Key Takeaways

- Strong contract growth, market share gains, and strategic international expansion are driving improved revenue visibility, volume growth, and reduced geographic risk.

- Investments in advanced rig technology and ongoing deleveraging are boosting margins, profitability, and balance sheet strength.

- Weak international demand, geopolitical risks, rising costs, and short contract terms threaten Ensign's revenue stability and margins as energy transition forces intensify industry headwinds.

Catalysts

About Ensign Energy Services- Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

- Increasing global energy demand, coupled with the slow pace of energy transition away from hydrocarbons, is fueling robust, multi-year drilling activity, as evidenced by Ensign's growing long-term contract book (now close to $1 billion forward revenue) and high fleet utilization; this supports expectations for improved revenue visibility and volume growth.

- Enhanced geopolitical focus on energy security in North America and globally is driving regional drilling expansion, leading to market share gains for Ensign in Canada (3% increase vs. industry's 9% decrease) and stable U.S. market share, which should underpin stable-to-rising revenues and higher contract rates.

- Ongoing investment in high-spec rig upgrades and advanced automation/app-based drilling solutions (like Edge Autopilot) is enabling Ensign to achieve premium pricing, higher rig margins, and increasing contract durations, directly supporting improvements in net margin and overall profitability.

- Strategic international expansion-such as new long-term contracts in Oman, high activity in Kuwait, and future growth potential in Argentina-broadens Ensign's revenue streams beyond North America, reducing geographic risk and supporting both top-line growth and earnings stability.

- Continued deleveraging, evidenced by rapid debt repayment and lower interest expense (down 27% year-over-year), is freeing up cash flow that can be deployed for reinvestment or shareholder returns, reinforcing net income growth and long-term balance sheet strength.

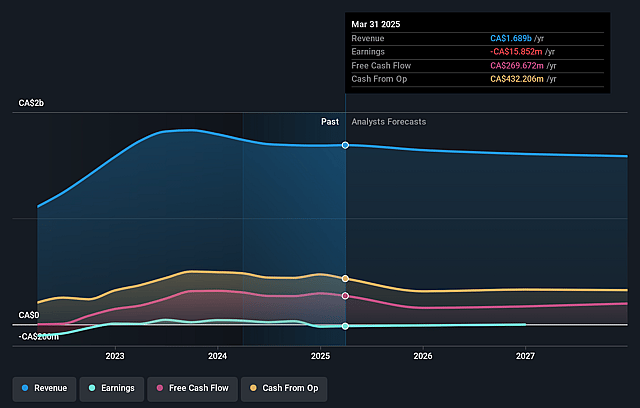

Ensign Energy Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ensign Energy Services's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -2.3% today to 2.1% in 3 years time.

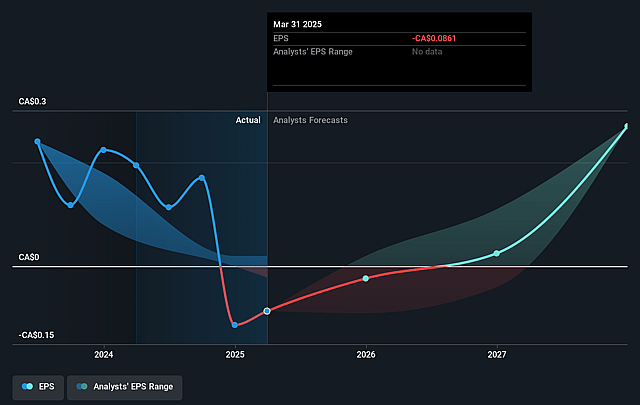

- Analysts expect earnings to reach CA$33.7 million (and earnings per share of CA$0.27) by about September 2028, up from CA$-37.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.3x on those 2028 earnings, up from -10.7x today. This future PE is greater than the current PE for the CA Energy Services industry at 10.0x.

- Analysts expect the number of shares outstanding to grow by 0.1% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.93%, as per the Simply Wall St company report.

Ensign Energy Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent decreases in international operating days (down 14% year-over-year in Q2 2025 and 13% for the first half of the year) suggest ongoing underutilization of international rig assets, which could continue to pressure revenues and margins if recovery in these markets remains weak or overcapacity issues (as in Australia) persist.

- Exposure to geopolitical risk is high, as seen with unplanned shutdowns in Venezuela due to OFAC sanctions and rig downtime in Argentina and Bahrain; recurring disruptions in these regions could produce volatile earnings and hamper long-term revenue growth.

- Margins are sensitive to elevated repairs and maintenance costs (notably in Canada after winter programs), and the need for continued upgrades of aging fleet equipment could drive higher, ongoing maintenance capital expenditures, thus constraining free cash flow and net margin improvement.

- Increasingly short-term contract duration (noted as 6-month contracts in the U.S. and only a third of rigs on long-term agreements globally) exposes Ensign to ongoing contract churn, pricing pressure, and limited forward revenue visibility, creating risk for earnings sustainability in a competitive market.

- Overall revenue and adjusted EBITDA have continued to decline year-on-year (revenues down 5% in Q2 and 2% for H1 2025; EBITDA down 19% and 16%, respectively), raising concerns about Ensign's ability to return to sustained revenue growth given sector cyclicality, high exposure to North American markets, and global trends towards energy transition and ESG-diversion of investor capital.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$2.458 for Ensign Energy Services based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.6 billion, earnings will come to CA$33.7 million, and it would be trading on a PE ratio of 18.3x, assuming you use a discount rate of 10.9%.

- Given the current share price of CA$2.2, the analyst price target of CA$2.46 is 10.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.