Last Update 16 Aug 25

Fair value Decreased 7.16%Despite higher consensus revenue growth forecasts for Quarterhill, a rising future P/E ratio appears to have outweighed this improvement, leading to a reduction in the consensus analyst price target from CA$1.98 to CA$1.84.

What's in the News

- Quarterhill secured new international contracts in Djibouti, Thailand, and South Korea, marking its first deployment in Djibouti with a World Bank-funded overweight enforcement system and additional follow-on orders in established Asian markets.

- The company announced a workforce reduction of about 100 positions (15% of headcount), targeting USD 12 million in annualized cost savings, to accelerate sustainable positive Adjusted EBITDA and better align resources with strategic priorities.

- Quarterhill’s back-office technology enabled the successful transition and system acceptance of about one million TxTag user accounts to the Harris County Toll Road Authority, improving operational efficiency and consolidating customer service in Texas.

- David Charron was appointed Chief Financial Officer, bringing extensive experience in global technology companies and public company financial management, with Morgan Demkey returning to his prior operational leadership role.

Valuation Changes

Summary of Valuation Changes for Quarterhill

- The Consensus Analyst Price Target has fallen from CA$1.98 to CA$1.84.

- The Consensus Revenue Growth forecasts for Quarterhill has significantly risen from 7.2% per annum to 9.8% per annum.

- The Future P/E for Quarterhill has significantly risen from 10.61x to 12.77x.

Key Takeaways

- Strategic focus on AI-driven, modular technology and infrastructure modernization is boosting high-margin software revenue, recurring business, and global market expansion.

- Operational restructuring and a strong project backlog are improving profitability, providing long-term earnings visibility, and strengthening competitive positioning in intelligent transportation systems.

- Ongoing operational inefficiencies, financial fragility, and over-reliance on select segments and government contracts threaten scalability, future growth, and long-term market competitiveness.

Catalysts

About Quarterhill- Operates in the intelligent transportation systems business in Canada and internationally.

- The increasing adoption of AI and data analytics in transportation infrastructure is driving demand for Quarterhill's next-generation, software-centric platforms such as iTHEIA and their new microservices-based tolling system-supporting long-term growth in high-margin software revenue that boosts both top-line growth and improves net margin profile.

- Significant cost reductions from recent restructuring (~$12M annualized savings, primarily in cost of sales) and optimization of operations are set to expand gross margins starting Q3, driving a clear path to improved EBITDA and net earnings.

- Robust international expansion and repeat business in core enforcement solutions (with new contracts in Africa and Asia and 40%+ gross margins in Safety & Enforcement) demonstrate global market traction and revenue visibility, which aligns with the ongoing modernization of smart infrastructure and intelligent transportation systems worldwide.

- A $463M backlog and a robust $2B pipeline, including higher-margin maintenance and service contracts, provide strong multi-year revenue visibility and improved earnings stability as more government and smart city projects come online, capitalizing on elevated policy support and infrastructure investment.

- Strategic investments in next-gen platforms and focus on modular, AI-driven technology reduce implementation risk, speed up deployments, strengthen Quarterhill's competitive position, and position the company to leverage the long-term shift toward sustainable, connected mobility-fueling future recurring revenue and operating leverage.

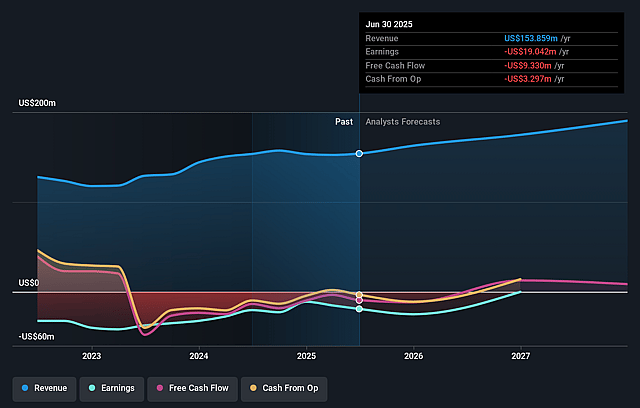

Quarterhill Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Quarterhill's revenue will grow by 8.7% annually over the next 3 years.

- Analysts are not forecasting that Quarterhill will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Quarterhill's profit margin will increase from -12.4% to the average US Communications industry of 10.8% in 3 years.

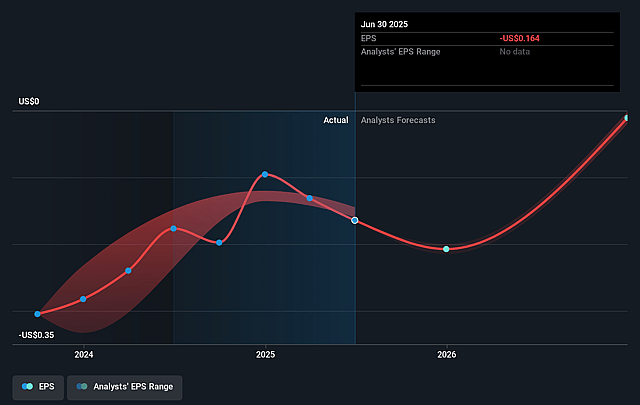

- If Quarterhill's profit margin were to converge on the industry average, you could expect earnings to reach $21.4 million (and earnings per share of $0.18) by about September 2028, up from $-19.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 9.4x on those 2028 earnings, up from -5.8x today. This future PE is lower than the current PE for the US Communications industry at 17.1x.

- Analysts expect the number of shares outstanding to grow by 1.01% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.24%, as per the Simply Wall St company report.

Quarterhill Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent issues with "problem contracts" in the tolling division continue to drag on profitability, with management unable to guarantee their resolution or future profitability-sustained losses here could weigh on net margins and earnings.

- The company violated its debt covenants at quarter-end and required a lender waiver through Q3, indicating balance sheet fragility; failure to resolve operational challenges by Q4 could result in restricted financial flexibility or even liquidity risks, directly impacting net earnings and investor confidence.

- Despite restructuring efforts and headcount reductions aimed at cost savings, most of the cuts were focused on projects already underperforming, suggesting limited operational optimization across core units and raising questions about the scalability and efficiency of the broader business model-this could hinder future margin expansion and earnings growth.

- Revenue growth remains concentrated in the Safety and Enforcement segment, while reliance on a small sales team and only incremental investment in R&D may constrain the company's ability to keep pace with technological disruption or outcompete larger, better-capitalized ITS and transportation tech firms, potentially limiting long-term revenue and market share.

- The company's high exposure to government contracts and infrastructure spending means it is vulnerable to changes in public funding priorities or budget constraints, which could slow project pipelines, reduce backlog conversions, and negatively impact future revenue and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$1.835 for Quarterhill based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $197.6 million, earnings will come to $21.4 million, and it would be trading on a PE ratio of 9.4x, assuming you use a discount rate of 8.2%.

- Given the current share price of CA$1.31, the analyst price target of CA$1.83 is 28.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.