Last Update 14 Nov 25

Fair value Increased 5.22%BDI: Future Dividend Increase Will Support Ongoing Bullish Momentum

The analyst price target for Black Diamond Group has increased from C$16.75 to C$17.63. Analysts cited stronger revenue growth expectations and recent upward price target revisions as factors supporting a more optimistic outlook.

Analyst Commentary

Recent analyst revisions reveal growing confidence in Black Diamond Group's outlook, with notable upward adjustments in price targets. These changes reflect updated perspectives on the company's performance and future prospects.

Bullish Takeaways

- Bullish analysts have substantially increased their price targets, suggesting expectations for continued revenue growth and robust business execution.

- Ongoing positive earnings momentum is seen as a driver for higher valuation multiples in the near term.

- Analysts cite improved operational efficiency, which supports stronger margins and a more positive profitability outlook.

- Rising demand in Black Diamond Group's core markets is expected to contribute to further top-line expansion.

Bearish Takeaways

- Some analysts remain cautious about execution risks related to expanding into new markets or segments.

- Potential macroeconomic headwinds could impact customer spending and may limit growth opportunities.

- Current valuation levels after recent stock appreciation might restrict additional upside without financial results exceeding expectations.

What's in the News

- Black Diamond Group Limited announced a 29% increase to its quarterly dividend, raising it from $0.035 to $0.045 per quarter. This change represents the fifth dividend increase since its reinstatement in 2021 (Key Developments).

- The fourth quarter dividend of $0.045 is scheduled to be paid on or about January 15, 2026, to shareholders of record as of December 31, 2025 (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen from CA$16.75 to CA$17.63. This reflects updated fair value estimates based on recent performance and outlook.

- Discount Rate has edged up slightly from 6.45% to 6.46%. This indicates a marginal increase in perceived risk or required return.

- Revenue Growth expectations have increased significantly, moving from 14.68% to 17.09%. This signals a more optimistic outlook for sales expansion.

- Net Profit Margin has declined from 12.65% to 9.40%. This suggests updated forecasts for lower profitability relative to revenue.

- Future P/E has climbed from 19.18x to 25.30x. This implies investors are now willing to pay more for expected future earnings.

Key Takeaways

- Robust project pipeline, legislative tailwinds, and initiatives like LodgeLink expansion position the company for growth, margin improvement, and more stable recurring revenues.

- Strengthened financial flexibility from equity financing and lower debt enables strategic M&A and organic growth, boosting free cash flow and returns.

- Exposure to political, regulatory, and commodity risks, along with heavy capital requirements, threatens consistent growth, margin stability, and effective capital deployment.

Catalysts

About Black Diamond Group- Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions in Canada, the United States, and Australia.

- Black Diamond is seeing a significant increase in future contracted rental revenue (up 9% year-over-year) and a pipeline of projects supported by major infrastructure and resource development initiatives, particularly in Canada, which is forecasted to drive both higher asset utilization and rental rates beginning late 2025 into 2026; this underpins future revenue growth and earnings expansion.

- Government priorities and recently passed legislation (e.g., Canada's bill C5) are fostering an uptick in nation-building projects and social infrastructure, positioning Black Diamond to benefit from sustainable and rapid workforce housing demand, which should support recurrent revenue and reduce earnings volatility.

- The Modular Space Solutions segment continues to achieve record rental revenues (19% year-over-year growth), with both core and transactional fleet businesses expanding steadily across North America and Australia; this segment's margin expansion due to scale and operational leverage is likely to boost overall company net margins.

- The accelerated investment and scaling of LodgeLink, which is reaching new regions like Australia and integrating capabilities such as air travel management, is expanding the addressable market for Black Diamond's asset-light, technology-driven revenues, supporting higher-margin earnings and potential multiple expansion.

- Strengthening balance sheet flexibility via oversubscribed equity financing and reduced debt enables the company to pursue M&A, capitalize on sector consolidation, and fund organic growth in asset-light and high-ROA segments-all of which support sustained free cash flow growth and improved return on equity.

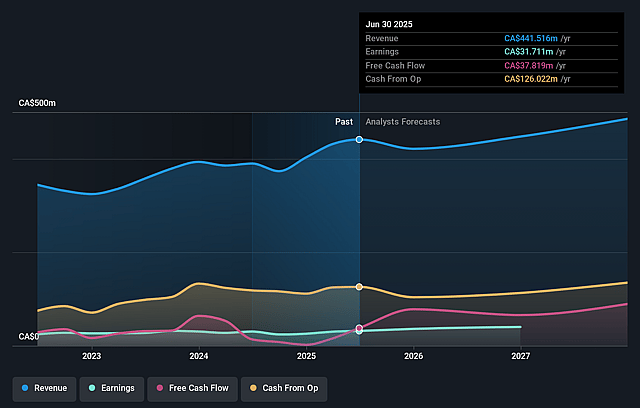

Black Diamond Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Black Diamond Group's revenue will grow by 2.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 7.2% today to 10.6% in 3 years time.

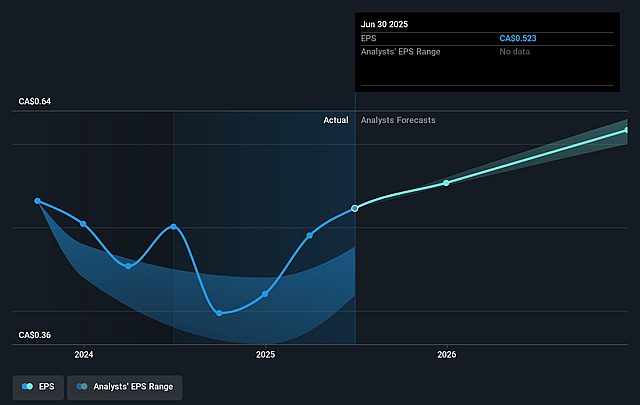

- Analysts expect earnings to reach CA$50.7 million (and earnings per share of CA$0.73) by about September 2028, up from CA$31.7 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 28.6x on those 2028 earnings, up from 24.1x today. This future PE is greater than the current PE for the CA Commercial Services industry at 21.4x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.54%, as per the Simply Wall St company report.

Black Diamond Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- A significant portion of Black Diamond's anticipated growth is based on government policy shifts (such as Canada's Bill C5) and major infrastructure project pipelines, which are subject to political reversals, regulatory delays, or cancellations-any of which could cause underutilization of fleet assets, impacting future revenue and earnings.

- Despite strong liquidity and balance sheet, Black Diamond is planning further M&A and capital investments; unsuccessful acquisitions, integration challenges, or overpayment for assets in a competitive M&A market could lead to inefficient capital allocation and lower net margins.

- Heavy reliance on the resource and oil & gas sectors, particularly for Workforce Solutions in Canada, exposes the company to commodity cycles and broader energy transition risks; a global move away from fossil fuels or sudden downturn in project starts would undermine recurring revenues and stability.

- Modular Space Solutions pricing momentum is slowing, with modest gains projected and risk of spot rates flattening or declining as contracts roll over; if market oversupply or economic slowdown occurs, utilization rates and rental income could weaken, reducing operating margins.

- The company's asset-heavy model, especially in workforce accommodations, requires ongoing capital expenditures for maintenance and replacement; as assets age, higher maintenance costs or technological obsolescence may compress margins unless sustained by consistent demand and pricing power.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$14.833 for Black Diamond Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$17.25, and the most bearish reporting a price target of just CA$13.5.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$479.0 million, earnings will come to CA$50.7 million, and it would be trading on a PE ratio of 28.6x, assuming you use a discount rate of 6.5%.

- Given the current share price of CA$11.45, the analyst price target of CA$14.83 is 22.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.