Last Update17 Oct 25Fair value Increased 9.54%

Analysts have raised their price target for Companhia de Saneamento de Minas Gerais from $27.95 to $30.62, citing improved projected profit margins even though revenue growth expectations are slightly lower.

What's in the News

- An Extraordinary Shareholders Meeting is scheduled for October 29, 2025, at 525 Mar de Espanha Street, Santo Antonio District, Belo Horizonte, Minas Gerais, Brazil (Key Developments)

Valuation Changes

- Fair Value: Increased from R$27.95 to R$30.62, reflecting an upward revision in the company's estimated worth.

- Discount Rate: Remains unchanged at 17.80%, indicating a stable risk assessment by analysts.

- Revenue Growth: Lowered from 6.67% to 5.27%, indicating slightly reduced expectations for topline expansion.

- Net Profit Margin: Improved from 11.64% to 15.26%, suggesting analysts expect stronger profitability.

- Future P/E: Decreased from 15.79x to 13.72x, which implies shares may be considered more attractively valued relative to projected earnings.

Key Takeaways

- Aggressive investment and regulatory improvements are boosting expectations of asset and earnings growth, while enhanced cost efficiency is seen driving long-term margin expansion.

- Strong credit ratings, low funding costs, and ESG advances are shaping confidence in sustainable financing, elevated valuations, and stable shareholder returns.

- Sustained investment in infrastructure, efficiency initiatives, and regulatory modernization position the company for stable earnings, revenue growth, and margin expansion amid strong demand fundamentals.

Catalysts

About Companhia de Saneamento de Minas Gerais- Plans, designs, performs, expands, remodels, manages, and provides water supply and sewage treatment services in Brazil and internationally.

- The company's significant ramp-up in capital expenditures (R$1.2 billion YTD, targeting R$2.5 billion for the year and an average of R$3.5 billion in coming years) is likely fueling investor expectations of accelerated growth, especially as universalization goals and expanding asset base are explicitly tied to future tariff increases and broader service coverage-suggesting revenue and regulated asset base expansion.

- Management highlighted positive regulatory momentum, including the third tariff cycle set to increase allowed WACC from 7.9% to 9.15% and the move to annual asset base recognition; these changes may be driving investor optimism that long-run earnings and margins will rise due to higher returns on an expanding asset base and more predictable, inflation-linked tariffs.

- The company's narrative around achieving high operational and cost efficiencies through restructuring, digitization, and advanced analytics may be causing markets to assume long-term sustainable improvements in net margin, embedding future margin expansion in present valuations.

- The AAA ratings affirmed by both Moody's and Fitch, coupled with ongoing efforts to lower funding costs through hedges and incentivized credit lines, may be leading to an expectation that future financing for infrastructure expansion will remain cheap-even in a riskier macro environment-supporting high investment and dividend payout expectations (impacting both free cash flow and shareholder returns).

- Ongoing ESG and sustainability efforts, as well as demonstrated advances in loss reduction and default rates, could be fueling a perception that Companhia de Saneamento de Minas Gerais will benefit disproportionately from growing institutional ESG investment flows, thus supporting higher valuation multiples on the belief of structurally lower cost of capital and long-term earnings stability.

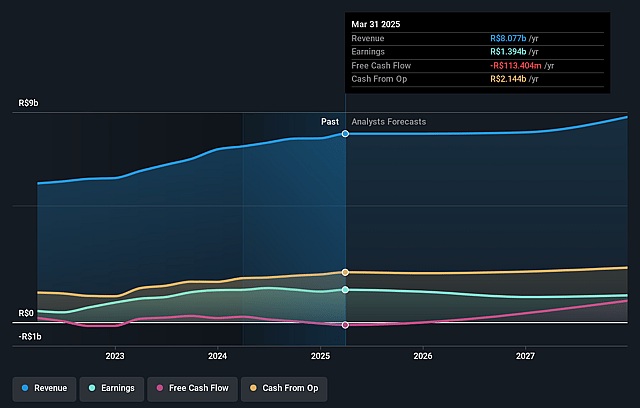

Companhia de Saneamento de Minas Gerais Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Companhia de Saneamento de Minas Gerais's revenue will grow by 5.2% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.5% today to 11.3% in 3 years time.

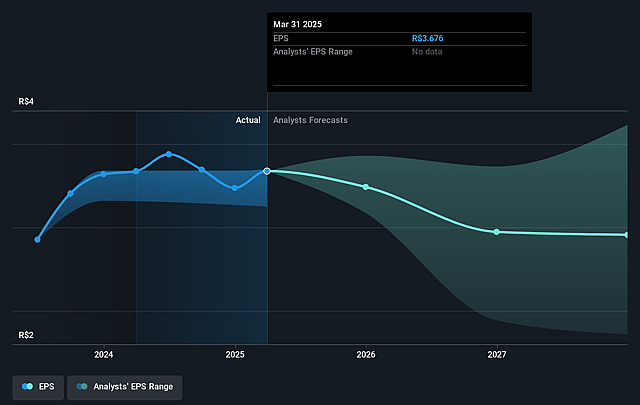

- Analysts expect earnings to reach R$1.0 billion (and earnings per share of R$2.81) by about September 2028, down from R$1.4 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting R$1.6 billion in earnings, and the most bearish expecting R$651.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 15.9x on those 2028 earnings, up from 8.4x today. This future PE is greater than the current PE for the BR Water Utilities industry at 7.4x.

- Analysts expect the number of shares outstanding to remain consistent over the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 17.8%, as per the Simply Wall St company report.

Companhia de Saneamento de Minas Gerais Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company is executing a robust, multi-year investment plan-projected to reach R$3.5 billion annually-focused on efficiency, universalization, and infrastructure upgrades, supported by regulatory annual recognition of investments and a higher WACC; this enhances the asset base and potential revenue growth.

- Operational efficiency initiatives, such as process restructuring, deployment of a shared services center, advanced analytics for fraud detection, zero-based budgeting, and scaling strategic sourcing, are already reducing personnel and operating costs and are likely to further improve net margins and earnings over time.

- The company demonstrated strong and stable operating cash generation (R$554 million in Q2) and maintains solid AAA credit ratings from Moody's and Fitch, reflecting reliable demand fundamentals, manageable leverage (2x, with guidance up to 3x), and favorable access to long-term financing, all of which support long-term earnings stability.

- Regulatory modernization-including the move to a real asset base for tariff calculation, annual investment recognition, and partial efficiency gain sharing-ensures improved cost recovery and incentivizes further investment, underpinning revenue certainty and margin stability through upcoming tariff cycles.

- Progress toward and commitment to meeting Brazil's universalization targets for sanitation-already at 99% water coverage and accelerating sewage coverage-alongside ongoing network upgrades and technological modernization (e.g., leak detection, smart meter renewal, migration to the free energy market), strongly position the company for sustainable topline and margin growth in the face of long-term industry demand trends.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$26.104 for Companhia de Saneamento de Minas Gerais based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$32.0, and the most bearish reporting a price target of just R$21.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$9.0 billion, earnings will come to R$1.0 billion, and it would be trading on a PE ratio of 15.9x, assuming you use a discount rate of 17.8%.

- Given the current share price of R$30.2, the analyst price target of R$26.1 is 15.7% lower.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.