Key Takeaways

- Strong early performance and pricing power for GRAFAPEX position Medexus for accelerated growth, higher margins, and market share gains ahead of expectations.

- Diversified rare disease pipeline, resilient legacy products, and improved financial flexibility support sustained growth and new product launches.

- Reliance on a single new product, generic competition, rising costs, mature franchise declines, and high debt create significant risks to sustainable growth and earnings stability.

Catalysts

About Medexus Pharmaceuticals- Operates as a pharmaceutical company in Canada and the United States.

- Analyst consensus projects GRAFAPEX to become a leading product with U.S. revenue potential exceeding one hundred million dollars annually, but recent launch momentum-rapid formulary wins, initial uptake exceeding expectations, and high gross-to-net pricing-suggests the product could achieve this peak revenue years ahead of schedule and potentially surpass consensus estimates, which would dramatically accelerate both top-line growth and market share gains.

- Analysts broadly agree GRAFAPEX's eighty percent gross margin will uplift Medexus's profitability, but early performance implies initial margins could be even higher due to favorable reimbursement dynamics and limited price resistance, positioning GRAFAPEX as a margin catalyst that could drive rapid expansion in overall EBITDA and net income.

- Medexus's core strategy of targeting therapies for rare diseases is uniquely positioned to capitalize on increasing global demand for specialized pharmaceuticals driven by the aging population and rise in chronic illness, unlocking a larger addressable market that can support sustained above-market revenue growth and defensible pricing.

- The company is building a deep pipeline-supported by ongoing licensing and acquisition efforts-that will leverage proven commercial infrastructure and regulatory expertise to bring additional high-value specialty drugs to market, enabling long-term revenue diversification and compounding margin improvement.

- Existing products like IXINITY and Rasuvo demonstrate surprising resilience and stable cash generation, while new regulatory amendments and reduced interest expense from renegotiated credit facilities will meaningfully enhance free cash flow, creating significant dry powder for future business development, pipeline expansion, and earnings growth.

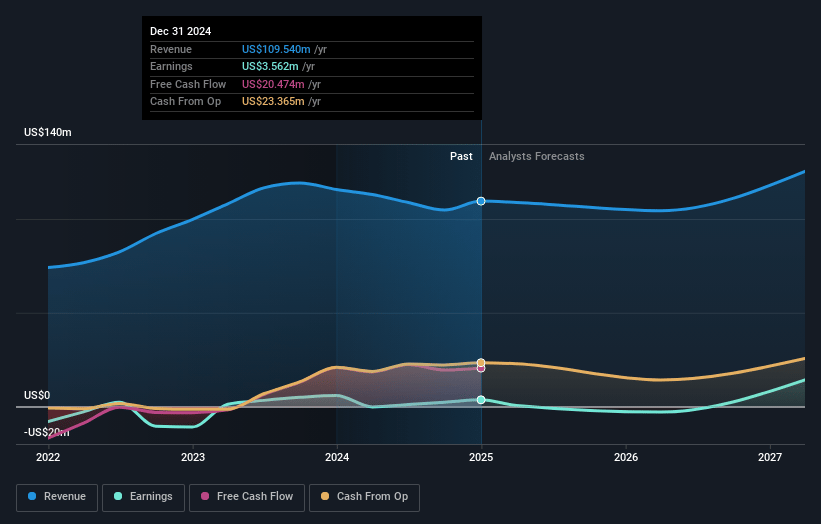

Medexus Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Medexus Pharmaceuticals compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Medexus Pharmaceuticals's revenue will grow by 15.7% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 2.1% today to 17.3% in 3 years time.

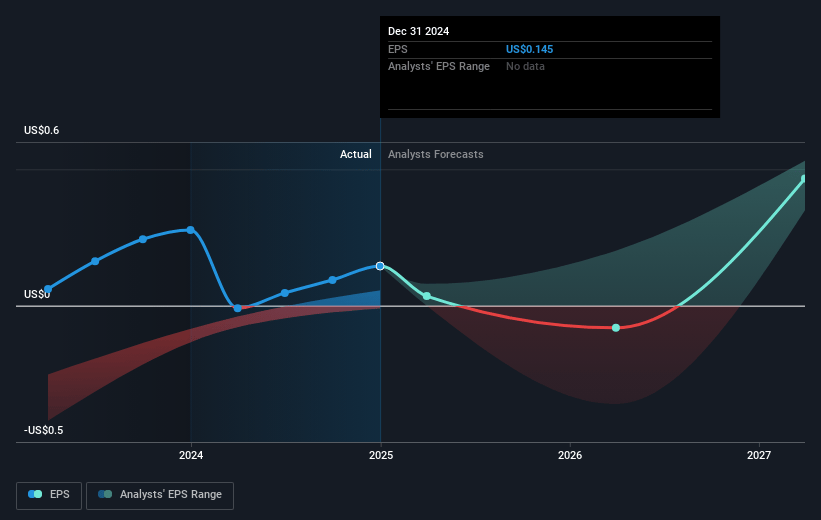

- The bullish analysts expect earnings to reach $29.1 million (and earnings per share of $1.12) by about July 2028, up from $2.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 11.7x on those 2028 earnings, down from 29.3x today. This future PE is lower than the current PE for the CA Pharmaceuticals industry at 16.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

Medexus Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Heavy reliance on GRAFAPEX for future growth means revenue is increasingly concentrated in a single new product, leaving Medexus vulnerable to any unexpected regulatory, reimbursement, or market access setbacks that could result in sudden material revenue or earnings declines.

- Rising prevalence of generics, as already seen with Rupall's loss of exclusivity in Canada, reflects broader industry and secular trends threatening branded pharmaceutical volumes, which may further erode revenues and gross profits across the existing product portfolio over time.

- Ongoing investments required to commercialize GRAFAPEX have already driven SG&A expenses higher, and with anticipated increases to 4 million dollars per quarter, there is continued pressure on margins and a real risk that elevated costs outpace new product revenue if adoption is slower than expected, impacting net income.

- Recent revenue declines in core base franchises-IXINITY, Rupall, and potentially Rasuvo-combined with lack of aggressive growth plans for these mature products, increase dependence on successful pipeline replenishment; yet the company's business model prioritizes in-licensing late-stage products over proprietary R&D, which could put sustainable revenue streams and future earnings at risk if new deals are delayed or become more expensive.

- Past acquisitions have contributed to historically high debt levels, currently at 37.6 million dollars outstanding, which, despite recent refinancing, may constrain Medexus' ability to make future strategic investments and could amplify earnings volatility in a rising interest rate environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Medexus Pharmaceuticals is CA$10.0, which is the highest price target estimate amongst analysts. This valuation is based on what can be assumed as the expectations of Medexus Pharmaceuticals's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$10.0, and the most bearish reporting a price target of just CA$3.45.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be $167.9 million, earnings will come to $29.1 million, and it would be trading on a PE ratio of 11.7x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$2.78, the bullish analyst price target of CA$10.0 is 72.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives