Catalysts

About Sylogist

Sylogist provides mission critical SaaS platforms for public sector and not for profit organizations, driving recurring, subscription based revenue.

What are the underlying business or industry changes driving this perspective?

- Rising public sector and not for profit demand for secure cloud based applications, combined with Sylogist's shift to 73 percent of recurring revenue from SaaS and 15 percent growth in SaaS ARR, should support sustained top line expansion and higher quality revenue.

- Longer average subscription terms increasing from 4.1 years to 5 years and stable SaaS net revenue retention of 106 percent improve revenue visibility and should gradually lift earnings stability and valuation multiples.

- Scaling of the partner led model, now nearly 100 percent for SylogistGov with growing penetration in Mission, is expected to reduce services intensity, increase operating leverage and expand net margins over time.

- Elevated status within the Microsoft ecosystem as a managed software development company, with all platforms on Azure, positions Sylogist to benefit from ongoing cloud and AI adoption, which should accelerate ARR growth and support premium gross margins.

- Sunsetting legacy on premises products such as Sunpac and methodical competitor displacement in public sector and not for profit markets are likely to drive higher wallet share per customer, supporting organic revenue growth and improved earnings power.

Assumptions

How have these above catalysts been quantified?

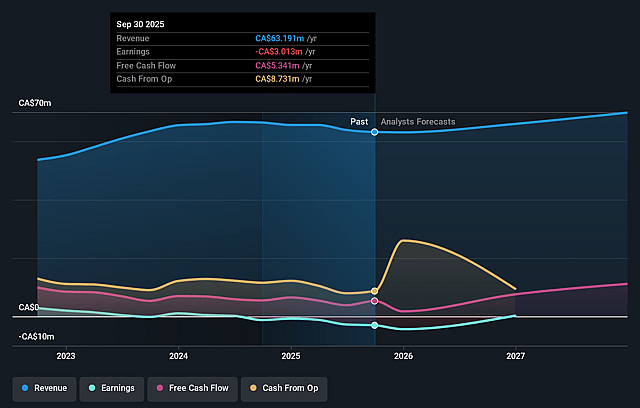

- Analysts are assuming Sylogist's revenue will grow by 4.4% annually over the next 3 years.

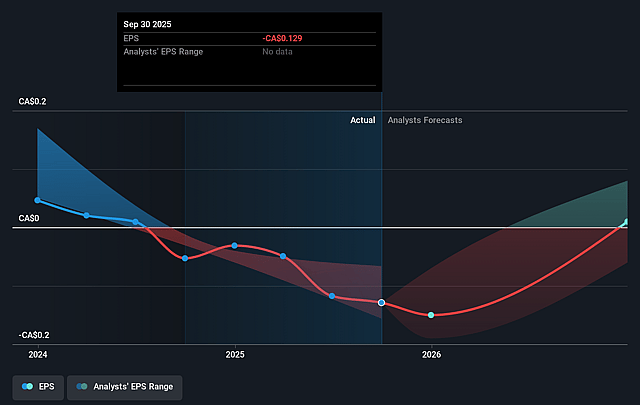

- Analysts are not forecasting that Sylogist will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Sylogist's profit margin will increase from -4.8% to the average CA Software industry of 11.4% in 3 years.

- If Sylogist's profit margin were to converge on the industry average, you could expect earnings to reach CA$8.2 million (and earnings per share of CA$0.35) by about December 2028, up from CA$-3.0 million today.

- In order for the above numbers to justify the price target of the analysts, the company would need to trade at a PE ratio of 33.1x on those 2028 earnings, up from -41.8x today. This future PE is lower than the current PE for the CA Software industry at 49.1x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.82%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The deliberate reduction in project services and the faster handoff of implementation work to partners may structurally shrink services revenue if partner led bookings do not scale as expected, which would weigh on total revenue growth and adjusted EBITDA margins over the long term.

- Churn and down sell in the SylogistMission segment, including strategic churn where customers and the company decide the platform is not the right fit, could signal weaker product market fit in the not for profit vertical, limiting ARR expansion and ultimately pressuring earnings growth.

- The sunsetting of legacy on premises products such as Sunpac in North Carolina is intended to drive upgrades, but if customers delay migrations, switch to competitors or resist price points, the company could face revenue attrition and lower net margins instead of the anticipated uplift.

- Reliance on an increasingly broad partner ecosystem and on Microsoft’s platform strategy creates execution and dependency risk, because any slowdown in partner productivity, misalignment in enablement or shifts in Microsoft’s priorities around Azure and Business Central could dampen ARR growth and constrain gross margin expansion.

- The company’s guidance for low to upper teens SaaS ARR growth and high teens adjusted EBITDA margins assumes continued strong demand from public sector and not for profit customers, so any cyclical budget tightening, policy changes or funding cuts in these end markets could slow new bookings and renewals, reducing revenue visibility and limiting improvements in earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The analysts have a consensus price target of CA$9.25 for Sylogist based on their expectations of its future earnings growth, profit margins and other risk factors.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.0, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the analysts, you'd need to believe that by 2028, revenues will be CA$71.9 million, earnings will come to CA$8.2 million, and it would be trading on a PE ratio of 33.1x, assuming you use a discount rate of 7.8%.

- Given the current share price of CA$5.39, the analyst price target of CA$9.25 is 41.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.