Key Takeaways

- Margin pressures from rising costs and flat revenue growth due to case mix suggest limited future profitability.

- One-time government income and capital returns reduce resources for investment, impacting long-term growth potential.

- Increased surgical case volumes and lower expenses suggest strong performance, while debt reduction and reputation enhancements could improve profitability and revenue stability.

Catalysts

About Medical Facilities- Through its subsidiaries, owns and operates specialty hospitals and ambulatory surgery center in the United States.

- Medical Facilities is experiencing margin pressures due to rising salaries and benefits, driven by market wage pressures and increased full-time staffing needs. This could negatively impact future net margins.

- The company is facing a flat facility service revenue as surgical and pain management volume increases are offset by case and payer mix changes. This suggests that future revenue growth may be limited without changes in case composition.

- Medical Facilities received a substantial one-time government stimulus income, which contributed significantly to the current revenue increase. This is non-recurring and does not indicate lasting revenue growth potential.

- Operating expenses are being managed with some reductions, but increased G&A and personnel costs could offset these savings in the future, pressuring operating margins and earnings.

- The reduction in corporate debt and share repurchases reflect a return of capital to shareholders, but may limit resources available for future investment opportunities to drive revenue and earnings growth.

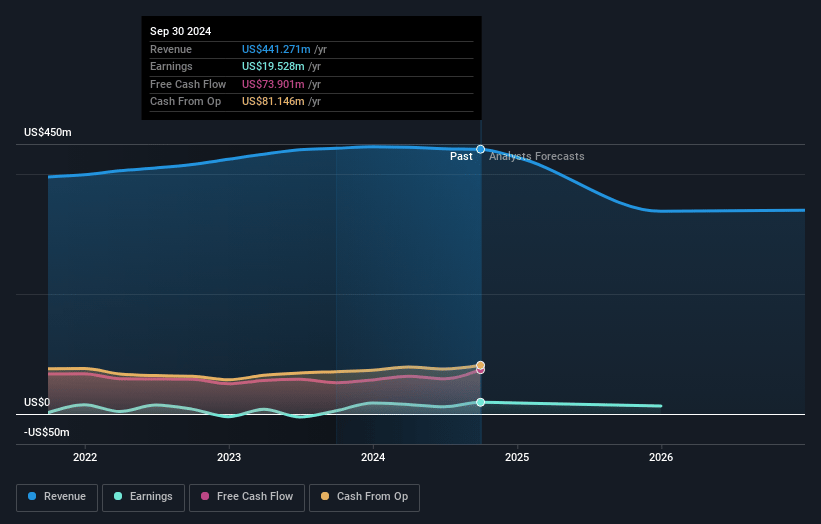

Medical Facilities Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Medical Facilities's revenue will decrease by 13.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.4% today to 2.4% in 3 years time.

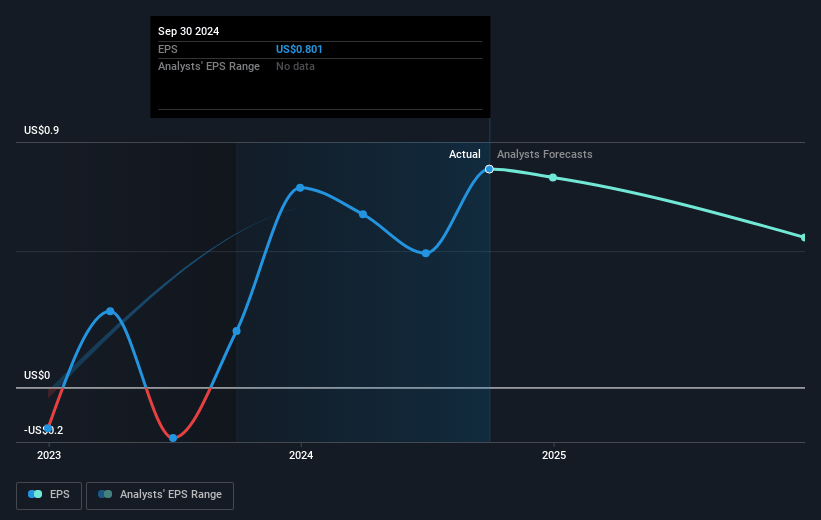

- Analysts expect earnings to reach $7.1 million (and earnings per share of $0.3) by about February 2028, down from $19.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 39.0x on those 2028 earnings, up from 14.1x today. This future PE is greater than the current PE for the CA Healthcare industry at 24.0x.

- Analysts expect the number of shares outstanding to decline by 3.99% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.96%, as per the Simply Wall St company report.

Medical Facilities Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The increase in surgical and pain management case volumes indicates stronger operational performance, which could lead to sustained or increased revenues going forward.

- A net decrease in operating expenses, particularly in consolidated drugs and supplies, could improve profit margins, enhancing net earnings.

- The forgiveness of PPP loans and recognition of government stimulus income provided a one-time boost to revenue, and similar future opportunities could further stabilize earnings.

- Reduction in corporate debt and maintenance of a relatively low outstanding balance could lower interest expenses, positively impacting net margins and profitability.

- The recognition and ranking of Arkansas Surgical Hospital as a top-performing hospital could enhance the company's reputation and lead to increased patient volumes, thereby potentially raising future revenues.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$16.543 for Medical Facilities based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $290.6 million, earnings will come to $7.1 million, and it would be trading on a PE ratio of 39.0x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$17.05, the analyst price target of CA$16.54 is 3.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives