Key Takeaways

- Efficient cost management and operational outperformance underpin stronger profitability, while flexible capital allocation enables quick adaptation to market shifts for sustained growth.

- Advances in waterflood and drilling, plus strong ESG positioning, position Saturn for premium pricing, regulatory incentives, and enhanced investor appeal.

- Structural shifts toward renewables, financial risk from high debt, regulatory pressure, ESG-driven capital constraints, and regional concentration threaten long-term growth and profitability.

Catalysts

About Saturn Oil & Gas- Engages in the acquisition, exploration, and development of petroleum and natural gas resource deposits in Canada.

- Analysts broadly agree that Saturn's operational cost reductions and synergy capture are strong, but the pace and magnitude of ongoing cost savings from integrating recent acquisitions like Flat Lake and Battrum are likely still underestimated, potentially driving a material uplift to net margins and free cash flow beyond consensus expectations.

- Analyst consensus highlights waterflood development and breakthrough drilling as key drivers, but recent quarterly drilling results, consistently outperforming type curves by 20 to 50 percent, coupled with extensive undrilled inventory and early-phase horizontal reentry programs, indicate the company could deliver a step-change in long-term production growth and revenue well above market assumptions.

- Saturn's unique capital allocation flexibility-enabled by low-commitment, short-cycle assets-positions it as one of the only Canadian E&Ps able to rapidly scale investment into higher-return oil or gas plays as commodity cycles shift, unlocking the potential for accelerated revenue and EBITDA growth during periods of rising global demand.

- The company's demonstrated track record in operational safety and efficiency, combined with its expanding waterflood and low-emission development initiatives, positions Saturn favorably for future regulatory incentives, improved ESG investment flows, and access to premium pricing, which could result in a sustained uplift to valuation multiples and cash flow.

- As North American energy security becomes a priority and infrastructure constraints ease, Saturn, with its high-quality, low-decline Canadian oil assets, stands to benefit disproportionately from higher realized oil prices and stable market access, materially supporting future top-line revenue and further improving balance sheet strength.

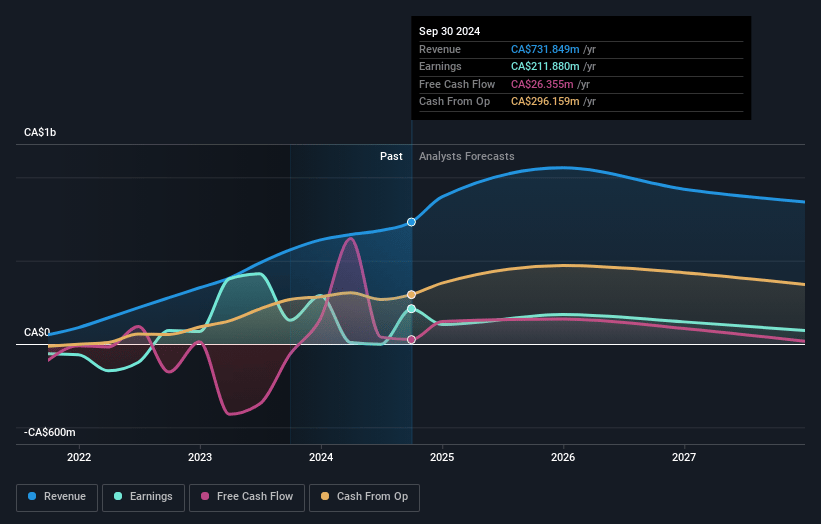

Saturn Oil & Gas Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- This narrative explores a more optimistic perspective on Saturn Oil & Gas compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts.

- The bullish analysts are assuming Saturn Oil & Gas's revenue will decrease by 2.1% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 17.1% today to 24.7% in 3 years time.

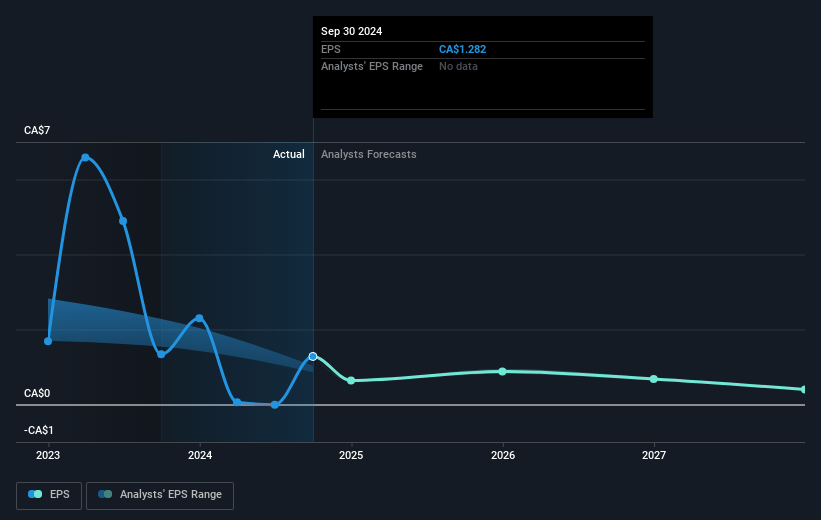

- The bullish analysts expect earnings to reach CA$209.6 million (and earnings per share of CA$1.12) by about July 2028, up from CA$154.9 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 6.0x on those 2028 earnings, up from 2.8x today. This future PE is lower than the current PE for the CA Oil and Gas industry at 11.8x.

- Analysts expect the number of shares outstanding to decline by 4.02% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.76%, as per the Simply Wall St company report.

Saturn Oil & Gas Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The long-term global shift toward renewable energy, decarbonization efforts, and greater adoption of electric vehicles threatens to undermine oil demand over the coming decades, which could structurally compress Saturn Oil & Gas's future top-line revenue and hinder sustainable earnings growth.

- Saturn's high net debt-$814 million as of quarter end-combined with its reliance on continual debt refinancing and acquisitive growth exposes the company to increased refinancing risk and higher interest expenses, which could squeeze net earnings and potentially pressure cash flow if debt markets tighten or oil prices remain low.

- Heightened regulatory scrutiny, potential increases in emissions-related taxes, and stricter environmental standards in Canada and globally could raise Saturn's operational costs, negatively impacting operating margins and net profitability over the long term.

- Growing preference among institutional investors and lenders for ESG-friendly investments may restrict access to capital for fossil fuel firms like Saturn, increasing the company's cost of capital and limiting its ability to invest for future growth, thus impacting long-term financial flexibility and expansion potential.

- Saturn's geographic concentration in the Western Canadian sedimentary basin, coupled with ongoing industry risks such as regional transportation bottlenecks and basis differentials, could lead to lower realized selling prices versus global benchmarks, further putting pressure on total revenues and reducing margin resilience.

Valuation

How have all the factors above been brought together to estimate a fair value?- The assumed bullish price target for Saturn Oil & Gas is CA$5.68, which represents two standard deviations above the consensus price target of CA$3.64. This valuation is based on what can be assumed as the expectations of Saturn Oil & Gas's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$6.0, and the most bearish reporting a price target of just CA$2.75.

- In order for you to agree with the bullish analysts, you'd need to believe that by 2028, revenues will be CA$848.3 million, earnings will come to CA$209.6 million, and it would be trading on a PE ratio of 6.0x, assuming you use a discount rate of 8.8%.

- Given the current share price of CA$2.21, the bullish analyst price target of CA$5.68 is 61.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.