Catalysts

About Americas Gold and Silver

Americas Gold and Silver is a North American precious metals producer focused on growing silver output with byproduct antimony, copper, lead and zinc from its Galena and Cosalá operations.

What are the underlying business or industry changes driving this perspective?

- Although the multiyear growth plan at Galena is beginning to lift throughput and unit costs, the company remains heavily dependent on successful execution of long hole stoping and infrastructure upgrades. Any delays or underperformance could cap production gains and limit the anticipated improvement in margins and cash flow.

- While EC120 is expected to transition Cosalá toward higher grade silver and copper output, the reliance on a smooth ramp to commercial production by the end of 2025 means that geotechnical setbacks or slower development could defer the planned silver volume growth and delay the move from adjusted losses to sustained positive earnings.

- Although Americas is positioned to benefit from structurally tight silver markets and higher prices tied to energy transition demand, the current cost base and recent net losses indicate that any reversal in silver prices or inability to further reduce all in sustaining costs could compress revenue leverage and prolong pressure on net margins.

- Despite promising test work showing over 99 percent antimony recovery alongside copper, monetizing this critical mineral hinges on advancing processing options and securing supportive government frameworks. Failure to lock in viable local processing or offtake could limit diversification of revenue and the expected uplift in EBITDA from antimony byproduct sales.

- While engagement with U S policymakers and the strategic position as a domestic supplier of antimony and silver could open access to incentives and defense related demand, the company still faces balance sheet constraints and a working capital deficit that may necessitate additional capital, which could dilute shareholders and weigh on earnings per share even as operations scale.

Assumptions

This narrative explores a more pessimistic perspective on Americas Gold and Silver compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts. How have these above catalysts been quantified?

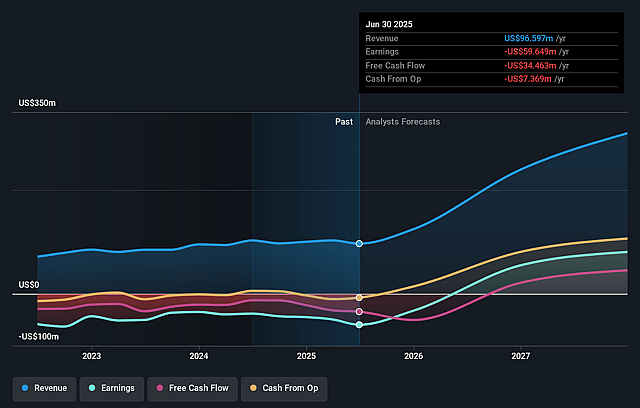

- The bearish analysts are assuming Americas Gold and Silver's revenue will grow by 36.6% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -58.5% today to 63.1% in 3 years time.

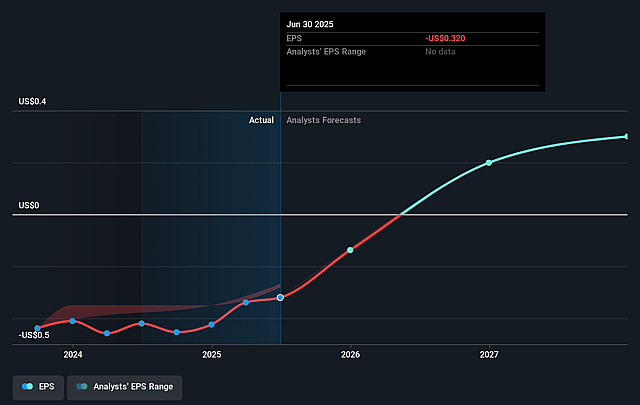

- The bearish analysts expect earnings to reach $168.9 million (and earnings per share of $0.19) by about December 2028, up from $-61.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.1x on those 2028 earnings, up from -20.2x today. This future PE is lower than the current PE for the CA Metals and Mining industry at 20.6x.

- The bearish analysts expect the number of shares outstanding to grow by 6.98% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.19%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The company’s recent production surge is highly leveraged to a silver price around 40 dollars per ounce. Any cyclical downturn in silver prices despite long-term energy transition demand could quickly erode revenue growth and reverse the nascent improvement in adjusted EBITDA and net earnings.

- The multiyear shift to long hole stoping and major infrastructure upgrades at Galena and the transition from San Rafael to EC120 at Cosalá increase operational complexity. Capital cost overruns, commissioning delays or lower than expected grades could lift unit costs and constrain improvements in net margins.

- The strategy to monetize antimony as a critical mineral depends on successful metallurgical scaling, new processing routes and supportive U S policy. Failure to secure timely government backing or viable local processing could leave a large portion of this byproduct value unrealized and limit diversification of EBITDA away from silver.

- Despite an improved but still negative working capital position and a history of net losses, the company continues to deploy significant growth capital. Any prolonged period of weak cash flow generation could force additional equity or debt financing, diluting shareholders and putting pressure on earnings per share.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bearish price target for Americas Gold and Silver is CA$7.5, which represents up to two standard deviations below the consensus price target of CA$8.55. This valuation is based on what can be assumed as the expectations of Americas Gold and Silver's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$9.6, and the most bearish reporting a price target of just CA$7.5.

- In order for you to agree with the more bearish analyst cohort, you'd need to believe that by 2028, revenues will be $267.4 million, earnings will come to $168.9 million, and it would be trading on a PE ratio of 13.1x, assuming you use a discount rate of 7.2%.

- Given the current share price of CA$6.3, the analyst price target of CA$7.5 is 16.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Americas Gold and Silver?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.