Last Update 05 Nov 25

Fair value Increased 0.82%ATRL: Ongoing Order Momentum Will Drive Share Performance Into 2025

AtkinsRéalis Group's analyst price target has increased modestly, rising from approximately $113.03 to $113.96. This change is based on updated analyst estimates that reflect an ongoing positive earnings outlook and recent upward revisions in target prices.

Analyst Commentary

Recent analyst actions have highlighted a generally optimistic tone regarding AtkinsRéalis Group's prospects, with several firms increasing their price targets in response to ongoing earnings momentum and improved growth expectations. Below is a summary of the prevailing views from the analyst community.

Bullish Takeaways- Bullish analysts have continued to raise target prices, signaling confidence in the company's robust fundamentals and upward earnings trajectory.

- Improved revenue growth execution and the company's ability to deliver on operational performance have prompted positive reassessments of valuation.

- Consistent Buy and Outperform ratings reflect expectations that AtkinsRéalis can maintain or accelerate its current pace of margin expansion and top-line improvement.

- Some analysts are factoring in continued sector tailwinds and strengthening order pipelines, which support a favorable outlook for long-term growth.

- Bearish analysts have shown some caution by lowering price targets when performance or guidance fell short of earlier elevated expectations.

- Concerns remain about the company's ability to sustain recent momentum against rising cost pressures and competitive dynamics in the sector.

- Execution risk is a focus, especially if order conversions or project timing face unforeseen disruptions.

What's in the News

- AtkinsRéalis Group Inc. (TSX:ATRL) has been added to the FTSE All-World Index (USD), reflecting increasing recognition on global markets (Key Developments).

- The company launched SIMULATOR, a new suite of digital resilience planning solutions for cities, transportation, and critical infrastructure at the 2025 ITS World Congress. This builds on the City Simulator platform (Key Developments).

- Management confirmed a primary focus on inorganic growth and continued investment in bolt-on and tuck-in acquisitions, particularly in the U.S. and other strategic markets. The company is not aiming for transformational acquisitions in the near term (Key Developments).

- AtkinsRéalis repurchased 1,604,500 shares from April to June 2025, completing the buyback of nearly two million shares announced in March for a total of CAD 154.9 million (Key Developments).

- The group raised full-year 2025 earnings guidance with a higher outlook for Nuclear revenue and record backlog, despite adjusting its Engineering Services organic revenue growth outlook downward for certain regions (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, moving from approximately CA$113.03 to CA$113.96.

- The discount rate has inched higher, now at 7.47 percent compared to the previous 7.38 percent.

- Revenue growth assumptions have edged down marginally, from 7.64 percent to 7.59 percent.

- The net profit margin projection has increased modestly, rising from 6.90 percent to 6.91 percent.

- The future P/E ratio estimate has gone up slightly, changing from 22.24x to 22.49x.

Key Takeaways

- Surging demand in nuclear and infrastructure markets, supported by government policies and technology leadership, drives strong backlog growth and recurring revenue opportunities.

- Strategic shift toward high-value services and disciplined capital allocation is expanding margins and positioning the company for sustained, outsized growth across core end markets.

- Revenue and earnings growth face significant risks from project delays, reliance on nuclear contracts, acquisition integration challenges, and persistent margin volatility in key markets.

Catalysts

About AtkinsRéalis Group- Provides professional services and project management, and capital investment services in United Kingdom, Canada, the United States, Saudi Arabia, and internationally.

- Record backlog growth, especially in Nuclear (backlog up 223% YoY to $5.6B), reflects surging demand as global energy transition and decarbonization accelerate; this large contracted pipeline is likely to drive sustained revenue and EBITDA growth for several years.

- Strategic capital allocation-industry-leading balance sheet, recent debt paydown, and clear priority on reinvesting in organic and bolt-on M&A-positions AtkinsRéalis to capture outsized revenue growth in expanding end markets (transport, water, renewables, power) as infrastructure spending increases globally.

