Narratives are currently in beta

Key Takeaways

- Strategic acquisitions and projects in utilities, renewables, and gas lines are expected to drive stable long-term revenue and earnings growth.

- Enbridge's integration of acquired assets and focus on high-margin segments predicts robust EBITDA and dividend growth, aligning with their low-risk model.

- Enbridge faces challenges from pipeline constraints, regulatory issues, competition, rising costs, and execution risks in renewable energy impacting revenue and earnings growth.

Catalysts

About Enbridge- Operates as an energy infrastructure company.

- Enbridge's acquisition of three U.S. gas utilities, which integrates well into their low-risk business model, is expected to provide stable, long-term revenue growth. These acquisitions are funded and extend Enbridge's equity self-funded model, contributing to improved earnings over time.

- The high utilization of Enbridge's Liquids Pipelines segment, including their crude export facility at Ingleside, is expected to unlock future revenue growth opportunities through expansions and new acquisitions.

- The development of Enbridge's Renewable Power projects, such as the 815-megawatt Sequoia Solar project in Texas, which is backed by long-term power purchase agreements, is expected to contribute to a greater proportion of high-margin revenue, supporting earnings growth.

- Enbridge's expanding footprint in high-growth areas, particularly in the data center and power generation sectors within their Gas Transmission and Gas Distribution segments, is projected to drive future revenue growth.

- Enbridge's anticipated 7% to 9% EBITDA growth through new assets entering service, tuck-in mergers and acquisitions, and contributions from the recently acquired utilities, underscores a promising outlook for earnings and dividend growth.

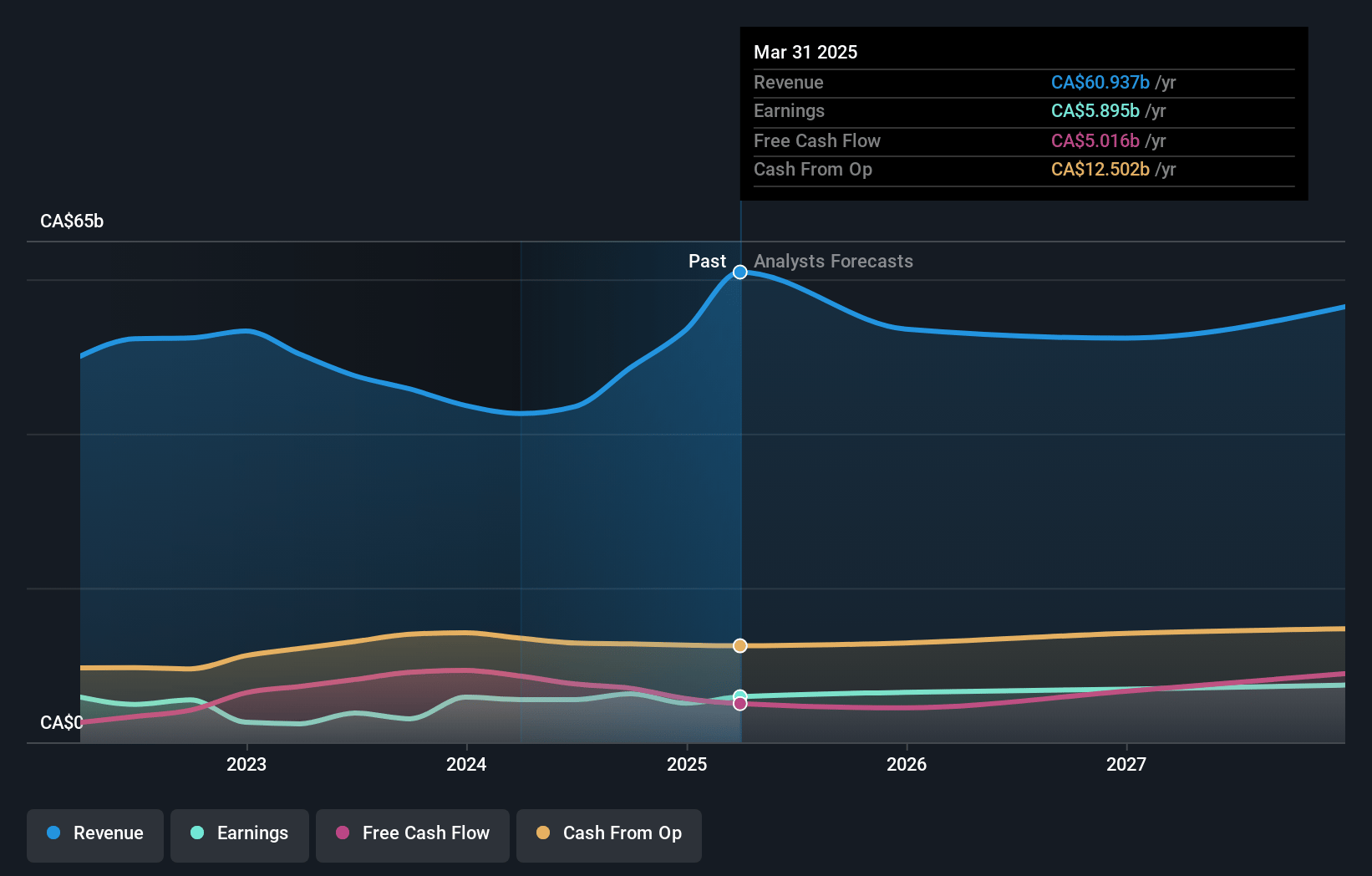

Enbridge Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Enbridge's revenue will decrease by -4.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 12.9% today to 15.8% in 3 years time.

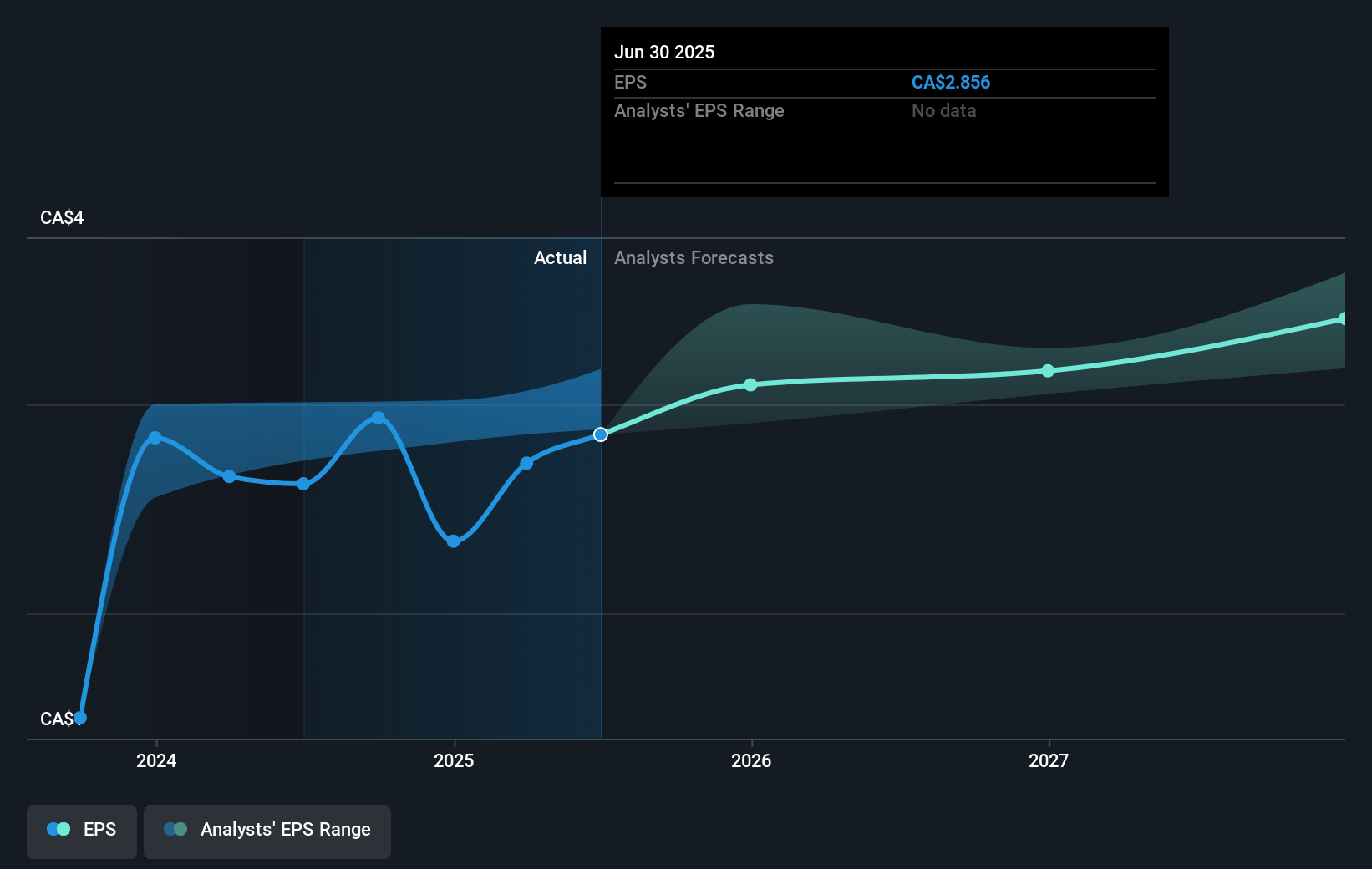

- Analysts expect earnings to reach CA$6.7 billion (and earnings per share of CA$3.06) by about January 2028, up from CA$6.3 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$8.5 billion in earnings, and the most bearish expecting CA$5.3 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 25.7x on those 2028 earnings, up from 22.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to grow by 0.24% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.05%, as per the Simply Wall St company report.

Enbridge Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Potential concerns about pipeline constraints and the need for future expansion might impact Enbridge's ability to maintain high utilization rates and revenue levels, despite recent apportionment exceeding expectations.

- Regulatory challenges, such as the D.C. Circuit vacating the authorization for the liquefaction facility related to the Rio Bravo Pipeline, could create project delays and impact future revenue streams from projected pipeline projects.

- Competition from other pipelines and the presence of overpiped regions may pressure Enbridge's pricing power and market share, potentially affecting revenue growth and net margins.

- Rising interest rates and higher maintenance capital requirements from recent acquisitions could impact Enbridge's cost structure and net earnings, especially if revenue growth does not keep pace.

- Dependence on stable returns from renewable energy projects, while ambitious, carries execution risks and a reliance on maintaining mid-teens returns, which are necessary to meet financial targets and achieve expected cash flow growth rates.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$62.32 for Enbridge based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$75.0, and the most bearish reporting a price target of just CA$52.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$42.6 billion, earnings will come to CA$6.7 billion, and it would be trading on a PE ratio of 25.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of CA$64.05, the analyst's price target of CA$62.32 is 2.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives