Key Takeaways

- Expansion in waterflood development and cost reduction initiatives are set to boost oil recovery, free cash flow, and profitability across market cycles.

- Stronger financial discipline and improved market access support resilient revenues, higher returns, and the potential for enhanced shareholder distributions.

- Ongoing dependence on oil, regional concentration, and waterflood reliance expose the company to multiple long-term risks amid shifting energy, regulatory, and capital market trends.

Catalysts

About Tamarack Valley Energy- Engages in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin.

- Anticipated long-term growth in global energy demand, especially from expanding populations and urbanization in Asia and Africa, provides Tamarack with resilient market opportunities for its oil production, supporting stable revenues and future production expansion.

- Tamarack's accelerating waterflood development in Clearwater and Charlie Lake is expected to materially increase oil recoveries (2-3x primary recovery per well), reduce overall decline rates, and significantly lower annual sustaining capital-driving structurally higher free cash flow and improving net margins.

- Ongoing cost reduction initiatives, highlighted by 23% lower production expenses YOY and continued drilling efficiencies (larger pad developments, cost/meter improvements), support robust operating netbacks, margin expansion, and increased profitability even in lower-price environments.

- Strong balance sheet improvements (net debt/EBITDA at 0.7x, $400 million undrawn credit) combined with disciplined capital allocation enable Tamarack to optimize buybacks and dividends, further enhancing per-share earnings growth and ROE.

- Regulatory and infrastructure advancements-including Canada's stringent ESG standards and expanded pipeline/export capacity-strengthen Tamarack's access to global markets and command for its responsibly-produced oil, increasing future realized prices and supporting revenue resilience.

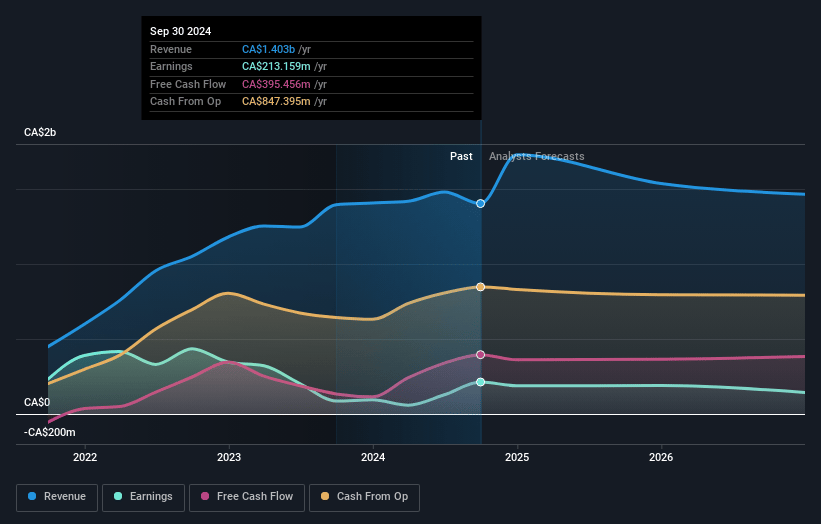

Tamarack Valley Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Tamarack Valley Energy's revenue will grow by 4.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 18.0% today to 4.9% in 3 years time.

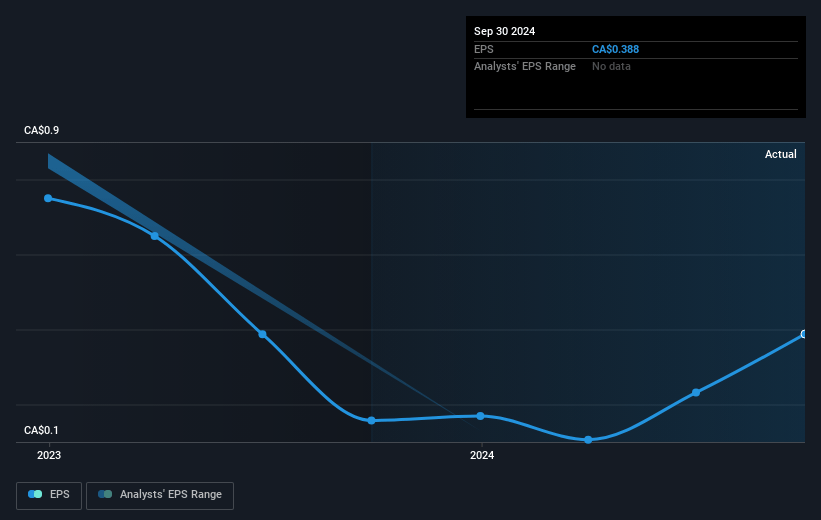

- Analysts expect earnings to reach CA$80.5 million (and earnings per share of CA$0.55) by about July 2028, down from CA$259.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 36.2x on those 2028 earnings, up from 9.8x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 12.0x.

- Analysts expect the number of shares outstanding to decline by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.24%, as per the Simply Wall St company report.

Tamarack Valley Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tamarack Valley Energy's heavy operational and revenue dependence on oil production exposes the company to long-term risks from global energy transition trends, including increasing decarbonization, growing renewable energy adoption, and accelerating EV usage, which could depress oil demand and put downward pressure on future revenue and cash flows.

- The company's strategic focus and geographic concentration in the Clearwater and Charlie Lake plays in Western Canada increases its exposure to region-specific regulatory changes, carbon tax escalation, and potential transportation bottlenecks or pipeline delays, which could negatively impact realized prices, revenue consistency, and net margins over the long term.

- While management emphasizes cost efficiency and decline mitigation through waterflooding, the text highlights that future production growth and free cash flow generation are highly reliant on continued waterflood effectiveness across its asset base; any technical setbacks, underperformance, or diminishing returns from waterflooding could lead to higher sustaining capital needs, weakening earnings and limiting production growth.

- Despite a currently strong balance sheet, Tamarack Valley's expansion strategy has involved sizable asset acquisitions and ongoing large-scale development projects; if commodity prices weaken for an extended period, the company could face constraints on capital allocation, reduced flexibility for shareholder returns, and heightened risk to net margins due to rising interest or funding costs, especially given the cyclical nature of oil prices.

- Industry-wide and investor-driven ESG pressures, including divestment from oil and gas companies and demands for lower emissions, may further restrict Tamarack's access to capital, raise its cost of capital, compress valuation multiples, and place sustained pressure on net income and long-term share price performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$6.045 for Tamarack Valley Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$7.5, and the most bearish reporting a price target of just CA$5.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.7 billion, earnings will come to CA$80.5 million, and it would be trading on a PE ratio of 36.2x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$5.09, the analyst price target of CA$6.05 is 15.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.