Key Takeaways

- Modernizing a fuel-intensive fleet amid stricter environmental rules will raise costs and squeeze margins, increasing financial risks and pressuring long-term profitability.

- Reliance on major partners and temporary international demand growth exposes the company to client concentration and potential revenue volatility.

- Robust e-commerce demand, diversified operations, stable long-term contracts, and ongoing efficiency investments together drive revenue stability and position Cargojet for sustained margin growth.

Catalysts

About Cargojet- Provides time-sensitive overnight air cargo services and carries in Canada.

- Stricter environmental regulations and emissions requirements are likely to raise operating costs for Cargojet as it modernizes and maintains a fuel-intensive fleet, creating persistent margin pressure and requiring heavy capital expenditures that could erode free cash flow and depress long-term earnings.

- Rising use of alternative delivery technologies, such as improved rail, autonomous ground transport, and drones, threatens to reduce dependence on air cargo for time-sensitive shipments, presenting significant headwinds for future revenue growth if businesses shift logistics strategies away from air.

- The surge in cross-border e-commerce volumes from China into Canada, highlighted as a current growth driver, may prove temporary given increasing risks of deglobalization, nearshoring, or changes in trade policy, which could shrink Cargojet's international market opportunities and stunt top-line expansion.

- The company's growing capital outlays to expand and modernize its fleet, including ongoing maintenance expenditures of up to 180 million dollars this year, threaten to strain its balance sheet, limit flexibility, and pressure net margins due to increased depreciation and interest expenses, particularly during periods of uncertain demand.

- Heavy reliance on a small number of major clients and contracted partners, including Amazon and DHL, exposes Cargojet to concentration risk; any renegotiation, reduction, or loss of these key contracts would have an outsized negative impact on revenue predictability and sustainable earnings, amplifying downside risks in future quarters.

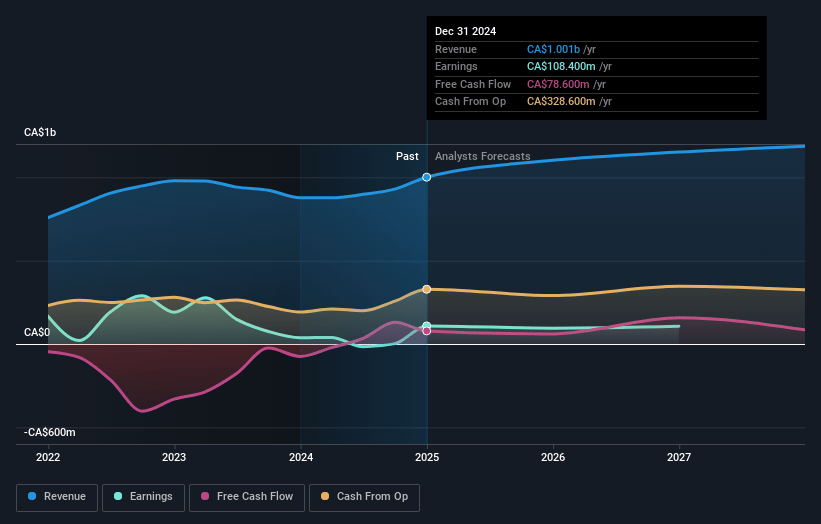

Cargojet Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on Cargojet compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming Cargojet's revenue will grow by 3.4% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 12.2% today to 9.8% in 3 years time.

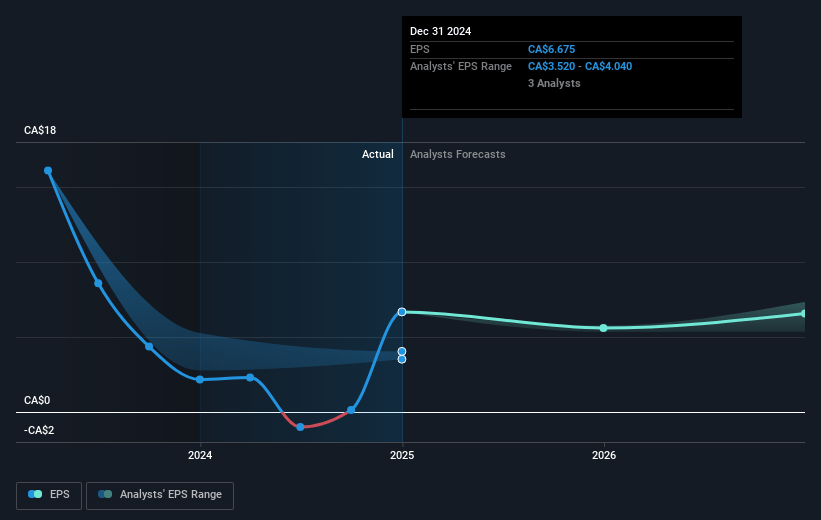

- The bearish analysts expect earnings to reach CA$110.9 million (and earnings per share of CA$7.49) by about July 2028, down from CA$123.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 16.0x on those 2028 earnings, up from 14.5x today. This future PE is greater than the current PE for the CA Logistics industry at 14.2x.

- Analysts expect the number of shares outstanding to decline by 3.91% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.57%, as per the Simply Wall St company report.

Cargojet Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained growth in Canadian e-commerce is driving record domestic revenues for Cargojet, as seen by a 16% year-over-year increase in domestic revenue and significant demand from global e-commerce players like Temu and Shein, which could continue to provide a strong, long-term tailwind for revenue.

- The company's flexible fleet management and network diversification have enabled it to redeploy capacity quickly in response to shifting market dynamics, allowing for revenue and earnings growth even during periods of weakness in specific business segments, which supports ongoing margin stability.

- Cargojet's strong long-term contracts with major global logistics partners like DHL and stable service agreements enable revenue visibility and cash flow stability even when facing short-term route or demand fluctuations, supporting consistent net earnings.

- The ability to offset segment softness (like ACMI) with rapid expansion in other lines such as domestic and ad hoc charter services demonstrates operational resilience, minimizing volatility in overall revenue and protecting operating margins.

- Long-term investments in fleet modernization, digitalization initiatives, IT transformation, and workforce engagement programs position Cargojet for continued cost efficiency and productivity gains, supporting improved net margins and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for Cargojet is CA$95.0, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Cargojet's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$177.0, and the most bearish reporting a price target of just CA$95.0.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$1.1 billion, earnings will come to CA$110.9 million, and it would be trading on a PE ratio of 16.0x, assuming you use a discount rate of 7.6%.

- Given the current share price of CA$104.37, the bearish analyst price target of CA$95.0 is 9.9% lower. Despite analysts expecting the underlying buisness to improve, they seem to believe the market's expectations are too high.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.