Catalysts

About Companhia de Saneamento de Minas Gerais

Companhia de Saneamento de Minas Gerais provides water supply and sewage services across the state of Minas Gerais, Brazil.

What are the underlying business or industry changes driving this perspective?

- Acceleration of a BRL 70 billion investment plan through 2029, with annual CapEx expected to be roughly double the prior tariff cycle, is expected to meaningfully expand the regulatory asset base and drive stronger regulated revenue and earnings over the next decade.

- Progress on the destatization agenda and potential privatization is set to unlock greater capital allocation flexibility and faster decision making, which can support higher return projects, enhance operating discipline and lift net margins.

- Regulatory advances, including recognition of CapEx in the asset base, gain sharing mechanisms and a preliminary 5.5 percent tariff increase from 2026, are improving visibility and legal certainty, supporting more predictable cash flows and long term earnings growth.

- Continuous efficiency initiatives, such as the Shared Service Center, zero based budgeting, strategic sourcing and loss reduction programs, are already lowering personnel and service costs, creating a long runway for margin expansion and net income growth.

- Strong positioning to benefit from nationwide sanitation expansion and universalization targets, combined with potential new concessions and contracts beyond Belo Horizonte, is expected to grow the customer base and service volumes, supporting sustained revenue and EBITDA growth.

Assumptions

This narrative explores a more optimistic perspective on Companhia de Saneamento de Minas Gerais compared to the consensus, based on a Fair Value that aligns with the bullish cohort of analysts. How have these above catalysts been quantified?

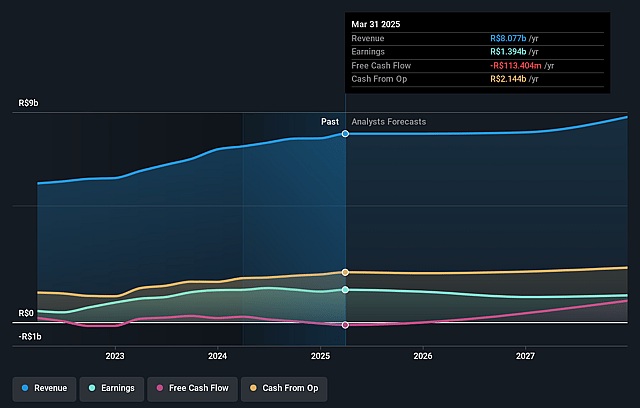

- The bullish analysts are assuming Companhia de Saneamento de Minas Gerais's revenue will grow by 7.6% annually over the next 3 years.

- The bullish analysts assume that profit margins will increase from 16.5% today to 19.2% in 3 years time.

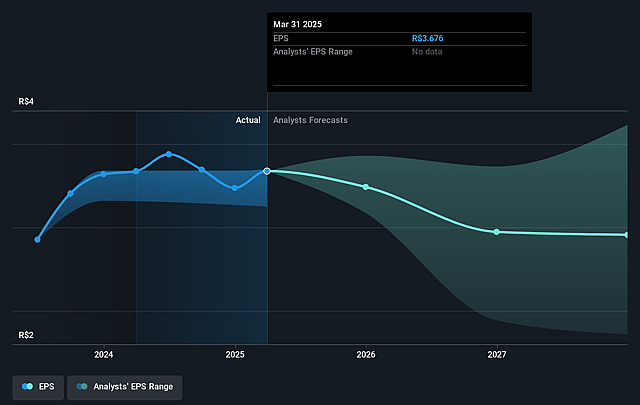

- The bullish analysts expect earnings to reach R$2.0 billion (and earnings per share of R$4.61) by about December 2028, up from R$1.4 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$661.2 million.

- In order for the above numbers to justify the price target of the more bullish analyst cohort, the company would need to trade at a PE ratio of 17.9x on those 2028 earnings, up from 12.3x today. This future PE is greater than the current PE for the BR Water Utilities industry at 12.3x.

- The bullish analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 18.16%, as per the Simply Wall St company report.

Risks

What could happen that would invalidate this narrative?

- The ambitious BRL 70 billion investment plan through 2029 relies on sustained regulatory support and access to low cost funding, but any delay in tariff recognition of CapEx, tightening in credit markets or higher real interest rates could force COPASA to scale back or slow projects. This would limit growth in the regulatory asset base and constrain long term revenue and earnings.

- The destatization and potential privatization process, although politically advanced, faces a challenging 2026 schedule and depends on continued social and legislative backing. Setbacks in approvals, legal challenges or changes in political priorities could prolong a state controlled structure with slower decision making and weaker capital allocation, weighing on margins and net income.

- The business model assumes significant tariff increases and efficiency gains to offset structurally rising costs such as energy, inflation linked debt and large scale maintenance CapEx. However, persistent cost inflation, higher than anticipated delinquency or an inability to fully pass through these pressures in tariffs would compress operating leverage and erode EBITDA margins and net profit.

- The long term plan hinges on aggressive expansion and universalization, including new concessions beyond Belo Horizonte. Failure to renew key contracts, losing tenders to competitors or underperforming in high loss metropolitan areas like Belo Horizonte could limit customer growth and prevent expected improvements in loss ratios, reducing revenue growth and undermining projected earnings.

- The push for universal sanitation and higher ESG standards requires sustained improvements in service quality and environmental performance. Project execution risks, delays in retrofitting sewage treatment plants or failure to reduce water losses despite record investments could trigger regulatory penalties, reputational damage and tighter allowed returns, which would pressure future tariffs, net margins and free cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?

- The assumed bullish price target for Companhia de Saneamento de Minas Gerais is R$56.0, which represents up to two standard deviations above the consensus price target of R$37.63. This valuation is based on what can be assumed as the expectations of Companhia de Saneamento de Minas Gerais's future earnings growth, profit margins and other risk factors from analysts on the bullish end of the spectrum.

- However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$56.0, and the most bearish reporting a price target of just R$22.25.

- In order for you to agree with the more bullish analyst cohort, you'd need to believe that by 2028, revenues will be R$10.2 billion, earnings will come to R$2.0 billion, and it would be trading on a PE ratio of 17.9x, assuming you use a discount rate of 18.2%.

- Given the current share price of R$43.68, the analyst price target of R$56.0 is 22.0% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Companhia de Saneamento de Minas Gerais?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystHighTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystHighTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystHighTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.