Key Takeaways

- Durable demand drivers and a focus on sustainable materials position ADENTRA for long-term revenue and profit growth as market conditions improve.

- Strategic acquisitions and operational enhancements bolster competitiveness, allowing margin protection and expanded market presence despite ongoing industry challenges.

- ADENTRA faces margin pressure from weak demand, increased sourcing costs, higher debt, and tougher competition due to shifting industry dynamics and tariff impacts.

Catalysts

About ADENTRA- Engages in the wholesale distribution of architectural building products to the residential, repair and remodel, and commercial construction markets in Canada and the United States.

- Structural undersupply, ongoing urbanization, and an aging housing stock in North America underpin durable, long-term demand for both new construction and renovations; as these factors begin to eclipse near-term softness, ADENTRA is positioned for sustained revenue growth as market conditions normalize.

- Rising demand for environmentally sustainable and green building materials-driven by regulations and consumer preference-aligns with ADENTRA's diversified and expanding product offering, allowing them to capture higher-margin sales and support gross profit expansion.

- Strategic M&A, exemplified by the successful Woolf acquisition, has diversified product mix and increased exposure to higher-margin categories; continued disciplined acquisitions in a fragmented market are expected to accelerate top-line growth and contribute positively to EBITDA margins.

- Investments in procurement, supply chain optimization, and price pass-through capabilities enable ADENTRA to manage tariff volatility and inflationary shocks more effectively than peers, protecting net margins and supporting earnings resilience.

- Deepened supplier relationships and national sourcing flexibility strengthen ADENTRA's competitive positioning, enabling the company to meet rising demand for ready-to-install, value-added building products-driving both revenue and margin enhancements as labor shortages persist within the industry.

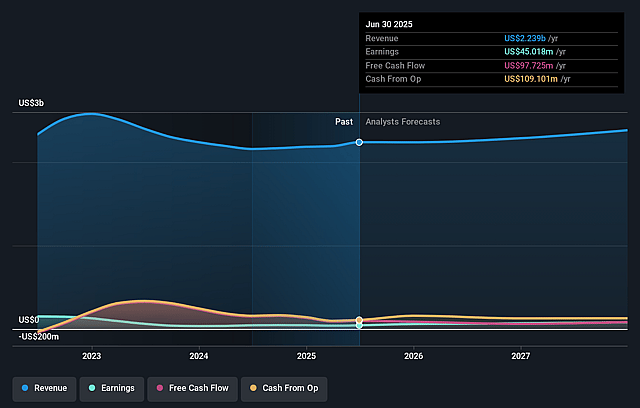

ADENTRA Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming ADENTRA's revenue will grow by 1.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.0% today to 3.8% in 3 years time.

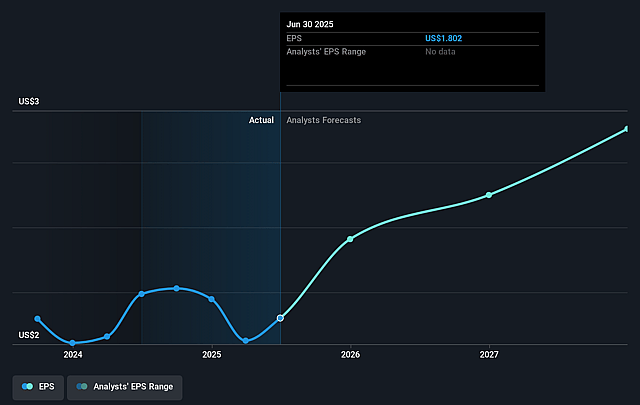

- Analysts expect earnings to reach $89.5 million (and earnings per share of $3.26) by about August 2028, up from $45.0 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 13.6x today. This future PE is lower than the current PE for the CA Trade Distributors industry at 14.3x.

- Analysts expect the number of shares outstanding to decline by 2.44% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.51%, as per the Simply Wall St company report.

ADENTRA Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Organic sales were flat in the quarter, with price increases masking modest volume declines, indicating underlying softness in demand-if this persists or worsens, it could pressure future revenue and earnings.

- ADENTRA's exposure to escalating tariffs and ongoing trade investigations (currently impacting 14% of product mix, possibly rising to 34%) poses the risk of higher sourcing costs; while the company relies on price pass-through, any inability to fully pass costs on could compress gross margins and profitability.

- The ongoing softness in residential construction, especially in the US, combined with high mortgage rates and buyer hesitancy, signals an uncertain demand environment that could drag on revenue growth in coming years.

- The company's leverage ratio increased to 3.0x (from 2.4x), driven by inventory build-if sales volumes do not normalize as anticipated or supply chain disruptions persist, inventory monetization could disappoint, leading to higher long-term debt and elevated interest costs that eat into earnings.

- With consolidation accelerating among large trade distributors and channel partners (e.g., OEM cabinet manufacturers), ADENTRA faces structural pressure from bigger, more sophisticated competitors and customers-potentially shrinking pricing power and making it harder to protect net margins and sustain organic growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of CA$43.226 for ADENTRA based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of CA$51.07, and the most bearish reporting a price target of just CA$38.05.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.3 billion, earnings will come to $89.5 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 9.5%.

- Given the current share price of CA$34.62, the analyst price target of CA$43.23 is 19.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.