Key Takeaways

- Strong growth in defense, space, and cybersecurity positions Calian to capitalize on expanding government budgets and heightened digital infrastructure needs.

- Targeted acquisitions and recurring healthcare contracts support margin expansion, diversification, and increased shareholder value through enhanced earnings and buybacks.

- Reliance on defense contracts, acquisition risks, segment underperformance, rising competition, and regulatory pressures threaten revenue stability, margins, and long-term profitability.

Catalysts

About Calian Group- Provides business products and solutions in Canada and internationally.

- Substantial recent growth in the defense business (now 50% of revenues and up 19% YoY) alongside a $1.5 billion backlog and a >$1 billion deal pipeline in Europe positions Calian to benefit from rising global defense spending-especially as public sector budgets in Canada and Europe expand in response to geopolitical instability-supporting strong future revenue and earnings growth.

- Intensifying investments in space and cybersecurity solutions-reinforced by increasing digitalization of critical infrastructure and heightened cyber threats-provide Calian with opportunities for premium, differentiated offerings, which should improve margin mix and drive robust EBITDA growth as these segments expand.

- Ongoing healthcare contract expansions (e.g., AMS acquisition and expanded HCPR contract), as well as the sustained need for healthcare and telehealth solutions driven by aging populations and government recruitment targets, underpin stable and recurring high-margin revenue growth for Calian's health business.

- Strategic M&A focus on high-margin, synergistic targets in defense, healthcare, and advanced tech bolsters diversification, accelerates revenue growth, and broadens Calian's cross-solution capabilities, supporting improved net margins and further enhancing the long-term earnings profile.

- Accelerated buyback activity (5% of shares YTD, targeting 6% for FY25), compounded by strong free cash flow generation and a robust balance sheet, will likely boost EPS and shareholder value as recurring revenue and improved segment performance materialize.

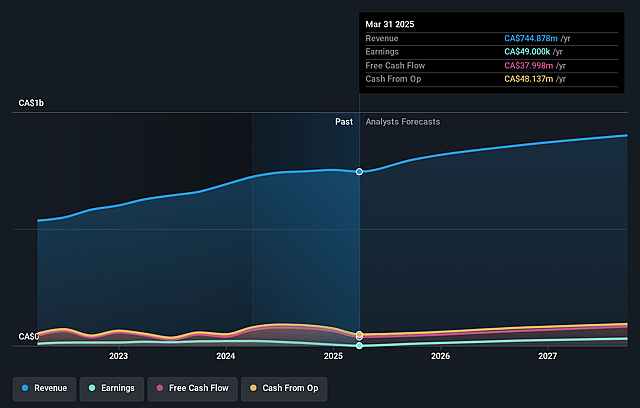

Calian Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Calian Group's revenue will grow by 6.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.1% today to 5.0% in 3 years time.

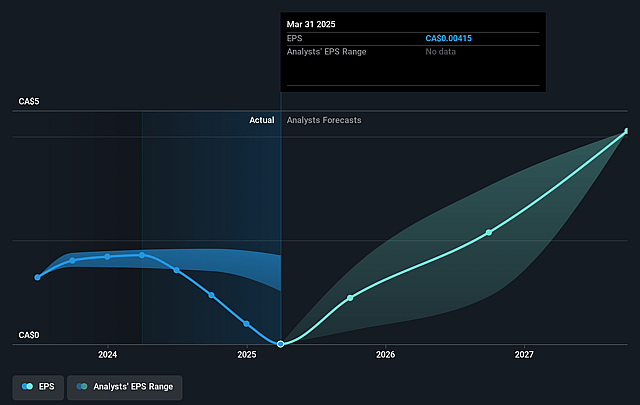

- Analysts expect earnings to reach CA$45.3 million (and earnings per share of CA$5.88) by about September 2028, up from CA$-659.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.8x on those 2028 earnings, up from -878.0x today. This future PE is lower than the current PE for the CA Commercial Services industry at 21.4x.

- Analysts expect the number of shares outstanding to decline by 3.87% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.49%, as per the Simply Wall St company report.

Calian Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent underperformance in the ITCS segment-including ongoing 10% revenue decline, management turnover, and delayed recovery-could signal structural challenges or market share loss, potentially eroding overall revenue and compressing margins if not reversed.

- Heavy reliance on government defense budgets (notably in Canada and Europe, where defense now contributes 50% of revenues) creates elevated exposure to political risk, procurement delays, or abrupt budget shifts, which could lead to revenue volatility and unpredictable contract timing.

- Aggressive expansion via acquisitions, while fueling growth, heightens integration risk and raises goodwill and debt levels; future acquisition missteps or rising valuation multiples for targets could trigger impairment charges and impact net earnings.

- Increased global competition in defense, IT, and healthcare services from both multinational primes and niche specialists may drive down average contract margins, dilute differentiation, and force Calian to spend more on sales, marketing, or hiring, thereby pressuring EBITDA and operating profits.

- Rising compliance costs from security, privacy, and ESG regulations, alongside talent shortages and wage inflation in specialized fields like cyber and engineering, risk inflating operating expenses and could constrain net margins and free cash flow over the long term.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$59.143 for Calian Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$911.0 million, earnings will come to CA$45.3 million, and it would be trading on a PE ratio of 15.8x, assuming you use a discount rate of 6.5%.

- Given the current share price of CA$51.0, the analyst price target of CA$59.14 is 13.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.