Key Takeaways

- The acquisition of Orion Health is expected to boost Healwell AI's international presence and revenue growth through enhanced data infrastructure and operational synergies.

- Strategic leadership changes and a focus on operational excellence are anticipated to drive sustainable profitability and improved long-term financial health.

- Integration of Orion Health presents challenges that may impact profitability, while reliance on acquisitions and early-stage AI monetization add execution risks and potential financial strain.

Catalysts

About Healwell AI- A healthcare artificial intelligence company, develops and commercializes clinical decision support systems in Canada, New Zealand, Australia, and the United Kingdom.

- The acquisition of Orion Health is expected to significantly enhance Healwell AI's international presence, adding over 70 key customers and nearly 400 skilled team members, which should drive substantial revenue growth.

- Orion Health's robust healthcare data infrastructure and strong operating margins are anticipated to enhance Healwell AI's financial profile, which is expected to improve net margins and earnings moving forward.

- The integration of Healwell's AI capabilities with Orion Health's platforms is expected to create a unified global healthcare platform, enhancing efficiency and patient outcomes, potentially leading to higher revenue and margins through value-added services.

- Strategic additions and changes to the executive team, including a new CEO and COO, are intended to support the company's focus on product expansion and commercial execution at scale, likely impacting profitability and revenue positively.

- The shift in strategy from M&A-driven growth to one focused on operational excellence and scalable growth is expected to lead to sustainable profitability, potentially driving improved earnings and long-term financial health.

Healwell AI Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Healwell AI's revenue will grow by 70.5% annually over the next 3 years.

- Analysts are not forecasting that Healwell AI will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Healwell AI's profit margin will increase from -70.3% to the average CA Healthcare industry of 5.3% in 3 years.

- If Healwell AI's profit margin were to converge on the industry average, you could expect earnings to reach CA$12.8 million (and earnings per share of CA$0.04) by about July 2028, up from CA$-34.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 104.0x on those 2028 earnings, up from -11.4x today. This future PE is greater than the current PE for the CA Healthcare industry at 24.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.95%, as per the Simply Wall St company report.

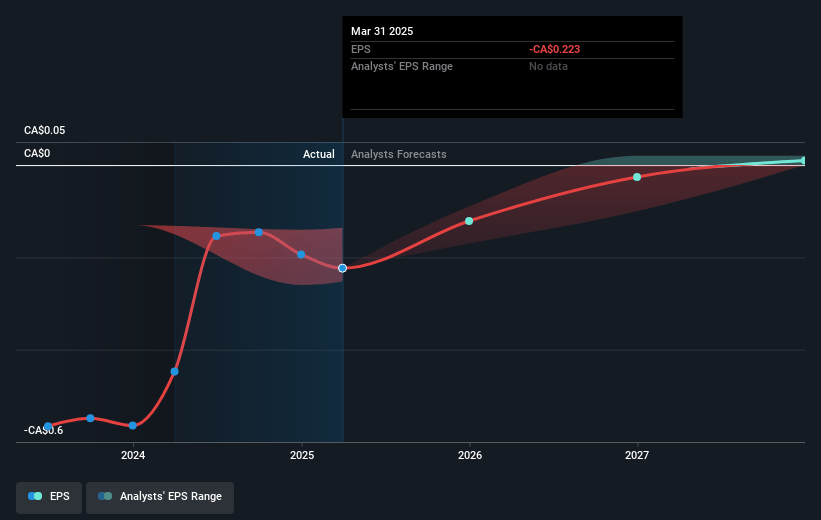

Healwell AI Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of Orion Health, while transformative, presents potential challenges and complexities, which could impact near-term operational efficiency and profitability as the processes and systems are merged. This might affect the company’s net margins and earnings.

- Despite the 208% increase in revenue compared to Q1 2024, Healwell AI reported a CA$14.1 million net loss for Q1 2025, driven by transaction costs related to the Orion acquisition and stock-based compensation. Ongoing costs and integration efforts could pressure net margins and delay profitability.

- The AI and data science segment, while showing substantial growth, is in its early stages of monetizing healthcare practitioners’ data, with a small percentage of recurring revenue, indicating a risk to steady revenue flow if momentum doesn't sustain.

- Healwell’s report of an adjusted EBITDA loss for the quarter shows that profitability hadn't been achieved yet by Q1 2025, indicating that profitability depends heavily on successful integration and operation of acquired businesses, which may fluctuate if things don't progress smoothly.

- The company's growth strategy relies heavily on acquisitions, which come with execution risks and financial strain. Any misstep in the acquisition strategy or inability to generate the anticipated synergies could lead to increased liabilities and affect net earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$3.45 for Healwell AI based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$2.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$240.4 million, earnings will come to CA$12.8 million, and it would be trading on a PE ratio of 104.0x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$1.46, the analyst price target of CA$3.45 is 57.7% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.