Key Takeaways

- Complete ownership in Aux Sable's U.S. operations and strategic JV investments can drive revenue growth through enhanced service offerings and infrastructure development.

- Major project advancements and increased Alliance ownership are set to bolster revenue and margins through capacity increases and economies of scale.

- Pembina faces risks from asset performance issues, operational disruptions, market volatility, fluctuating interest rates, and execution challenges in growth projects.

Catalysts

About Pembina Pipeline- Provides energy transportation and midstream services.

- The acquisition of the remaining 14.6% interest in Aux Sable’s U.S. operations allows for complete ownership and potential for enhanced service offerings, which could drive revenue growth through greater asset utilization and integration.

- Pembina and KKR's JV, PGI, has entered into transactions with growth-focused companies, Whitecap and Veren, involving investments in infrastructure development. These initiatives are expected to boost asset utilization and capture future volumes, positively impacting revenue and earnings.

- Advances in major projects, such as the Northeast BC midpoint pump station expansion, Cedar LNG project, and RFS IV expansion, position Pembina for increased capacity and efficiency. These should bolster future revenues and potentially improve net margins through cost-effective project execution.

- Higher ownership in Alliance and increased demand for the pipeline’s services can potentially lead to increased pipeline volumes and improved earnings due to elevated throughput and economies of scale.

- Pembina's strategy for broader market engagement, particularly with potential greater volume movement for Cedar LNG and the outlook for interruptible volumes, can create opportunities for increased earnings and enhanced margins through optimized operational solutions.

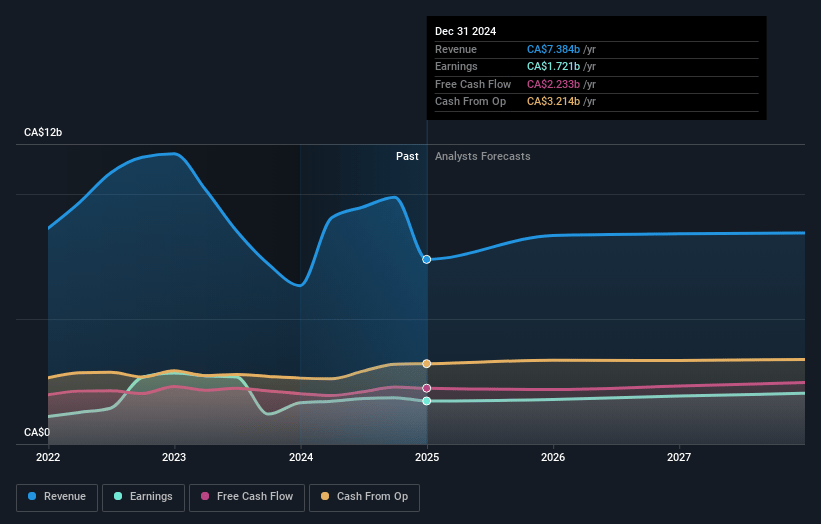

Pembina Pipeline Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Pembina Pipeline's revenue will decrease by -3.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 18.8% today to 21.1% in 3 years time.

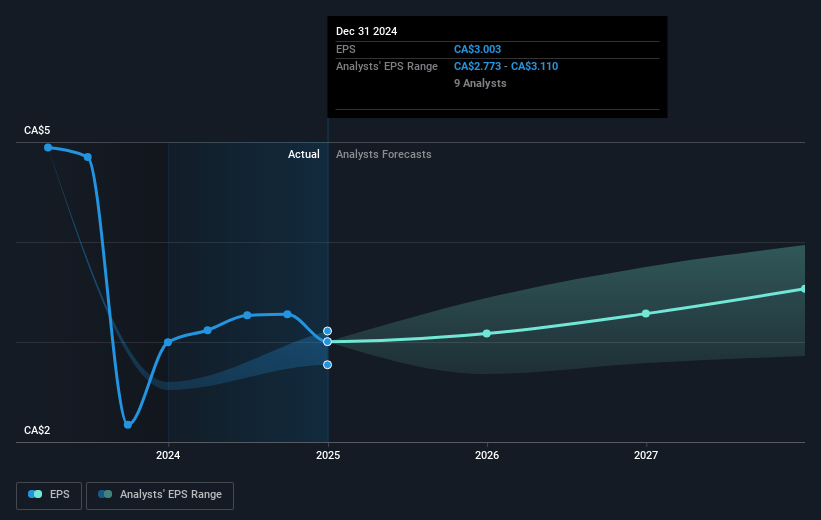

- Analysts expect earnings to remain at the same level they are now, that being CA$1.9 billion (with an earnings per share of CA$3.19). However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as CA$2.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.0x on those 2028 earnings, up from 16.4x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to grow by 0.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.52%, as per the Simply Wall St company report.

Pembina Pipeline Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Pembina's revenue could be negatively impacted by performance issues with specific assets like the Cochin Pipeline, due to lower tolls on new long-term contracts and lower volumes, which might offset gains from other areas.

- The company's net margins may be affected by various onetime or transitory events, as seen with the unplanned outage at Aux Sable, demonstrating vulnerability to operational disruptions.

- Earnings might be susceptible to fluctuations in interest rates, as shown by unrealized losses recognized by PGI and Cedar LNG on interest rate derivative financial instruments.

- Lower realized gains on commodity-related derivatives indicate that Pembina's earnings could be subject to market volatility, and not fully hedged revenue streams.

- There is execution risk on future growth projects such as the Cedar LNG project and the Taylor to Gordondale expansion, where construction delays or regulatory hurdles could impact Pembina’s projected revenue and EBITDA growth timelines.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$61.78 for Pembina Pipeline based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$66.0, and the most bearish reporting a price target of just CA$55.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$8.8 billion, earnings will come to CA$1.9 billion, and it would be trading on a PE ratio of 24.0x, assuming you use a discount rate of 7.5%.

- Given the current share price of CA$52.42, the analyst's price target of CA$61.78 is 15.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives