Key Takeaways

- Leadership in real-time logistics visibility and global trade compliance is accelerating adoption, boosting recurring revenue, and expanding Descartes' market reach and pricing power.

- Strategic acquisitions and advanced AI integration are strengthening cross-selling, reducing customer churn, and driving sustained earnings growth with expanding margins.

- Geopolitical uncertainty, supply chain shifts, regulatory pressures, acquisition risks, and intensifying competition threaten Descartes' growth, profitability, market share, and long-term revenue stability.

Catalysts

About Descartes Systems Group- Provides global logistics technology solutions worldwide.

- Analyst consensus expects MacroPoint and other transportation management solutions to drive steady growth, but this is likely understated; as Descartes continues to take market share from less capable competitors during a period of industry consolidation, real-time visibility leadership should drive outsized volume gains and materially boost recurring SaaS revenues and margins.

- While analysts broadly expect Global Trade Intelligence solutions to benefit from tariff volatility, ongoing regulatory churn and near-daily updates to global trade rules are causing a structural, not cyclical, ramp in adoption; combined with Descartes' unique Datamyne database and rapid cross-sell to compliance customers, this could meaningfully accelerate both top-line growth and average customer spend beyond current expectations.

- Descartes is poised to be a prime beneficiary as the surge in global e-commerce and omni-channel retail requires agile, compliance-ready logistics platforms, unlocking significant new international expansion opportunities and enlarging its total addressable market, driving a sustained increase in high-margin subscription revenue.

- The company's unparalleled global logistics network and its network effect, rapidly strengthened by acquiring key players like 3GTMS and MyCarrierPortal, is positioning Descartes as a mission-critical infrastructure layer for global supply chains-this embeddedness should substantially reduce customer churn and increase pricing power, providing a long-term lift to net margins.

- A step-change in AI and automation integration across Descartes' product suite-enabled by a strong balance sheet and disciplined cost management-is set to drive operating leverage, enable smarter cross-selling, and create a unique moat, leading to accelerating earnings growth and durable margin expansion over the coming years.

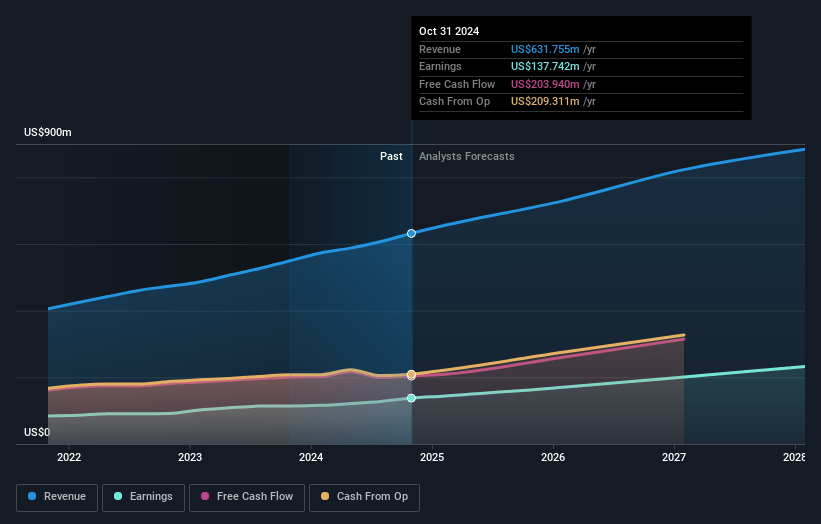

Descartes Systems Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Descartes Systems Group compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Descartes Systems Group's revenue will grow by 11.8% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 21.7% today to 27.2% in 3 years time.

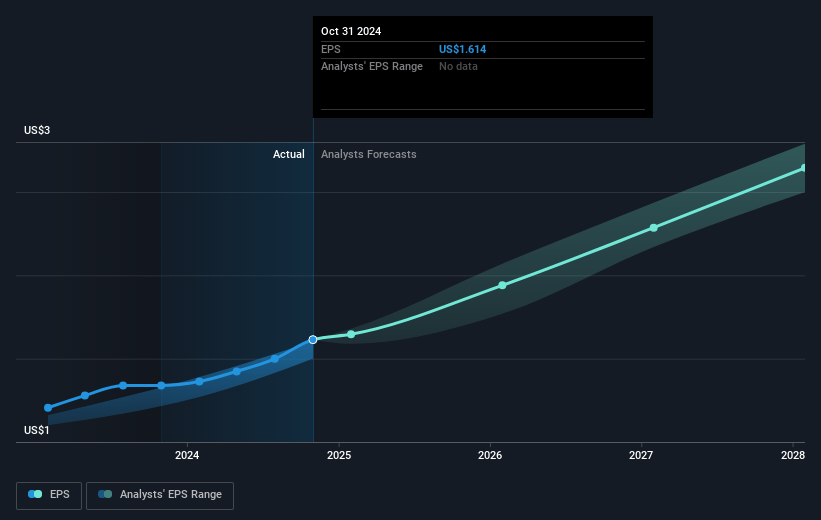

- The bullish analysts expect earnings to reach $253.6 million (and earnings per share of $2.89) by about July 2028, up from $144.8 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 53.6x on those 2028 earnings, down from 63.0x today. This future PE is greater than the current PE for the US Software industry at 53.2x.

- Analysts expect the number of shares outstanding to grow by 0.35% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.43%, as per the Simply Wall St company report.

Descartes Systems Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing geopolitical uncertainty, trade tariffs, and protectionist measures are already creating substantial hesitation among Descartes' customers to make long-term logistics software investments, which is causing volatility in transaction volumes and may further limit new revenue and organic growth for years to come.

- Ongoing shifts in global supply chains toward onshoring and nearshoring in the US and Europe could reduce the complexity and volume of international shipments, decreasing long-term demand for Descartes' cross-border and global logistics management solutions and pressuring future revenues.

- Heightened regulatory demands related to data privacy and cybersecurity, especially across multiple jurisdictions, are likely to increase compliance costs and operational risk for Descartes' SaaS model, potentially leading to lower net margins and reduced profitability over time.

- The company's reliance on acquisitions for growth exposes it to integration challenges, potential underperformance of acquired entities like 3GTMS, and the risk of goodwill write-downs, all of which could adversely affect long-term earnings and impact the return on equity.

- Intensifying competition from larger enterprise providers and agile technology startups, coupled with the risk of logistics software commoditization and price erosion, may squeeze Descartes' pricing power and margins, while advances in AI could enable disruption by new entrants, leading to customer churn and threatening the company's future market share and revenue base.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Descartes Systems Group is CA$173.79, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Descartes Systems Group's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$173.79, and the most bearish reporting a price target of just CA$131.34.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $933.5 million, earnings will come to $253.6 million, and it would be trading on a PE ratio of 53.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of CA$145.18, the bullish analyst price target of CA$173.79 is 16.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.