Key Takeaways

- Store modernization, network expansion, and supply chain automation position Metro for sustained revenue growth and margin improvement as urbanization and health trends continue.

- Strong e-commerce momentum, private label outperformance, and effective loyalty programs support customer retention and earnings resilience in a competitive, inflationary market.

- Rising competition, inflationary pressures, and higher costs threaten Metro's margins and revenue stability, especially given geographic concentration and challenges in online and pharmacy segments.

Catalysts

About Metro- Through its subsidiaries, operates as a retailer, franchisor, distributor, and manufacturer in the food and pharmaceutical sectors in Canada.

- The company's ongoing investments in store modernization and network expansion-including new store openings, major renovations, and upgrades-position Metro to capitalize on Canada's urbanization and population growth, supporting higher long-term sales volumes and top-line revenue growth.

- Robust growth in pharmacy same-store sales (5.5% in the quarter, with further tailwinds from increasing prescription and specialty medication demand) suggests Metro is well-placed to benefit from rising consumer focus on health and wellness, bolstering both revenue and premium-margin opportunities.

- Sustained improvements in supply chain automation and productivity at new and upgraded distribution centers are contributing to higher gross margins and are expected to continue supporting further net margin expansion as efficiencies mature and more products move through automated systems.

- Strong momentum in e-commerce and online sales (up 14% in the quarter) and expansion of home delivery and click-and-collect partnerships (including a recent agreement with DoorDash) demonstrate that Metro is leveraging digital and omnichannel capabilities to drive customer retention and incremental revenue growth, as shopping behaviors shift online over time.

- Continued outperformance of private label sales versus national brands, along with increased promotional activity and customer loyalty program engagement, is likely to support gross margin resilience and protect earnings amid a highly competitive and inflationary market environment.

Metro Future Earnings and Revenue Growth

Assumptions

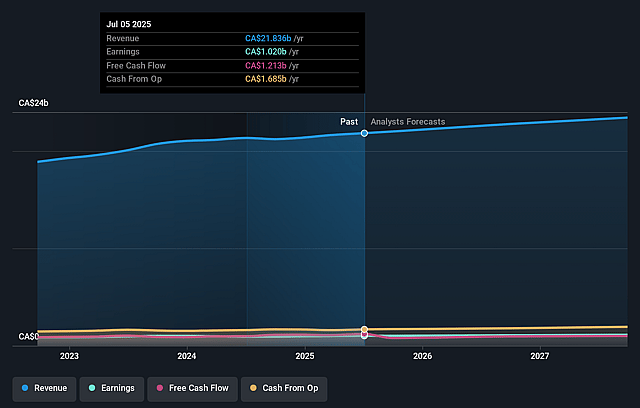

How have these above catalysts been quantified?- Analysts are assuming Metro's revenue will grow by 3.3% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 4.7% today to 4.5% in 3 years time.

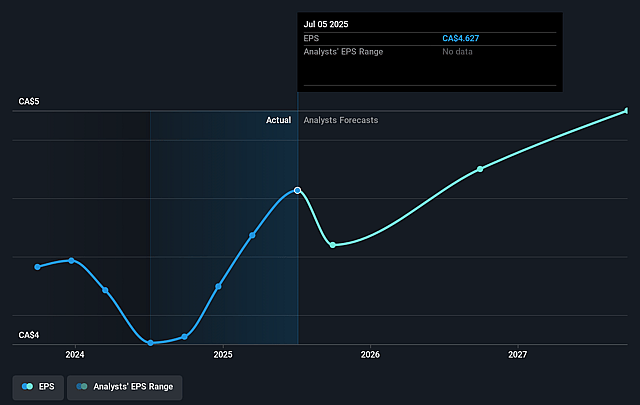

- Analysts expect earnings to reach CA$1.1 billion (and earnings per share of CA$5.06) by about September 2028, up from CA$1.0 billion today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as CA$1.2 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 23.9x on those 2028 earnings, up from 20.9x today. This future PE is greater than the current PE for the CA Consumer Retailing industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 2.06% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.22%, as per the Simply Wall St company report.

Metro Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Intensifying competition from discount grocers and increased promotional activity, especially in Ontario, may lead to price wars and margin compression, directly challenging Metro's ability to grow revenues and maintain net margins.

- Acceleration of inflation in certain commodity categories (notably meat) and new tariffs are prompting more vendors to seek price increases, raising Metro's cost of goods and pressuring gross margins if those costs cannot be fully passed on to consumers.

- Elevated and rising SG&A expenses from recurring costs tied to new automated distribution centers and the rapid shift to online/third-party delivery partnerships could compress operating margins, especially if e-commerce growth requires higher-than-expected capital outlays with uncertain near-term profitability.

- Metro's high geographic concentration in Quebec and Ontario exposes it to regional economic downturns, competitive threats from new discount banner expansions, and demographic shifts that could lead to more volatile revenues and earnings.

- The shift towards generic pharmaceuticals (particularly pending Ozempic patent expiries) may dilute Metro's pharmacy margins, as distribution fees on generics are lower, posing a risk to long-term earnings growth in this segment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$105.909 for Metro based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$118.0, and the most bearish reporting a price target of just CA$80.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$24.1 billion, earnings will come to CA$1.1 billion, and it would be trading on a PE ratio of 23.9x, assuming you use a discount rate of 6.2%.

- Given the current share price of CA$98.47, the analyst price target of CA$105.91 is 7.0% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.