Last Update 10 Dec 25

CTC.A: Dividends And Buybacks Will Support Measured Returns Ahead

Analysts have modestly revised their price target on Canadian Tire Corporation upward to approximately $180.55 per share. This reflects largely unchanged assumptions for fair value, revenue growth, profit margins, and future valuation multiples, along with a slightly lower discount rate that marginally enhances the stock's risk adjusted appeal.

What's in the News

- Board declares a quarterly dividend of $1.80 per share payable March 1, 2026, marking the 16th consecutive annual increase and lifting the annual payout to $7.20 per share, up approximately 1.4% year over year (Key Developments)

- Company plans to initiate a new share repurchase program in 2026, authorizing up to an additional $400 million in Class A Non Voting share buybacks (Key Developments)

- Canadian Tire reports completion of a major tranche of its 2025 buyback, repurchasing 2,228,108 shares, or 4.06% of shares outstanding, for a total of CAD 366.8 million (Key Developments)

- Launch of the first Hudson's Bay Stripes holiday capsule collection in Canadian Tire stores beginning December 5, 2025, marking the first major product milestone since acquiring Hudson's Bay brand assets (Key Developments)

- Expanded partnership with the Gord Downie & Chanie Wenjack Fund to support Oshki Wupoowane | The Blanket Fund, with Canadian Tire committing 100% of its net proceeds from Hudson's Bay Point Blanket sales and a minimum of $1 million annually to Indigenous led initiatives (Key Developments)

Valuation Changes

- Fair Value Estimate remains unchanged at approximately CA$180.55 per share, indicating no material revision to intrinsic value assumptions.

- The discount rate edged down slightly from about 10.25 percent to roughly 10.23 percent, modestly increasing the present value of projected cash flows.

- Revenue growth remains effectively unchanged at about 25.33 percent, reflecting stable expectations for top line expansion.

- The net profit margin is effectively flat at approximately 4.44 percent, signaling no meaningful change in long term profitability assumptions.

- The future P/E multiple was nudged down slightly from about 15.12 times to roughly 15.11 times, implying a marginally lower valuation multiple applied to future earnings.

Key Takeaways

- Short-term sales gains may not be sustainable due to demographic shifts, changing consumer habits, and transitory growth drivers fading over time.

- Investments in digital and store improvements face challenges from rising costs, tough online competition, and potential margin pressures impacting long-term profitability.

- Enhanced customer loyalty, digital transformation, strong private brands, resilient core categories, and supply chain investments position the company for sustained growth and profitability.

Catalysts

About Canadian Tire Corporation- Provides a range of retail goods and services in Canada.

- Elevated investor optimism appears linked to recent strong discretionary sales and revenue growth, but this over-extrapolates consumer resilience; demographic headwinds like an aging population and shifting spending priorities are likely to dampen demand in home, automotive, and leisure categories, potentially limiting sustainable revenue expansion.

- There is an implicit bet that Canadian Tire's increased investments in digital, omnichannel infrastructure, and automation will quickly translate into competitive advantage, yet the ongoing catch-up spending compared to online-first retailers risks margin compression and leaves the company exposed to further market share loss, impacting long-term earnings growth and profitability.

- Strong short-term sales have benefited from patriotic purchasing, favorable weather, and post-pandemic replacement cycles-transitory drivers that may not persist, while the longer-term shift towards e-commerce and digital-first shopping habits may reduce the relevance of brick-and-mortar traffic and constrain future revenue growth.

- Ongoing investments in store refreshes, loyalty programs, and supply chain optimization are expected to drive cost efficiencies over time; however, the current and projected increase in fixed and variable costs, combined with wage and utility inflation, could pressure net margins and delay anticipated operating leverage improvements.

- Expectations for continued margin strength and market share gains may not sufficiently account for intensifying competition from global e-commerce giants and direct-to-consumer brands, nor for consumer shifts towards experiential spending over goods, raising the risk that revenue and net income projections are overly optimistic given secular industry changes.

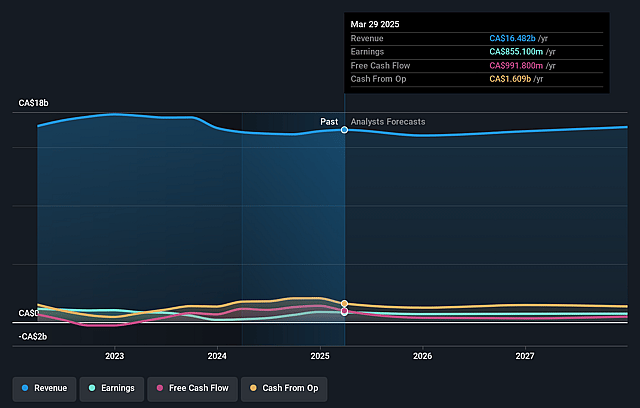

Canadian Tire Corporation Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Canadian Tire Corporation's revenue will decrease by 0.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.9% today to 4.3% in 3 years time.

- Analysts expect earnings to reach CA$732.2 million (and earnings per share of CA$14.74) by about September 2028, down from CA$815.6 million today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as CA$625 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.7x on those 2028 earnings, up from 11.1x today. This future PE is lower than the current PE for the CA Multiline Retail industry at 26.0x.

- Analysts expect the number of shares outstanding to decline by 2.79% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.1%, as per the Simply Wall St company report.

Canadian Tire Corporation Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Strong customer loyalty, shown by a 6% increase in the active Triangle Rewards member base and expanded partnerships with RBC and WestJet, could drive higher repeat purchases, increase customer stickiness, and support long-term revenue stability and growth.

- Significant investments in digital infrastructure-including store automation, omnichannel enhancements (same-day delivery, one-click checkout), and the rollout of advanced data analytics/AI tools-are improving operational efficiency; over time, these are likely to drive higher sales and margin expansion as e-commerce sales are already outpacing overall growth.

- Ongoing strategic focus on private label and owned brands (with the HBC brand asset purchase and strong responses to new product launches) may result in higher gross margin and brand differentiation, supporting both top-line growth and improved profitability.

- The company's resilient and expanding core categories (home, automotive, seasonal, sporting goods) continue to benefit from Canadian trends in household formation, renewal cycles for big-ticket items, and robust discretionary spend-providing a buffer for long-term revenue and earnings even in periods of economic uncertainty.

- Ongoing supply chain investments-including a new large distribution center and increases in automation-are improving inventory velocity and cost leverage; combined with balance sheet deleveraging and active share repurchases, these efforts are positioned to drive improvements in net margin and overall shareholder returns in the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$175.636 for Canadian Tire Corporation based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$211.0, and the most bearish reporting a price target of just CA$150.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$16.9 billion, earnings will come to CA$732.2 million, and it would be trading on a PE ratio of 15.7x, assuming you use a discount rate of 10.1%.

- Given the current share price of CA$168.45, the analyst price target of CA$175.64 is 4.1% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Canadian Tire Corporation?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.