Key Takeaways

- Integration challenges, regulatory burdens, and operational complexity may restrict margin improvements and slow the scalability of WELL's digital healthcare initiatives.

- Heavy reliance on Canadian market expansion and successful subsidiary IPOs introduces concentration risk, especially amid tough competition and evolving regulatory landscapes.

- Heavy dependence on acquisitions, regulatory pressures, and decreased geographic diversity heighten operational risks, amplify exposure to the Canadian market, and threaten sustained profit growth.

Catalysts

About WELL Health Technologies- Operates as a practitioner-focused digital healthcare company in Canada, the United States, and internationally.

- Despite WELL Health's significant exposure to the long-term shift toward digital and AI-driven healthcare delivery, operational complexity and execution risk from the divestment of U.S. care assets and the integration of multiple acquired entities, such as HEALWELL and WELLSTAR, could create near-term inefficiencies that weigh on net margins and delay forecasted EBITDA improvements.

- Although WELL is aiming to rapidly scale its Canadian clinic network to achieve a 10% market share-capitalizing on increased healthcare consumerization and the aging population's rising care needs-the fragmented and low-margin nature of primary care, plus challenges in provider recruitment and clinic transformation, could result in higher integration costs and uneven returns on invested capital.

- While WELL's technology platforms benefit from the ongoing digital transformation and the healthcare industry's migration to SaaS and high-margin recurring revenue models, increasing regulatory and data privacy requirements, together with heightened compliance costs evidenced in divisions like Wisp, are likely to put pressure on profitability and operational scalability.

- Although the company expects the consolidation and eventual IPOs of subsidiaries such as WELLSTAR and HEALWELL to unlock shareholder value and drive cash flow, the success of these outcomes relies on execution in capital markets and the ability of management to sustain organic growth and software innovation ahead of intensifying competition from large, well-capitalized incumbents, threatening future revenue uplifts.

- Despite the healthy M&A pipeline and demonstrated historical improvements in EBITDA for acquired clinics, WELL's shift away from U.S.-based care businesses exposes it to concentration risk in the Canadian healthcare market, where reimbursement regime changes, slower-than-expected regulatory adoption of digital tools, or resistance from providers to technology adoption could dampen revenue growth and margin expansion targets.

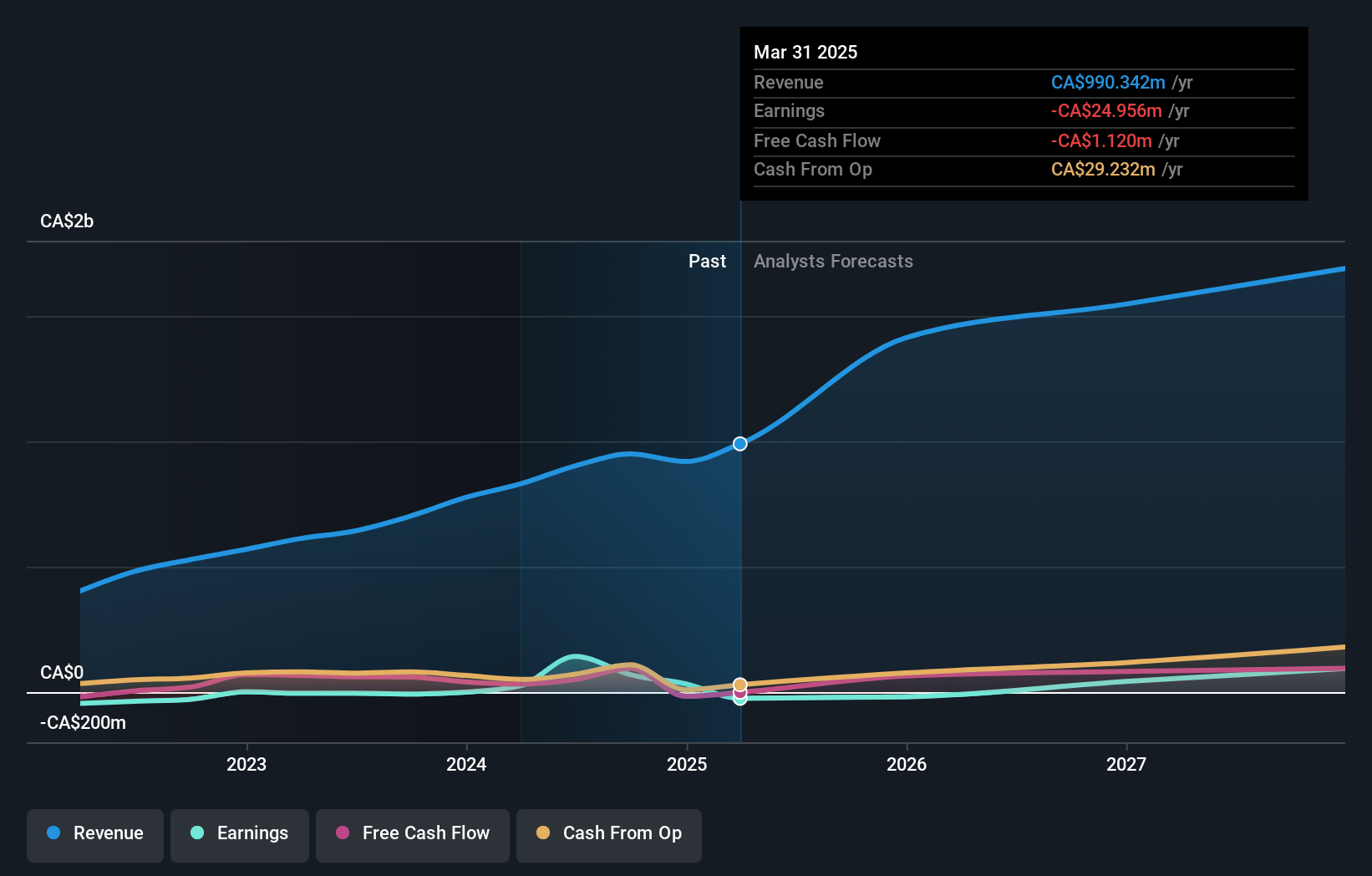

WELL Health Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more pessimistic perspective on WELL Health Technologies compared to the consensus, based on a Fair Value that aligns with the bearish cohort of analysts.

- The bearish analysts are assuming WELL Health Technologies's revenue will grow by 22.2% annually over the next 3 years.

- The bearish analysts assume that profit margins will increase from -2.5% today to 7.3% in 3 years time.

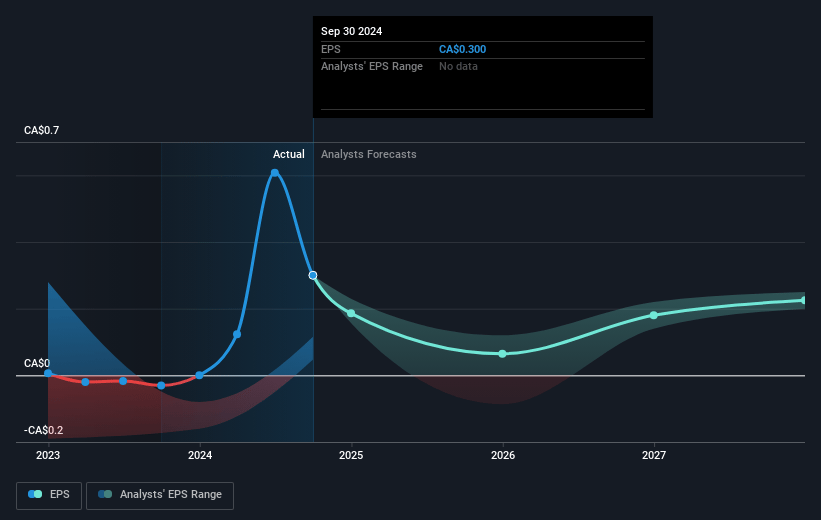

- The bearish analysts expect earnings to reach CA$132.5 million (and earnings per share of CA$0.42) by about July 2028, up from CA$-25.0 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bearish analyst cohort, the company would need to trade at a PE ratio of 13.3x on those 2028 earnings, up from -49.0x today. This future PE is lower than the current PE for the CA Healthcare industry at 24.6x.

- Analysts expect the number of shares outstanding to grow by 1.67% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

WELL Health Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- WELL Health's aggressive focus on acquiring small, fragmented clinics in Canada exposes the company to significant integration risks, which may lead to operational inefficiencies, increased overhead, and declining net margins if execution falters and the integration of acquired clinics does not drive expected efficiencies.

- The planned divestiture of U.S. care delivery assets such as Circle Medical, Wisp, and CRH reduces geographic diversification and future revenue streams, making the company's financial performance heavily dependent on Canadian healthcare market dynamics and policy decisions, thus increasing earnings volatility and risk if Canadian growth does not materialize as forecast.

- Intensifying competition from incumbents and major tech or healthcare players, combined with the collapse of the number two Canadian clinic network (ELNA) from covenant breaches, highlights the pressures in this space that could compress WELL's pricing power, limit organic revenue growth, and squeeze operating margins across its core markets.

- The company acknowledges rising overhead, partially driven by the need to scale shared services and compliance in response to increased regulatory scrutiny and evolving data privacy rules in healthcare, which could directly impact both profitability and future free cash flow as compliance costs and operational friction grow.

- WELL Health's reliance on M&A for sustained revenue and EBITDA growth leaves its financial performance susceptible to rising interest rates and tighter capital markets, which could restrict access to affordable funding for acquisitions and R&D, ultimately slowing revenue growth and limiting adjusted EBITDA expansion.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bearish price target for WELL Health Technologies is CA$5.59, which represents two standard deviations below the consensus price target of CA$7.65. This valuation is based on what can be assumed as the expectations of WELL Health Technologies's future earnings growth, profit margins and other risk factors from analysts on the more bearish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$9.0, and the most bearish reporting a price target of just CA$5.25.

- In order for you to agree with the bearish analysts, you'd need to believe that by 2028, revenues will be CA$1.8 billion, earnings will come to CA$132.5 million, and it would be trading on a PE ratio of 13.3x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$4.83, the bearish analyst price target of CA$5.59 is 13.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystLowTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystLowTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystLowTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.