- Margin expansion is materializing as the company pivots away from lower-margin fixed-price construction, with high-value services (engineering, advisory, project management) now driving segment adjusted EBITDA margin increases (e.g., 16% in Engineering Services, 25% in Nuclear), supporting improved long-term profitability and net margins.

- Government policy tailwinds and announced multi-year public infrastructure commitments in core markets (e.g., $1.3T UK infrastructure plan, Canadian infrastructure investments, U.S. Department of Transportation contracts) underpin predictable and recurring revenue streams ahead as infrastructure renewal and urbanization trends persist.

- Acceleration of nuclear new build and life extension projects-underpinned by AtkinsRéalis' technology leadership and strategic partnerships (EDF, SMR projects)-creates a multi-year growth opportunity, directly supporting both top-line revenue and recurring earnings, placing the company at the center of the global shift toward resilient, low-carbon energy infrastructure.

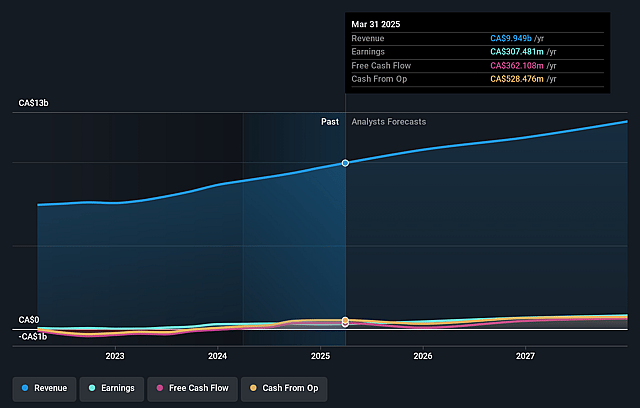

AtkinsRéalis Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AtkinsRéalis Group's revenue will grow by 7.4% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 24.7% today to 7.0% in 3 years time.

- Analysts expect earnings to reach CA$896.4 million (and earnings per share of CA$5.33) by about September 2028, down from CA$2.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.6x on those 2028 earnings, up from 6.1x today. This future PE is lower than the current PE for the CA Construction industry at 24.5x.

- Analysts expect the number of shares outstanding to decline by 5.15% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.39%, as per the Simply Wall St company report.

AtkinsRéalis Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Lowered 2025 organic revenue growth outlook in key Engineering Services Regions (USLA and EMEA), as a result of project delays, contract terminations, and reprioritization of major programs (e.g., in Saudi Arabia and EMEA), increases risk of slower long-term revenue growth than previously targeted.

- Organic revenue contraction in core U.S. and EMEA geographies-despite short-term optimism-signals potential structural demand fluctuations and exposes the business to ongoing economic volatility, which could weigh on future revenue and profitability.

- Execution risk surrounding the company's aggressive bolt-on and tuck-in acquisition strategy, including integration challenges and potential overpayment, could result in unexpected write-downs or impairment charges that negatively affect earnings and capital allocation effectiveness.

- Heavy reliance on nuclear segment growth and large, lumpy CANDU/new build contracts introduces revenue concentration risk; failure to secure new nuclear build or life-extension wins, or regulatory/capacity bottlenecks, could materially impair medium

- and long-term revenue and earning streams.

- Persistent historic issues in fixed-price/LSTK and lower-margin segments, as well as exposure to project delays, volatile government funding, and cost overruns, may continue to constrain margin expansion and lead to earnings volatility, hindering sustainable improvements in net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$110.714 for AtkinsRéalis Group based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$124.0, and the most bearish reporting a price target of just CA$95.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$12.8 billion, earnings will come to CA$896.4 million, and it would be trading on a PE ratio of 21.6x, assuming you use a discount rate of 7.4%.

- Given the current share price of CA$94.21, the analyst price target of CA$110.71 is 14.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.