Last Update16 Aug 25Fair value Increased 34%

Driven by significant increases in both Electrovaya's future P/E ratio and net profit margin, analysts have notably raised the consensus price target from CA$4.50 to CA$6.01.

What's in the News

- Launched battery systems for airport ground support equipment in partnership with a major OEM; first commercial shipment set for August and products to be showcased at the International GSE Expo.

- Introduced multiple battery system products for robotic vehicle platforms through collaborations with three major OEMs in the US and Japan; initial deliveries to begin this quarter with commercial ramp-up in fiscal 2026.

- Received approximately $4.5 million in new purchase orders from a leading Fortune 100 e-commerce company, bringing total demand from this customer to over $20 million in fiscal 2025 for Infinity battery systems.

- Successfully completed UL2580 certification for 448 models of next-gen 24V, 36V, and 48V lithium-ion battery systems, offering industry-leading energy density; new models available to customers this year.

- Signed commercial supply agreement with Janus Electric Holdings to provide advanced high voltage Infinity batteries for electric truck conversions, supporting Janus’s zero-emission swappable battery platform.

Valuation Changes

Summary of Valuation Changes for Electrovaya

- The Consensus Analyst Price Target has significantly risen from CA$4.50 to CA$6.01.

- The Future P/E for Electrovaya has significantly risen from 8.11x to 12.54x.

- The Net Profit Margin for Electrovaya has significantly risen from 14.70% to 16.42%.

Key Takeaways

- Electrovaya's strategic focus on diverse, recurring revenue streams and manufacturing expansion suggests potential for improved revenue growth and operational efficiency.

- Avoidance of Chinese supply chains and exploration of high-margin markets enhance resilience, competitive positioning, and potential earnings improvement.

- Tariff uncertainties, execution risks, customer dependency, and market volatility challenge Electrovaya's revenue stability and gross margins.

Catalysts

About Electrovaya- Engages in the design, development, manufacture, and sale of lithium-ion batteries, battery management systems, and battery-related products for energy storage, clean electric transportation, and other specialized applications in North America.

- Electrovaya's development of recurring revenue streams, including energy service programs and software-enabled battery insights, is expected to contribute significantly over time, potentially impacting revenue growth positively.

- The expansion of lithium-ion cell manufacturing in Jamestown, NY, enabled by a $51 million loan from the Export-Import Bank of the United States, is expected to scale operations and may improve net margins through reduced supply chain vulnerabilities and production efficiencies.

- Strong order momentum, with over $25 million in new orders and visibility into sustained growth, suggests anticipated revenue growth and increased operational profitability.

- The strategic decision to avoid Chinese supply chains enhances Electrovaya's resilience against disruptions and improves its competitive positioning, potentially positively impacting gross margins and customer confidence.

- The continuous exploration of high-margin verticals, such as energy storage and robotic applications, and the strategic partnership with Sumitomo for high-voltage battery systems, could lead to higher-margin revenue streams and an improvement in overall earnings.

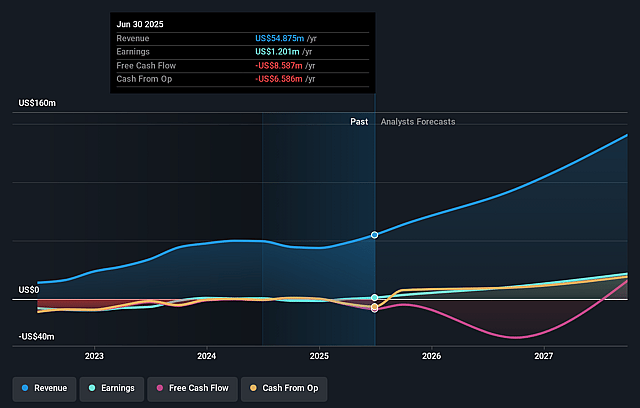

Electrovaya Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Electrovaya's revenue will grow by 50.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.1% today to 14.7% in 3 years time.

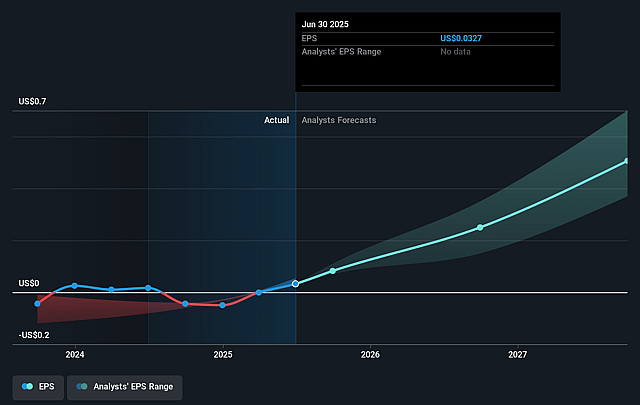

- Analysts expect earnings to reach $24.1 million (and earnings per share of $0.51) by about May 2028, up from $-30.0 thousand today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.1x on those 2028 earnings, up from -4004.7x today. This future PE is lower than the current PE for the CA Electrical industry at 9.6x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.51%, as per the Simply Wall St company report.

Electrovaya Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Tariff uncertainties and increased material costs have affected Electrovaya's components, impacting their gross margins, which could affect earnings if not managed efficiently.

- Concerns about the timely execution of key initiatives, such as the Jamestown cell production ramp-up, could impact the company's ability to meet its revenue growth projections, affecting net earnings.

- Dependency on specific large customers, such as a Fortune 100 company and a leading discount retailer, for a significant portion of orders could pose a risk to revenue stability if these customers delay or cancel orders.

- Market volatility and uncertainty, as evident in the fluctuations in the logistics and third-party logistics sectors, may affect overall order intake and future revenue streams.

- Potential competitive pressures, especially given that competitors may raise prices, could force Electrovaya to reevaluate its pricing strategy, potentially impacting future revenue and profit margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$4.498 for Electrovaya based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $164.3 million, earnings will come to $24.1 million, and it would be trading on a PE ratio of 8.1x, assuming you use a discount rate of 7.5%.

- Given the current share price of CA$4.19, the analyst price target of CA$4.5 is 6.8% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.