Key Takeaways

- Strategic acquisitions and transitioning to an in-house sales team are aimed at reducing costs and boosting revenue and earnings for Cipher Pharmaceuticals.

- Expanding Natroba's market presence, out-licensing, and a diverse product portfolio are central to Cipher's growth strategy and improving net margins.

- Dependence on Natroba's integration success and setbacks in revenue stability and new product development could negatively impact future earnings and cash flow.

Catalysts

About Cipher Pharmaceuticals- Operates as a specialty pharmaceutical company in Canada.

- The recent acquisition of Natroba and its authorized generic spinosad in the U.S. provides a North American platform that Cipher plans to grow both organically and through further acquisitions, which could increase revenue significantly.

- By transitioning sales from a prior co-promotion partner to an in-house sales team, Cipher expects to reduce costs and enhance earnings from the Natroba business starting in 2025.

- Out-licensing Natroba globally, especially in warm regions with high unmet needs, and introducing it to the Canadian market is expected to bolster revenue streams and improve net margins.

- The potential addition of complementary dermatology and infectious disease products to the U.S. sales portfolio is part of Cipher's strategy for inorganic growth, which could boost revenue and potentially improve net margins.

- Ongoing development and potential future approval of pipeline products such as MOB-015 and piclidenoson (CF-101) could provide new sources of revenue and enhance earnings if these products successfully enter the market.

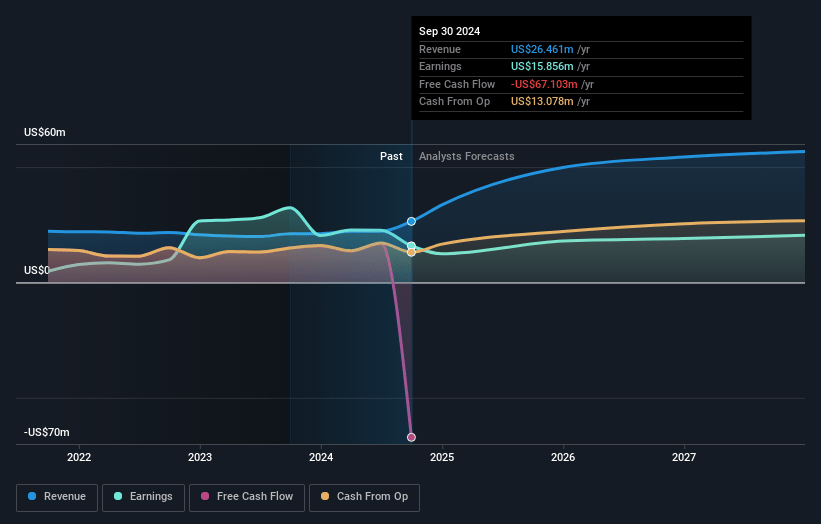

Cipher Pharmaceuticals Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Cipher Pharmaceuticals's revenue will grow by 28.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 59.9% today to 35.8% in 3 years time.

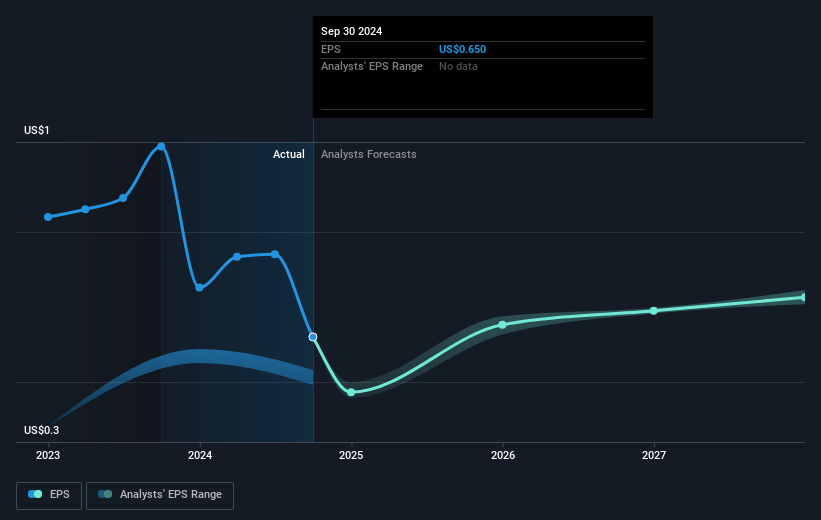

- Analysts expect earnings to reach $20.1 million (and earnings per share of $0.77) by about February 2028, up from $15.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 20.8x on those 2028 earnings, up from 14.2x today. This future PE is lower than the current PE for the CA Pharmaceuticals industry at 21.8x.

- Analysts expect the number of shares outstanding to grow by 6.12% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.82%, as per the Simply Wall St company report.

Cipher Pharmaceuticals Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition away from a co-promotion partner for the Natroba business impacted Cipher's sales and earnings during the third quarter, highlighting potential risks to future revenue stability.

- A significant decline in licensing revenue, particularly from Absorica in the U.S., due to lower product shipments raises concerns about Cipher's future revenue streams from existing products.

- The setback in the North American Phase III study for the MOB-015 product indicates potential delays or challenges in bringing new products to market, affecting future revenue and earnings potential.

- Increased selling, general and administrative expenses, primarily due to acquisition and restructuring costs associated with the Natroba acquisition, could impact net margins negatively if not mitigated through revenue growth.

- Dependence on the successful integration and performance of the recently acquired Natroba business poses risks if expected synergies and cost efficiencies are not realized, potentially affecting earnings and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$16.7 for Cipher Pharmaceuticals based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$18.6, and the most bearish reporting a price target of just CA$14.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $56.1 million, earnings will come to $20.1 million, and it would be trading on a PE ratio of 20.8x, assuming you use a discount rate of 5.8%.

- Given the current share price of CA$12.5, the analyst price target of CA$16.7 is 25.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives