Key Takeaways

- Global expansion and infrastructure investments are driving diversified, visible revenue growth, supported by strong demand trends and a robust project pipeline.

- Operational improvements, financial discipline, and innovation are enhancing margins, boosting cash flow, and positioning for long-term market leadership.

- Weak Farm segment demand, high financial leverage, and dependence on key commercial projects create significant operational and financial risks amid ongoing costly transformation and evolving industry trends.

Catalysts

About Ag Growth International- Manufactures and distributes equipment for bulk agriculture commodities worldwide.

- Rapid international commercial expansion-especially in Brazil, EMEA, and India-driven by large-scale processing, handling, and storage projects, is diversifying revenue sources and creating a strong, growing order book (+15% year-over-year in Commercial), indicating visibility into sustained revenue growth through late 2025 and into 2026.

- Increasing investments in food security and agricultural infrastructure globally, including government-backed projects (e.g., corn ethanol, soy crushing, fertilizer capacity) and secular trends of higher food demand and supply chain resilience, are supporting long-term demand for AGI's integrated solutions, benefiting both revenue and margin growth.

- Structural improvements in operational efficiency, including ongoing cost optimization and the ERP system rollout, are helping to offset mix-related margin pressures, with a clear pathway for EBITDA margin expansion as farm recovery occurs and the revenue mix normalizes.

- Monetization of long-term receivables, especially in Brazil, combined with disciplined capex and working capital management, is expected to materially reduce net leverage (from 3.9x towards the low 3x range), improve free cash flow, and enhance financial flexibility for future growth investments.

- Ongoing product innovation, digital offerings, and a premium brand position-alongside market share gains in strategic regions-position AGI to capitalize on broader industry shifts toward mechanization, automation, and more advanced storage/handling technology, supporting sustainable topline and margin expansion over the medium to long term.

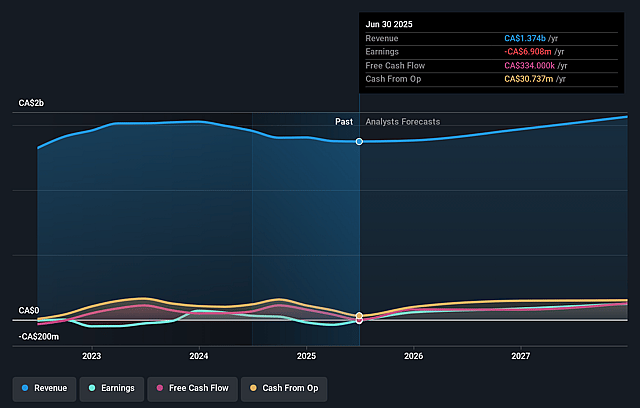

Ag Growth International Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Ag Growth International's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.5% today to 11.2% in 3 years time.

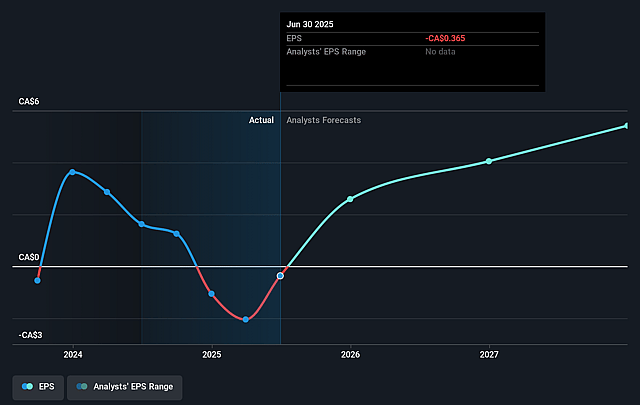

- Analysts expect earnings to reach CA$178.7 million (and earnings per share of CA$5.42) by about September 2028, up from CA$-6.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, up from -110.5x today. This future PE is lower than the current PE for the CA Machinery industry at 26.9x.

- Analysts expect the number of shares outstanding to decline by 1.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.71%, as per the Simply Wall St company report.

Ag Growth International Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness in the Farm segment, including soft commodity prices, shifting tariff policies, uncertain subsidy programs, and elevated dealer channel inventories, has created challenging market conditions with limited visibility into recovery, potentially restricting revenue and margin growth if the segment remains subdued.

- Elevated net debt leverage ratio (3.9x) driven by sizable temporary working capital investments and customer financing-particularly in Brazil-poses financial risk; any delays or failures in receivables monetization strategies could constrain free cash flow and limit ability to invest in growth or withstand earnings volatility.

- Heavy dependence on the Commercial segment, especially large-scale projects in Brazil and EMEA, concentrates risk as a slowdown, project delay, or geopolitical/infrastructure shift in these markets could materially impact consolidated revenue and EBITDA.

- Ongoing ERP implementation and operational restructuring will continue to incur transformation costs through at least 2027, which may depress net margins and earnings in the medium term, especially if growth in higher-margin Farm segment does not materialize as anticipated.

- Secular trends toward automation, digitalization, and shifts in agricultural practices (e.g., precision farming, changing crop demand, sustainability demands) could outpace AGI's product innovation or dilute demand for traditional grain handling and storage equipment, impacting future topline growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$53.375 for Ag Growth International based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be CA$1.6 billion, earnings will come to CA$178.7 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 9.7%.

- Given the current share price of CA$40.62, the analyst price target of CA$53.38 is 23.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.