Last Update 01 May 25

Fair value Increased 2.12%Key Takeaways

- Conservative lending and portfolio management strategies help maintain asset quality, revenue stability, and consistent dividends despite market fluctuations.

- Demographic trends and stricter bank lending standards drive sustained demand and capital inflows, supporting growth in lending opportunities and funding flexibility.

- Prolonged real estate market weakness, rising credit risk, lower originations, shrinking margins, and regulatory scrutiny threaten Atrium's revenue, profitability, liquidity, and portfolio health.

Catalysts

About Atrium Mortgage Investment- Provides financing solutions to the commercial real estate and development communities in Canada.

- Sustained population growth and persistent housing undersupply in major Canadian cities are keeping long-term demand for mortgage financing robust, which supports a steady pipeline for loan origination and drives future revenue growth.

- Tighter mortgage lending standards at traditional banks are funneling real estate developers and non-prime borrowers towards private lenders like Atrium, expanding its addressable lending market and supporting higher potential loan volumes and revenue.

- Portfolio rebalancing towards lower-risk commercial and single-family mortgage sectors, along with conservative loan-to-value ratios, is helping to preserve asset quality and net margins, reducing loan loss provisions and supporting stable future earnings.

- Ongoing investor appetite for stable, income-generating assets amid demographic shifts is likely to drive continued capital inflows, enhancing Atrium's funding flexibility and supporting sustained growth in assets and net interest income.

- Strong management discipline in underwriting, risk management, and geographic/project diversification has demonstrated resilience through market downturns, underpinning revenue stability and supporting consistent, growing dividend payouts and earnings.

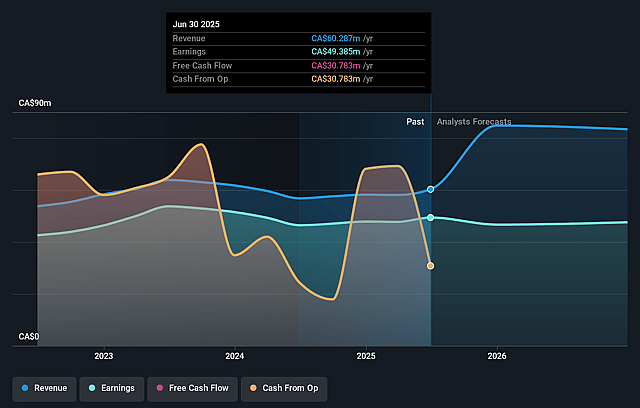

Atrium Mortgage Investment Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Atrium Mortgage Investment's revenue will grow by 24.1% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 81.9% today to 39.3% in 3 years time.

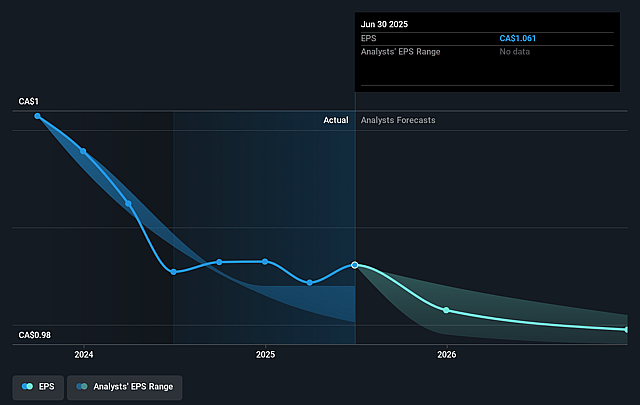

- Analysts expect earnings to reach CA$45.3 million (and earnings per share of CA$0.93) by about September 2028, down from CA$49.4 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.6x on those 2028 earnings, up from 11.1x today. This future PE is greater than the current PE for the CA Diversified Financial industry at 13.3x.

- Analysts expect the number of shares outstanding to grow by 1.08% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.86%, as per the Simply Wall St company report.

Atrium Mortgage Investment Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness in the Canadian real estate market-including significantly lower new home sales in key regions like the GTA (down 60% year-over-year and 82% below the 10-year average), declining resale prices, and ongoing softness in the condo sector-could dampen loan origination activity and reduce collateral values, ultimately impacting Atrium's future revenue growth and portfolio quality.

- Increased proportion of Stage 2 and Stage 3 loans (from 10.6% to 14.8% of the portfolio) and rising arrears in the single-family segment, especially as market value declines push effective loan-to-value ratios above the original thresholds, heighten the risk of credit losses and could negatively affect net margins and earnings.

- Decline in average mortgage rates (from 9.56% to 9.3% this quarter) due to higher repayments of older, higher-yielding loans and replacement with lower-yield originations, may put downward pressure on net interest income and strain overall profitability if market rates remain subdued or competition further compresses spreads.

- Limited origination opportunities and the expectation of slowing loan volumes in upcoming quarters, attributed to subdued real estate transaction activity, pose a risk to maintaining historical revenue and earnings growth, especially if repayments continue to outpace new lending or attractive lending opportunities remain scarce.

- Regulatory uncertainties-including disruption from the audit of Atrium's former auditor and increased scrutiny on alternative lenders-could delay access to capital markets, hinder funding diversification, increase compliance costs, or restrict lending activities, with potential negative effects on operating performance, liquidity, and long-term earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$12.99 for Atrium Mortgage Investment based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$115.3 million, earnings will come to CA$45.3 million, and it would be trading on a PE ratio of 17.6x, assuming you use a discount rate of 7.9%.

- Given the current share price of CA$11.47, the analyst price target of CA$12.99 is 11.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.