Key Takeaways

- The acquisition and infrastructure expansions aim to increase production and transport capacity, potentially boosting revenues, netbacks, and profit margins.

- Operational efficiencies and strategic asset integrations could lower costs and enhance earnings and cash flow, offering growth opportunities.

- Integration challenges, decreased natural gas production, and lower commodity prices may pressure margins and cash flows, affecting revenues, dividends, and long-term earnings stability.

Catalysts

About Canadian Natural Resources- Acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs).

- The acquisition of Chevron's 20% interest in AOSP and the addition of SCO production is expected to increase Canadian Natural's production by approximately 62,500 barrels per day, potentially boosting revenues and free cash flow.

- The planned increase in crude oil transportation capacity on the TMX by 75,000 barrels per day is aimed at accessing expanded refining markets, which could lead to higher netbacks and improved profit margins.

- The ongoing solvent pilot project at Kirby North, if successful, could lead to enhanced oil recovery and lower steam-to-oil ratios, potentially reducing operating costs and improving net margins.

- Strong operational performance and high utilization rates in oil sands mining and upgrading are contributing to lower operating costs per barrel, which could positively impact net earnings.

- The integration of the Duvernay assets, with expected production growth and capital efficiency, may offer meaningful near-term growth opportunities and contribute to higher earnings and free cash flow.

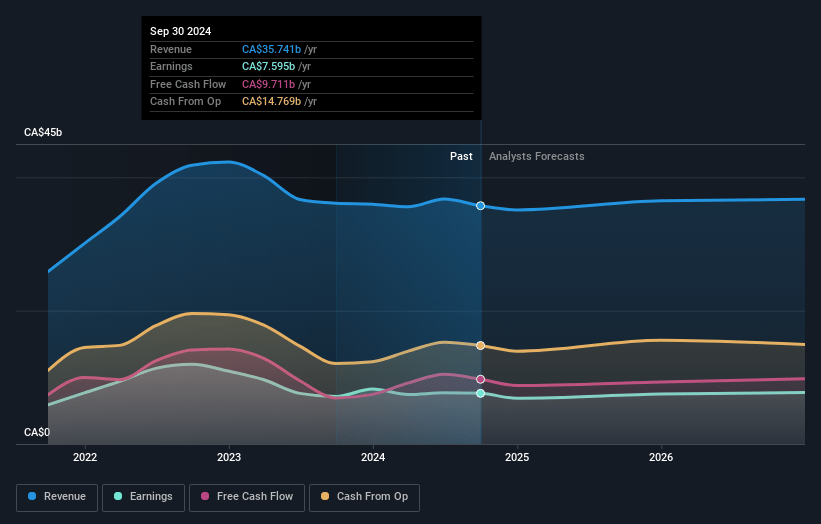

Canadian Natural Resources Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Canadian Natural Resources's revenue will decrease by 0.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 21.3% today to 22.2% in 3 years time.

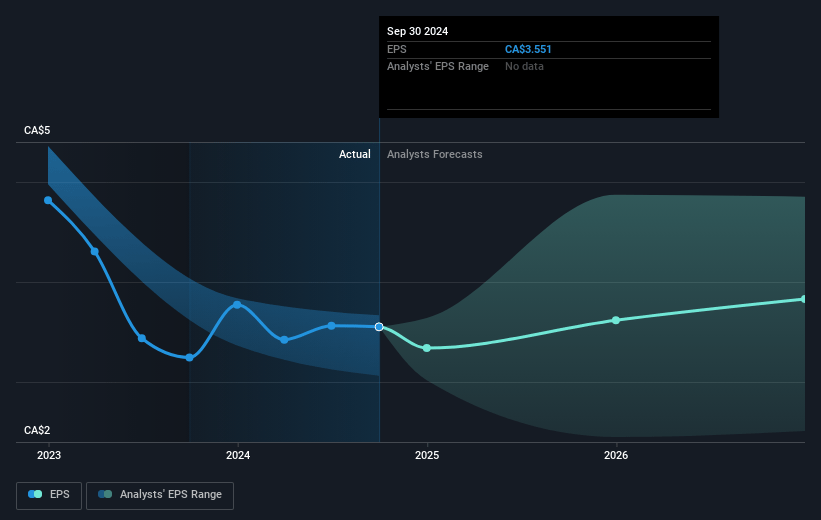

- Analysts expect earnings to reach CA$8.1 billion (and earnings per share of CA$3.88) by about January 2028, up from CA$7.6 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting CA$12.4 billion in earnings, and the most bearish expecting CA$3.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.5x on those 2028 earnings, up from 12.2x today. This future PE is greater than the current PE for the US Oil and Gas industry at 10.9x.

- Analysts expect the number of shares outstanding to decline by 0.2% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.84%, as per the Simply Wall St company report.

Canadian Natural Resources Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The integration of Chevron's assets may come with unforeseen challenges that could increase operational costs, potentially impacting net margins.

- The decrease in North American natural gas production due to deferrals and environmental conditions could reduce overall revenue from natural gas operations.

- Reliance on continuous cost optimization and efficiency improvements may face diminishing returns, potentially impacting future net margins and earnings.

- Lower commodity price environments could pressure operating cash flows, which may affect dividends and shareholder returns.

- Anticipated production declines from assets like the North Sea could reduce future revenue streams, impacting long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$55.55 for Canadian Natural Resources based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$62.0, and the most bearish reporting a price target of just CA$50.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$36.6 billion, earnings will come to CA$8.1 billion, and it would be trading on a PE ratio of 17.5x, assuming you use a discount rate of 6.8%.

- Given the current share price of CA$43.78, the analyst's price target of CA$55.55 is 21.2% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

Warren A.I. is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by Warren A.I. are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that Warren A.I.'s analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives

There are no other narratives for this company.

View all narratives