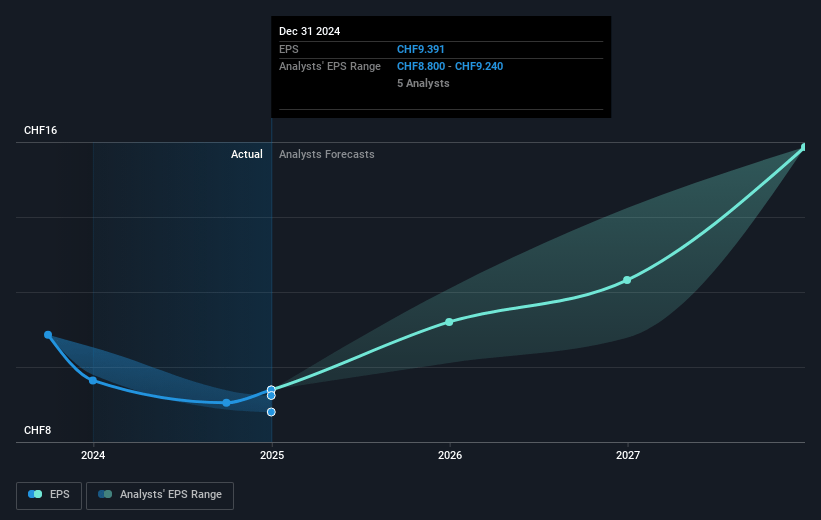

- The bullish analysts expect earnings to reach CHF 128.0 million (and earnings per share of CHF 16.65) by about July 2028, up from CHF 72.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.8x on those 2028 earnings, down from 18.3x today. This future PE is lower than the current PE for the GB Trade Distributors industry at 18.9x.

- Analysts expect the number of shares outstanding to grow by 0.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.52%, as per the Simply Wall St company report.

Bossard Holding Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent and accelerating trade barriers and tariff regimes, especially the doubling of U.S. tariffs on steel and aluminum fasteners, are creating cost pressures, planning uncertainty, and export difficulties, which could negatively impact revenue growth and undermine Bossard's ability to sustainably increase sales outside core domestic markets.

- Bossard's organic growth is heavily reliant on cyclical industrial sectors such as automotive, machinery, and electromobility, many of which are showing continued weakness or lack of recovery (notably in the United States and core European markets), heightening exposure to global economic downturns and thereby increasing earnings volatility.

- While management aims to pass through steep cost increases from tariffs and currency fluctuations to customers, implementation involves difficult negotiations, lag times, and the real risk of customer resistance or demand loss, which could compress net margins and reduce near-term profitability.

- Significant investments in digital transformation, ERP systems, and ESG compliance are necessary for long-term competitiveness but, as highlighted by the declining free cash flow and increased net debt, these capital outlays raise operational risk if not quickly matched by efficiency gains or corresponding revenue growth.

- Increased direct sourcing trends among manufacturers, competitive pricing in the commoditized fastener market, and market disruptions from potential supply chain instability or e-commerce entrants threaten Bossard's traditional distributor role, potentially leading to long-term market share erosion and downward pressure on both revenue and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Bossard Holding is CHF276.54, which represents two standard deviations above the consensus price target of CHF199.17. This valuation is based on what can be assumed as the expectations of Bossard Holding's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CHF278.0, and the most bearish reporting a price target of just CHF160.0.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CHF1.3 billion, earnings will come to CHF128.0 million, and it would be trading on a PE ratio of 17.8x, assuming you use a discount rate of 5.5%.

- Given the current share price of CHF171.4, the bullish analyst price target of CHF276.54 is 38.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.