Key Takeaways

- Enhanced technology integration and digitization are improving operational efficiency, recurring revenue, and accelerating market share gains, supporting long-term earnings growth.

- Demographic trends and expanded partnerships are fueling sustained asset growth and deepening the company's competitive moat across evolving specialized finance markets.

- Customer concentration risk, margin compression, and operational execution challenges may hinder profitability and long-term growth if current weaknesses and strategic dependencies persist.

Catalysts

About ECN Capital- ECN Capital Corp. originates, manages, and advises on credit assets on behalf of its partners in North America.

- The ongoing upgrade strategies and enhanced technology integration in key business lines (Triad, Source One, IFG) are set to further strengthen ECN's recurring fee-based servicing revenue, improve operational efficiency, and drive higher net margins as these initiatives reach completion in the second half of 2025 and into 2026.

- Strong demographic tailwinds-especially aging populations and increasing demand for affordable manufactured housing-continue to fuel record originations and asset growth at Triad, positioning ECN for sustained revenue and earnings growth in its core markets.

- Growing digitization and customer preference for embedded finance have led to shorter loan decision times, improved product offerings, and enhanced dealer acquisitions, which are expected to accelerate top-line growth and market share gains, positively impacting both revenue and long-term EPS potential.

- Strategic expansion of third-party servicing and continued deepening of partnerships (e.g. with Champion Homes and institutional funding partners) are boosting ECN's scale and competitive moat, supporting resilient recurring revenues and reducing sensitivity to credit risk.

- Secular industry trends around the shift from traditional bank lending to specialized origination and servicing platforms provide additional growth opportunities for ECN, enhancing the sustainability and scalability of revenue streams as the company capitalizes on its niche market leadership.

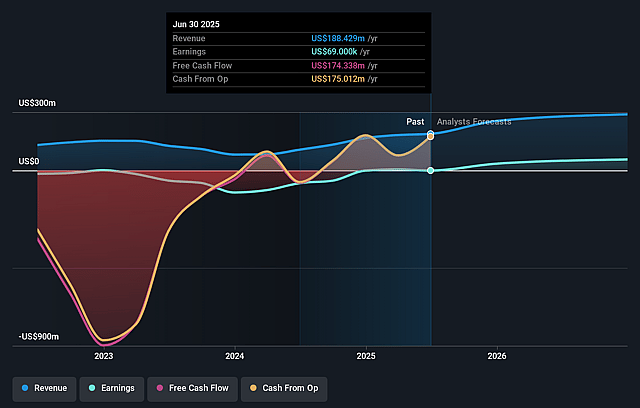

ECN Capital Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ECN Capital's revenue will grow by 31.3% annually over the next 3 years.

- Analysts assume that profit margins will increase from 0.0% today to 50.3% in 3 years time.

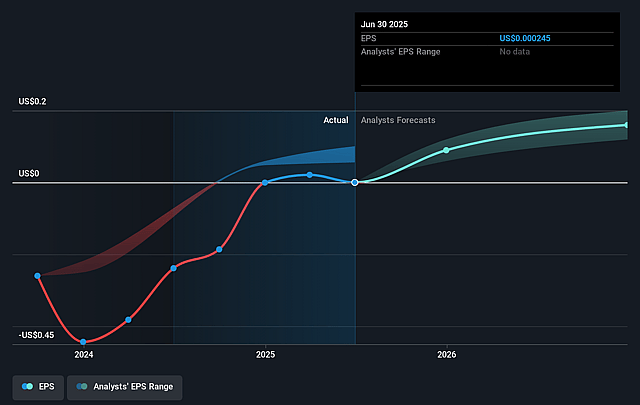

- Analysts expect earnings to reach $214.7 million (and earnings per share of $0.61) by about September 2028, up from $69.0 thousand today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 4.5x on those 2028 earnings, down from 8615.9x today. This future PE is lower than the current PE for the CA Diversified Financial industry at 13.4x.

- Analysts expect the number of shares outstanding to grow by 0.13% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.56%, as per the Simply Wall St company report.

ECN Capital Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The RV & Marine segment has experienced industry headwinds with reduced volumes, delayed asset sales, and income below prior guidance, suggesting that prolonged weakness or sluggish recovery in this cyclical division could drag on consolidated revenues and adjusted operating income for an extended period.

- The company's reliance on a few key strategic partnerships and funding programs (e.g., with Champion Homes, Blackstone, and major bank/credit union partners) creates customer concentration risk; any deterioration or adverse renegotiation in these arrangements could lead to revenue volatility and negative impacts on earnings.

- While management highlights strong growth in manufactured housing originations and market share, commercial business originations have remained flat, and management acknowledges a need to turn around this area; failure to reignite commercial growth or diversify beyond present market segments could constrain long-term revenue growth and margin expansion.

- The business model's emphasis on recurring servicing revenues and fee-based income is attractive, but a shift in the mix toward more institutional/flow partner sales (lower-margin) and JV structures has already compressed origination revenue margins below target; if this persists, especially amid competitive pressures or changing partner behavior, it may weigh on overall net margins and EPS.

- Although recent operating expense growth is attributed to scale and investment in "upgrade strategies," elevated expense levels coupled with the risk of execution missteps in aggressive sales expansion and ongoing business transformations could erode profitability if targeted revenue and margin gains do not materialize.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$3.688 for ECN Capital based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$5.0, and the most bearish reporting a price target of just CA$3.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $426.9 million, earnings will come to $214.7 million, and it would be trading on a PE ratio of 4.5x, assuming you use a discount rate of 8.6%.

- Given the current share price of CA$2.92, the analyst price target of CA$3.69 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.