Last Update03 Oct 25Fair value Increased 5.83%

Analysts have raised their price target for Parex Resources by C$1 to C$18.17, citing the company’s improved strategy, continued operational success, and the potential for positive shifts in investor sentiment.

Analyst Commentary

Recent research notes reflect a shift in sentiment among analysts following Parex Resources’ strategic updates and operational achievements. Adjustments to ratings and price targets signal changing expectations for the company’s future performance.

Bullish Takeaways

- Bullish analysts have increased their price targets for Parex Resources, citing confidence in the company's revised strategy and positioning for growth.

- There is optimism that the company is approaching an inflection point, with recent quarters showcasing consistent, low-risk operational execution.

- Analysts anticipate that Parex shares could benefit from improving investor sentiment as pending catalysts play out.

- Higher ratings and upward revisions in price targets reflect the belief in sustained or enhanced valuation if the current momentum continues.

Bearish Takeaways

- Some analysts maintain a cautious Sector Perform stance, awaiting more definitive proof of sustained improvement before fully endorsing further upside.

- There are concerns about the company's ability to deliver on pending catalysts and whether operational consistency can be maintained in a challenging market.

- Questions remain regarding how quickly improved sentiment will translate into actual share price re-rating, given recent volatility in energy markets.

What's in the News

- Parex Resources reported average production of 44,000 boe/d for the third quarter ended September 30, 2025 (Key Developments).

- The company completed the repurchase of 630,000 shares, representing 0.64 percent, for $6.1 million between April and June 2025 (Key Developments).

- Production for July 2025 averaged 44,450 boe/d (Key Developments).

- Parex issued 2025 production guidance, projecting an average of 43,000 to 47,000 boe/d, with a midpoint of 45,000 boe/d (Key Developments).

- For the second quarter, oil and gas production was 42,542 boe/d, with details showing shifts between light, medium, and heavy crude yields compared to the previous year (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from CA$17.17 to CA$18.17.

- Discount Rate remains unchanged at 5.97%.

- Revenue Growth holds steady, with projections consistent at approximately 0.61%.

- Net Profit Margin shows stability, maintaining a level just above 25.48%.

- Future P/E ratio has increased moderately from 5.47x to 5.72x.

Key Takeaways

- Enhanced efficiency and cost reductions support resilient earnings and margins, strengthening the company's position amid changing oil prices and energy market dynamics.

- Expansion into new reserves, gas monetization, and a focus on low-emission operations drive growth, revenue diversification, and improved investor appeal.

- Heavy reliance on mature Colombian assets exposes Parex to regulatory, operational, and energy transition risks that threaten long-term growth prospects and margin stability.

Catalysts

About Parex Resources- Engages in the exploration, development, production, and marketing of oil and natural gas in Colombia.

- The company is rapidly expanding production capacity through successful development drilling, secondary recovery (EOR), and near-field exploration across its core Colombian assets, positioning it to capitalize on persistent global energy demand growth and potential oil supply tightness-this should drive revenue and free funds flow growth as production volumes rise.

- Meaningful internal cost optimizations, infrastructure upgrades, and lower normalized power costs have structurally reduced operating expenses, enhancing netbacks and driving higher net margins-enabling more resilient earnings even in a lower oil price environment.

- Accelerated near-field and greenfield exploration (e.g., Putumayo, Llanos Foothills, VIM area) are expected to open up new reserves and production streams, leveraging technological advancements and offering visible production and revenue upside in 2026 and beyond.

- The upcoming monetization of significant natural gas volumes (e.g., La Belleza block), supported by new pipeline infrastructure in a Colombian market experiencing gas shortages, represents a forward-looking catalyst for revenue diversification and margin expansion.

- Parex's commitment to low-emission operations and the release of its annual sustainability report reinforce its ability to attract capital and maintain regulatory favor, positioning the company to benefit from the industry's shift toward higher environmental standards and supporting long-term cost of capital and share price potential.

Parex Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Parex Resources's revenue will decrease by 0.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.5% today to 25.5% in 3 years time.

- Analysts expect earnings to reach $243.7 million (and earnings per share of $0.46) by about September 2028, up from $126.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 5.5x on those 2028 earnings, down from 9.7x today. This future PE is lower than the current PE for the CA Oil and Gas industry at 12.2x.

- Analysts expect the number of shares outstanding to decline by 2.26% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 5.97%, as per the Simply Wall St company report.

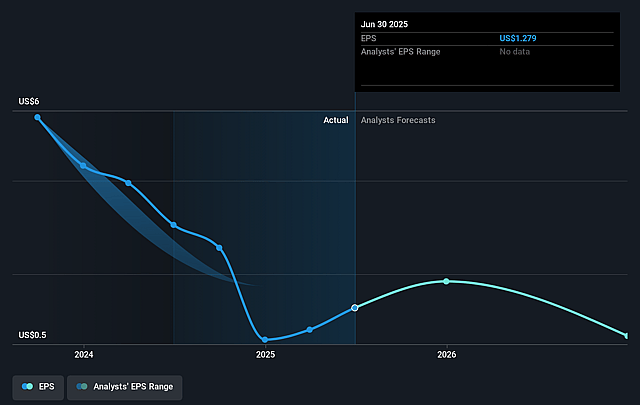

Parex Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Parex's exclusive focus and asset concentration in Colombia exposes it to significant geographic and political risk, making it vulnerable to changes in local regulatory, tax, and royalty policies, which could directly impact revenue stability and increase the possibility of future asset impairments.

- The company's strategy relies on continued development of existing mature assets, such as Cabrestero and Llanos 34, which are subject to natural production decline rates that may require continually higher capital expenditures to simply maintain output, potentially leading to lower free cash flow and squeezed net margins over the long term.

- Planned production growth and future gas monetization projects depend on successful acquisition and timely renewal of exploration licenses, ongoing community engagement, and complex infrastructure builds, introducing execution and bureaucratic risks that could delay or reduce future earnings.

- Long-term secular trends favoring global decarbonization, accelerating renewable energy adoption, and the increasing electrification of transportation threaten to structurally reduce oil demand and prices, putting sustained pressure on Parex's revenue and profit outlook.

- Heightened investor and regulatory focus on ESG standards could raise capital costs, constrain access to financing, and shrink the potential investor pool for oil producers; coupled with the potential implementation of stricter emissions regulations, this could increase compliance and operating costs and erode long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$17.167 for Parex Resources based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $956.5 million, earnings will come to $243.7 million, and it would be trading on a PE ratio of 5.5x, assuming you use a discount rate of 6.0%.

- Given the current share price of CA$17.51, the analyst price target of CA$17.17 is 2.0% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.