Key Takeaways

- Significant debt reduction and subscriber growth are set to enhance financial flexibility and revenue potential for Rogers Communications.

- Strategic investments in technology and content aim to sustain competitive edge and profitability across telecom and media sectors.

- Increased cash outflows, competitive pressures, regulatory changes, slowed market growth, and potential delays in asset sales pose financial challenges for Rogers Communications.

Catalysts

About Rogers Communications- Operates as a communications and media company in Canada.

- The structured equity financing of $7 billion is expected to reduce Rogers' debt leverage ratio significantly by year-end 2024, providing more financial flexibility and potentially positively impacting future earnings.

- The company has added a strong number of mobile phone and internet subscribers over the past quarters, indicating robust growth in subscriber base which is likely to enhance future revenue streams.

- Continuous investment and advancements in network technology, including trials of DOCSIS 4 modem and partnerships like the one with SpaceX, are expected to maintain Rogers’ competitive edge and could drive future revenue and margin improvements.

- The acquisition of Bell's stake in Maple Leaf Sports & Entertainment aligns with Rogers' long-term strategy to increase its content offering, which could bolster growth and profitability in its sports and media division.

- Efficiency gains and industry-leading financial performance in wireless and cable services have led to record margins, which are expected to support future improvements in net margins and earnings.

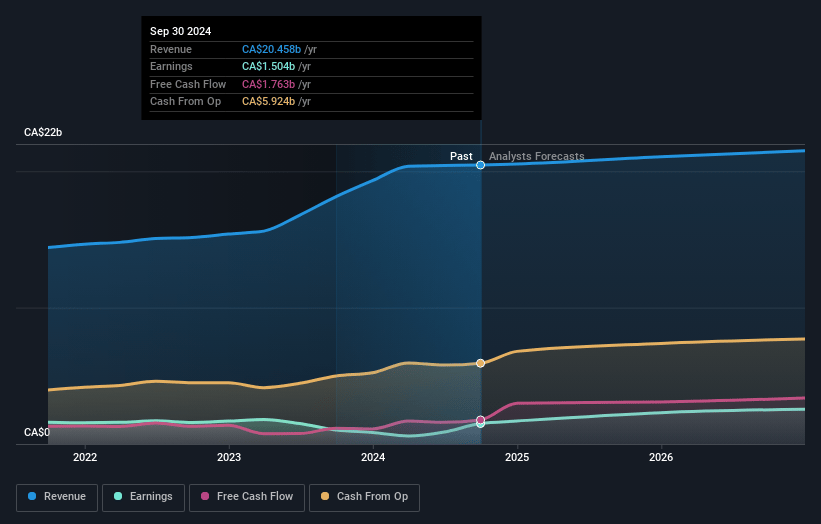

Rogers Communications Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rogers Communications's revenue will grow by 2.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.4% today to 14.0% in 3 years time.

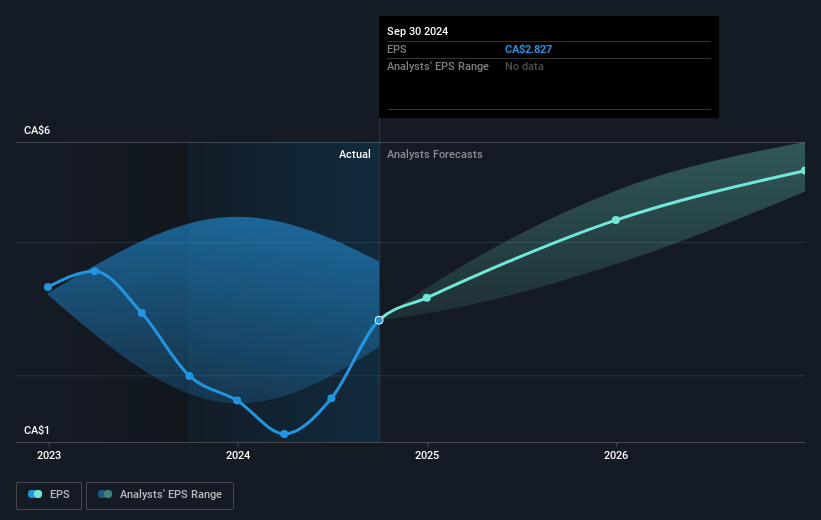

- Analysts expect earnings to reach CA$3.1 billion (and earnings per share of CA$5.85) by about January 2028, up from CA$1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.6x on those 2028 earnings, down from 14.9x today. This future PE is lower than the current PE for the CA Wireless Telecom industry at 14.9x.

- Analysts expect the number of shares outstanding to decline by 0.41% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.38%, as per the Simply Wall St company report.

Rogers Communications Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The structured equity financing deal could potentially increase cash outflows due to distributions to minority equity holders, which may affect Rogers' ongoing free cash flow and overall financial flexibility.

- The competitive market environment, particularly in wireless services, could pressure Rogers' ARPU (Average Revenue Per User) and overall service revenue growth in the face of competitors' aggressive promotional strategies.

- Regulatory changes by CRTC concerning roaming rates and other telecommunications policies may impact Rogers' revenue streams if they result in reduced pricing power or increased compliance costs.

- The Canadian government's curbing of immigration, including foreign students and temporary workers, may result in slower market growth, affecting Rogers' subscriber growth and revenue potential.

- Any delays or challenges in executing the sale of noncore real estate assets could hinder Rogers' deleveraging plans and financial optimization strategies.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$61.06 for Rogers Communications based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$76.0, and the most bearish reporting a price target of just CA$39.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$22.0 billion, earnings will come to CA$3.1 billion, and it would be trading on a PE ratio of 12.6x, assuming you use a discount rate of 6.4%.

- Given the current share price of CA$41.87, the analyst's price target of CA$61.06 is 31.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives