Key Takeaways

- Record production levels and reduced costs are boosting upstream revenue and margins through efficient operations and higher output.

- Strategic projects like TMX and Cold Lake are stabilizing pricing and enhancing earnings, while innovations improve capacity and margins.

- Lower commodity prices, declining margins, increasing capital expenditures, and regulatory risks threaten Imperial Oil's revenue, profit, and sustainability prospects.

Catalysts

About Imperial Oil- Engages in exploration, production, and sale of crude oil and natural gas in Canada.

- Imperial Oil is experiencing record production levels and reduced unit costs, which are expected to enhance its upstream revenue and net margins through more efficient operations and higher output.

- The successful start-up of the Trans Mountain Expansion (TMX) project provides additional egress capacity, stabilizing price differentials and contributing to future earnings growth by improving net income from oil sales.

- The Grand Rapids Phase 1 project at Cold Lake achieved better-than-expected production rates, which suggests future opportunities for volume growth and cost reductions, positively impacting revenue and net margins.

- Completion of significant downstream turnaround activities and the advancement of the renewable diesel project at the Strathcona refinery are expected to enhance revenue and earnings by increasing capacity and offering low-carbon product options.

- Continuous improvement in digital technologies and operational efficiencies, such as autonomous hauls and cost-effective maintenance, should support future cash flow growth and improve operating margins.

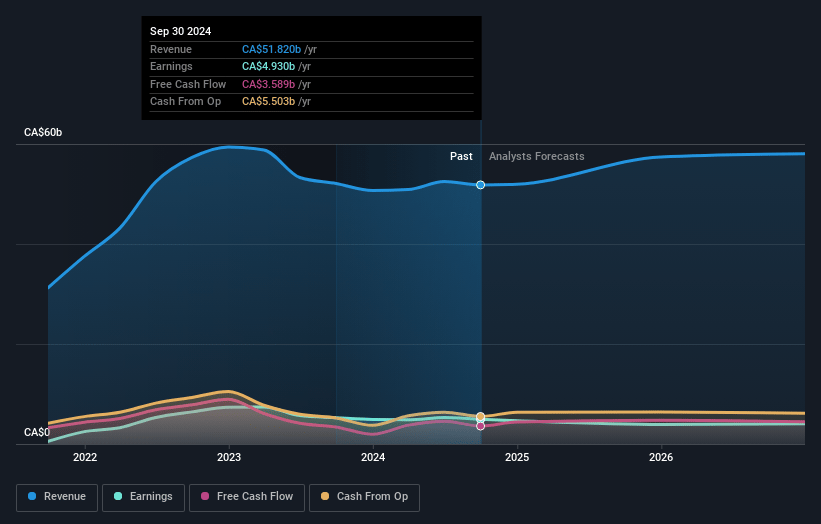

Imperial Oil Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Imperial Oil's revenue will decrease by -0.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 9.5% today to 7.4% in 3 years time.

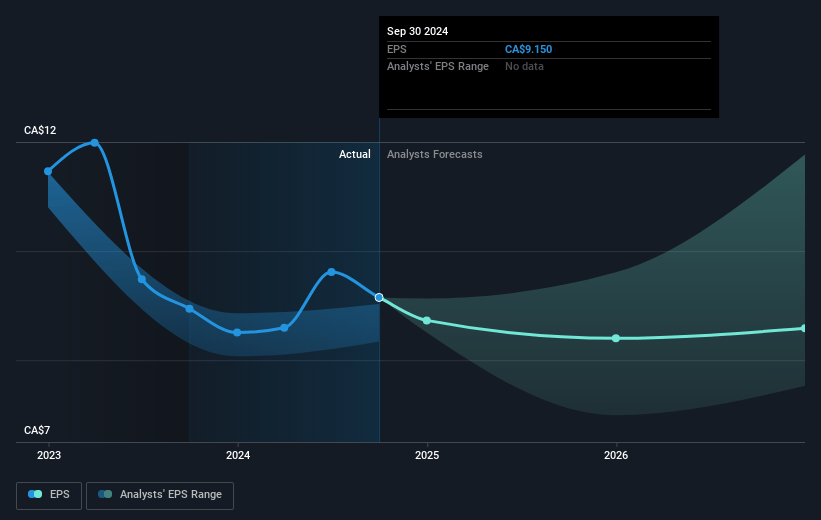

- Analysts expect earnings to reach CA$3.8 billion (and earnings per share of CA$8.19) by about January 2028, down from CA$4.9 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$4.8 billion in earnings, and the most bearish expecting CA$3.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.2x on those 2028 earnings, up from 9.3x today. This future PE is greater than the current PE for the CA Oil and Gas industry at 11.0x.

- Analysts expect the number of shares outstanding to decline by 3.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.72%, as per the Simply Wall St company report.

Imperial Oil Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lower commodity prices and downstream margin declines have already impacted earnings, signaling potential revenue and profit risks if these trends continue.

- Capital expenditures are increasing beyond projections, which could pressure free cash flow and earnings if not offset by proportional revenue gains.

- Downstream earnings are declining, driven by lower refining margins, potentially affecting overall net margins and future profitability.

- The need for agreement on carbon capture fiscal frameworks introduces regulatory risk, which could delay projects and affect future earnings and sustainability initiatives.

- Market volatility, especially around commodity prices, poses a broader risk to revenue stability and could challenge Imperial Oil's ability to maintain current earnings levels in a fluctuating environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$102.74 for Imperial Oil based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$120.0, and the most bearish reporting a price target of just CA$89.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$51.4 billion, earnings will come to CA$3.8 billion, and it would be trading on a PE ratio of 15.2x, assuming you use a discount rate of 6.7%.

- Given the current share price of CA$88.59, the analyst's price target of CA$102.74 is 13.8% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives