Key Takeaways

- Extreme revenue and client concentration in Saudi Arabia creates significant vulnerability to policy, project, and contract risks impacting growth and cash flow.

- Ongoing cost pressures and working capital challenges threaten margin expansion and may necessitate unfavorable financing despite growing product adoption and project backlog.

- Heavy reliance on a single geographic market, cash flow constraints, and uncertain software adoption create financial vulnerability amid rising costs and evolving regulatory and economic risks.

Catalysts

About NTG Clarity Networks- Provides network, telecom, IT, and infrastructure solutions to medium and large network service providers in Canada, North America, Iraq, Saudi Arabia, Egypt, and Oman.

- While NTG Clarity Networks is benefitting from robust digitization initiatives and heavy investments in digital transformation within Saudi Arabia, the company's extreme revenue concentration-95% sourced from a single country-exposes it to the risk of sudden project slowdowns, policy changes, or shifts in funding priorities, which could materially impact future revenue growth and cash flow stability.

- Despite the momentum in 5G rollouts and recurring customer expansion driving a record revenue backlog, NTG remains highly dependent on a limited set of large clients; if key contracts are not renewed or are scaled back, this could introduce significant earnings and margin volatility over the coming years.

- Although product adoption is growing for NTGapps, with software now accounting for 9% of revenue and high-margin potential, the company's overall profitability remains restricted by the need to ramp up investment in talent and sales infrastructure, and cost pressures from hiring and expansion may persist, preventing sustainable margin expansion in future quarters.

- While telecom network automation, IoT integration, and OSS/BSS modernization across emerging markets play to NTG's core strengths, ongoing global economic uncertainty-particularly fluctuating oil prices and their potential direct or indirect effect on Saudi state technology investments-may dampen capital expenditures by telecom operators, limiting NTG's top-line and backlog growth prospects.

- Even though cloud-native migration and cybersecurity requirements are generating new project opportunities, NTG Clarity's ongoing working capital pressures, driven by high accounts receivable and modest cash flow conversion, create operational risk and could force reliance on dilutive financing if collections do not improve in tandem with revenue expansion, ultimately threatening net earnings growth and financial flexibility.

NTG Clarity Networks Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on NTG Clarity Networks compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming NTG Clarity Networks's revenue will grow by 27.0% annually over the next 3 years.

- The bearish analysts assume that profit margins will shrink from 15.3% today to 12.4% in 3 years time.

- The bearish analysts expect earnings to reach CA$16.3 million (and earnings per share of CA$0.32) by about July 2028, up from CA$9.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 14.4x on those 2028 earnings, up from 10.3x today. This future PE is lower than the current PE for the CA Software industry at 53.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.64%, as per the Simply Wall St company report.

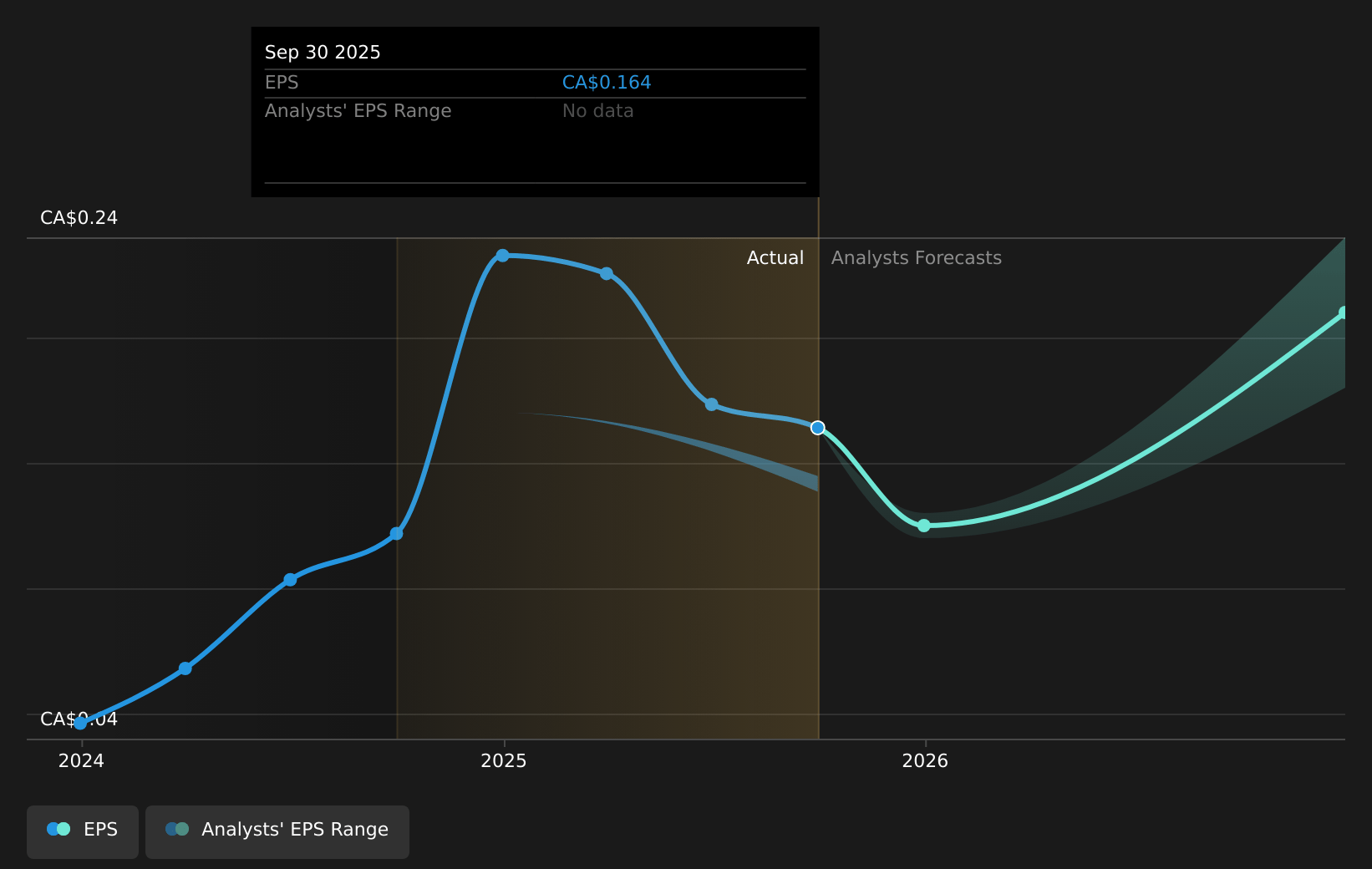

NTG Clarity Networks Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- NTG Clarity Networks remains highly dependent on the Saudi Arabian market, with around 95 percent of revenue originating from this single geography, exposing the company to concentrated customer, contract renewal, and geopolitical risks that could cause revenue volatility and uncertain cash flows.

- Persistent challenges around working capital, particularly recurring increases in accounts receivable tied closely to revenue growth, continue to constrain operating cash flow, which could limit the company's ability to scale, invest in new opportunities, or manage unforeseen downturns and therefore impact earnings growth.

- Although NTGapps shows promise for higher-margin revenue, the transition from proof-of-concept trials to recurring full-scale contracts is still early and not guaranteed, and a failure to ramp up software adoption could limit anticipated gross margin expansion and long-term profitability.

- Significant ongoing investments in talent and sales expansion, as well as anticipated uplisting costs, could pressure the company's operating expenses; if topline growth moderates or temporary costs become more persistent, this may squeeze net margins and stall improvement in earnings.

- The region's secular trends around digitization and automation are driving near-term demand, but long-term global factors such as regulatory changes, tightening data privacy rules, global economic uncertainty, or talent shortages could raise compliance costs, disrupt project delivery, or slow telecom spending, all of which threaten future revenue and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for NTG Clarity Networks is CA$3.3, which represents the lowest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of NTG Clarity Networks's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$3.3.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$131.2 million, earnings will come to CA$16.3 million, and it would be trading on a PE ratio of 14.4x, assuming you use a discount rate of 7.6%.

- Given the current share price of CA$2.14, the bearish analyst price target of CA$3.3 is 35.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives