Key Takeaways

- Revenue growth is bolstered by increased mortgage originations from government incentives and rate cuts, particularly in high-cost urban areas.

- Technology upgrades entail initial costs but promise long-term efficiency and margin improvements.

- A decrease in net interest margins and increased costs linked to technology and staffing may reduce profitability, compounded by economic concerns and market conditions.

Catalysts

About First National Financial- First National Financial Corporation, together with its subsidiaries, originates, underwrites, and services residential and commercial mortgages in Canada.

- Expected growth in single-family mortgage originations is driven by improved mortgage commitment levels, without the need to adjust pricing or credit quality, suggesting potential for increased future revenue.

- Recent government incentives and a series of Bank of Canada rate cuts are contributing to higher originations, particularly larger insured mortgages in high-cost cities, which can positively impact revenue growth and net margins.

- The anticipated normalization of net interest margins (NIM) following temporary compression due to higher short-term funding costs presents an opportunity for improved earnings as funding costs align with rate cuts.

- Planned technology upgrades involve significant upfront IT expenses, but these investments are expected to deliver efficiency advantages and potentially enhance net margins in future years.

- Continued strong demand in the multi-unit residential sector, supported by CMHC's affordable loan programs and natural pipeline from existing construction loans, indicates stable to growing revenue and margins in the commercial mortgage segment.

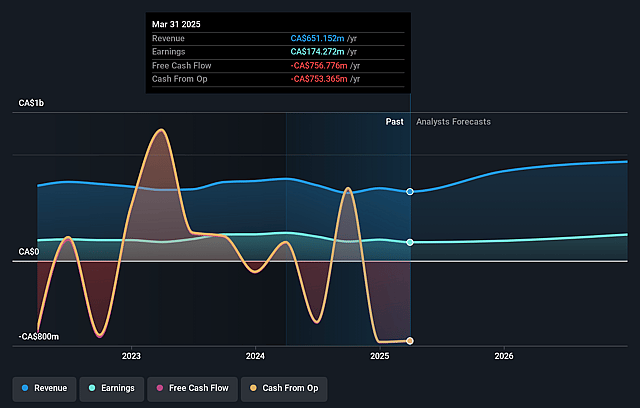

First National Financial Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First National Financial's revenue will grow by 24.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 26.3% today to 25.3% in 3 years time.

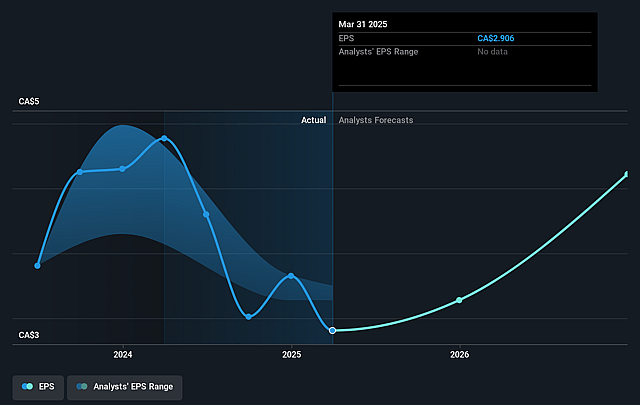

- Analysts expect earnings to reach CA$337.4 million (and earnings per share of CA$5.61) by about September 2028, up from CA$183.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 11.5x on those 2028 earnings, down from 15.7x today. This future PE is lower than the current PE for the CA Diversified Financial industry at 13.3x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 11.02%, as per the Simply Wall St company report.

First National Financial Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant drop in net interest margin (NIM) due to amortization of high-margin pandemic era mortgages and temporarily high funding costs could reduce profitability. This is a key concern for net margins.

- Lower revenues from core operations, such as mortgage servicing and third-party underwriting, amidst declining interest rates and tighter placement margins, may inhibit earnings growth.

- Elevated costs, particularly from a 7% increase in headcount and significant spending on technology upgrades, could continue to pressure operating expenses and reduce net margins.

- The possibility of reduced commercial mortgage originations due to CMHC's more cautious stance and evolving market conditions could impact revenue and earnings.

- Risks associated with economic factors such as potential recession, cross-border tariffs, and job losses may adversely affect housing market activity and First National's revenue streams.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$48.0 for First National Financial based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.3 billion, earnings will come to CA$337.4 million, and it would be trading on a PE ratio of 11.5x, assuming you use a discount rate of 11.0%.

- Given the current share price of CA$48.05, the analyst price target of CA$48.0 is 0.1% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.