Last Update01 May 25Fair value Decreased 8.07%

AnalystConsensusTarget has decreased revenue growth from 4.0% to -0.8%, decreased profit margin from 4.7% to 1.8% and increased future PE multiple from 8.0x to 22.1x.

Read more...Key Takeaways

- Higher commodity prices and expanded market access are set to increase rig utilization, stabilize revenue, and enhance earnings visibility for Ensign.

- Investment in advanced drilling technology and contract diversification is enabling margin expansion, lessening volatility, and supporting superior long-term earnings potential.

- Exposure to weak U.S. drilling, commodity and regulatory volatility, underutilized rigs, execution risks around automation, and high capital intensity threaten future margins and earnings.

Catalysts

About Ensign Energy Services- Provides oilfield services to the oil and natural gas industries in Canada, the United States, and internationally.

- Global underinvestment in upstream oil and gas since 2014 combined with persistent energy demand growth is creating a supply gap that is expected to drive higher commodity prices and increased drilling activity, which will likely boost Ensign’s fleet utilization and support revenue and earnings growth over the medium to long term.

- North American energy security initiatives, such as new LNG export projects coming online and increased pipeline capacity (e.g., LNG Canada, TMX), are expanding Ensign’s addressable market and have already resulted in higher Canadian rig activity and forward contract bookings, which should strengthen revenue visibility and reduce volatility.

- Investments in automation and premium, high-spec drilling equipment (ADR/EDGE AutoPilot systems) are allowing Ensign to secure higher-margin, performance-based contracts and command premium day rates, supporting margin expansion and long-term earnings upside.

- Ongoing reduction in leverage and interest expense—driven by robust free cash flow generation, asset sales, and disciplined capex—provides more financial flexibility for growth initiatives and directly improves net margins and future earnings power.

- Geographic and contract diversification, including international market exposure and a growing proportion of long-term and performance-based contracts, reduce dependency on regional cycles and pricing shocks, helping stabilize revenue and enhance earnings predictability.

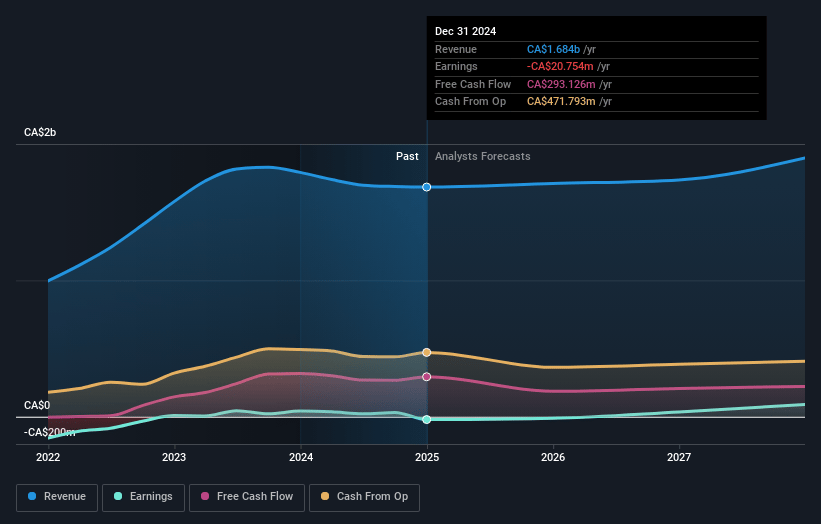

Ensign Energy Services Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ensign Energy Services's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.9% today to 1.8% in 3 years time.

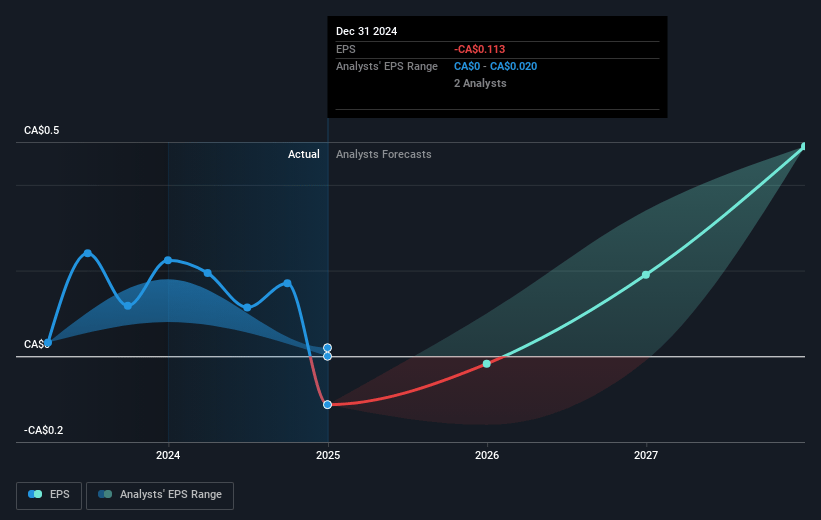

- Analysts expect earnings to reach CA$29.5 million (and earnings per share of CA$0.19) by about May 2028, up from CA$-15.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.1x on those 2028 earnings, up from -23.3x today. This future PE is greater than the current PE for the CA Energy Services industry at 7.8x.

- Analysts expect the number of shares outstanding to grow by 0.14% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.02%, as per the Simply Wall St company report.

Ensign Energy Services Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Softness in U.S. drilling activity, including 12% lower U.S. operating days and near-term expectations for further rig count reductions, underscores Ensign’s vulnerability to pricing pressure, customer capital discipline, and competitive headwinds in this key market, which could negatively impact revenue and EBITDA margins if these trends persist.

- Ongoing volatility in commodity prices and uncertainty regarding regulatory and political decisions (such as OFAC directives in Venezuela, Canadian energy regulations, and pipeline projects) create significant risks around project continuity and the ability to maintain or grow activity levels, potentially resulting in unpredictable revenue and margin fluctuations.

- A material portion of the rig fleet in some international markets remains inactive or underutilized, with costs (evidenced by reactivation and deactivation expenses in the U.S. and Australia) occasionally outweighing incremental contributions, thus raising concerns about depreciation leverage, elevated maintenance capex, and potential negative earnings impact if activity does not recover.

- While Ensign highlights technology adoption (e.g., EDGE AutoPilot, automated drilling) as a differentiator, there is execution risk if the company fails to keep pace with rapid automation, digitalization, or ESG-driven requirements across the industry, which could erode Ensign’s competitive position, limit pricing power, and compress future revenues.

- High ongoing capital intensity—including substantial maintenance capex needs on an aging fleet, coupled with debt reduction targets—places pressure on both free cash flow and available resources for growth investment, potentially limiting the company’s ability to modernize its fleet or pivot strategically should secular shifts (such as the energy transition or customer ESG demands) accelerate, impacting long-term net margins and earnings power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$2.583 for Ensign Energy Services based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$3.0, and the most bearish reporting a price target of just CA$2.25.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.7 billion, earnings will come to CA$29.5 million, and it would be trading on a PE ratio of 22.1x, assuming you use a discount rate of 11.0%.

- Given the current share price of CA$2.01, the analyst price target of CA$2.58 is 22.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.