Last Update 24 Nov 25

Fair value Decreased 5.63%PORT3: Future Index Exclusions And Lowered Outlook May Pressure Shares

Analysts have revised their price target for Wilson Sons downward from $17.65 to $16.66. This adjustment is due to more cautious assumptions for revenue growth and future price-to-earnings ratios, despite a slight improvement in the company's profit margin outlook.

What's in the News

- Wilson Sons S.A. has been dropped from multiple key indexes, including the S&P Global BMI Index, Brazil Special Corporate Governance Stock Index, Brazil Corporate Sustainability Index, Brazil Small Cap Index, and Brazil Special Tag Along Stock Index (Key Developments).

- A Board Meeting is scheduled for November 11, 2025 to consider the postponement of the Extraordinary General Meeting (Key Developments).

- A Special/Extraordinary Shareholders Meeting will be held on December 3, 2025 at praia de botafogo, 186, 4o andar, Botafogo, Rio de Janeiro, Brazil (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has decreased from R$17.65 to R$16.66.

- Discount Rate has fallen from 20.75 percent to 18.77 percent.

- Revenue Growth assumptions have edged down from 3.50 percent to 3.41 percent.

- Net Profit Margin outlook has improved from 16.89 percent to 17.45 percent.

- Future P/E ratio estimate has dropped from 23.44x to 20.43x.

Key Takeaways

- Regulatory uncertainties and lack of clarity on timelines for key processes may affect financial stability and strategic initiatives.

- Capacity expansion and strong core performance are promising, but expectations might already be reflected in the stock, limiting growth potential.

- Wilson Sons shows robust revenue and earnings growth through improved operations, financial stability, and strategic developments enhancing future capacity and resilience.

Catalysts

About Wilson Sons- Through its subsidiaries, provides port and maritime logistics and supply chain solutions primarily in Brazil.

- The expectation of delivering three new tugboats starting in late 2025 could significantly increase operational capacity in the following years, potentially boosting future revenue.

- The anticipated antitrust clearance process with CADE, expected by the second half of 2025, could introduce regulatory uncertainties, impacting net margins and delaying potential strategic initiatives or partnerships.

- The lack of a specific date for the company's OPA (public acquisition offer) introduces uncertainty regarding capital allocation and shareholder returns, potentially affecting earnings stability and future financial projections.

- Strong performance in core segments, with significant growth in terminal volumes and towage maneuvers, suggests high expectations for continued outperformance, which might already be priced into the stock, limiting future earnings growth potential.

- The strategic focus on capital allocation and maintaining high safety standards suggests potential increases in operational costs in the near term, which could compress net margins and affect future profitability.

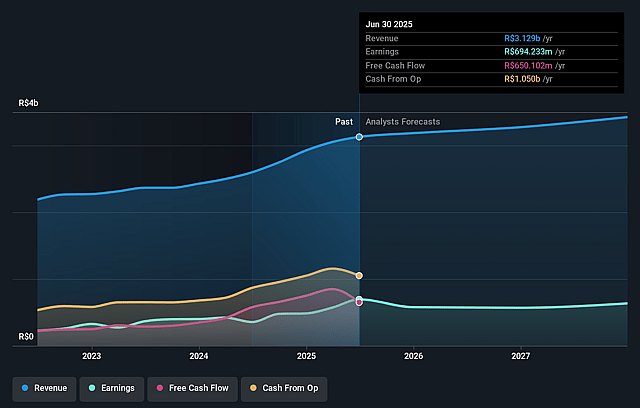

Wilson Sons Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Wilson Sons's revenue will grow by 7.5% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 17.4% today to 9.7% in 3 years time.

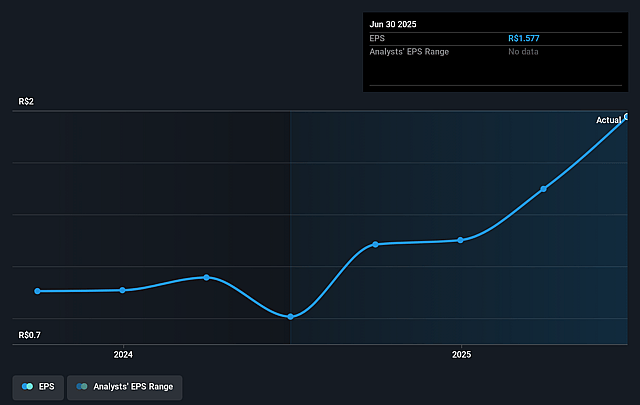

- Analysts expect earnings to reach R$333.1 million (and earnings per share of R$0.73) by about March 2028, down from R$477.2 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.8x on those 2028 earnings, up from 16.1x today. This future PE is greater than the current PE for the BR Infrastructure industry at 15.5x.

- Analysts expect the number of shares outstanding to grow by 0.09% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 21.54%, as per the Simply Wall St company report.

Wilson Sons Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Wilson Sons reported a significant increase in net revenue (24% in the third quarter and 18% for the first nine months of 2024), driven by improved operating performance. This suggests a positive trend in revenue growth.

- The company saw a substantial rise in EBITDA (47% in the quarter), particularly from strong container terminal and towage results, indicating potential for increased earnings.

- The bank leverage ratio decreased from 1.4x to 1.1x EBITDA due to lower debt and higher earnings, reflecting improved financial stability and potentially better net margins.

- Positive performance in core segments, with increased trade flows and volumes, demonstrates operational resilience and the potential for sustained revenue growth.

- Wilson Sons is pursuing strategic developments, like building new tugboats and engaging in the approval process with antitrust authorities, which could enhance future operational capacity and earnings.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$15.883 for Wilson Sons based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$18.1, and the most bearish reporting a price target of just R$12.92.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$3.4 billion, earnings will come to R$333.1 million, and it would be trading on a PE ratio of 37.8x, assuming you use a discount rate of 21.5%.

- Given the current share price of R$17.41, the analyst price target of R$15.88 is 9.6% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.