Key Takeaways

- Growth is driven by urbanization, portfolio optimization, and cost-saving initiatives like automation and generative AI, supporting expanding margins and long-term earnings.

- Strategic asset selection, new concessions, ESG projects, and potential airport portfolio changes enable recurring revenues, capital reallocation, and improved shareholder value.

- Rising leverage, regulatory and auction risks, macroeconomic exposure, and asset recycling uncertainty threaten growth, financial flexibility, and stability of Motiva Infraestrutura de Mobilidade.

Catalysts

About Motiva Infraestrutura de Mobilidade- Provides infrastructure services for highway, rail, and airport concessions in Brazil.

- Motiva is well positioned to benefit from increasing demand for transportation infrastructure driven by urbanization and population growth in major Brazilian cities, as evidenced by steady growth in toll roads, rails, and airports-supporting higher future project volumes and revenue expansion.

- Ongoing efficiency gains via cost reduction, portfolio optimization (termination of loss-making assets), and automation-including the implementation of generative AI initiatives-are driving down OpEx/revenue ratios and are expected to enhance EBITDA margins and net earnings over time.

- Strategic expansion through new concessions (e.g., Sorocabana and PRVias) and a disciplined approach to asset selection and capital allocation in core growth markets (especially São Paulo and Paraná) positions Motiva for stable, annuity-like revenues and long-term earnings growth.

- Motiva's ability to participate in large-scale public and private sector investments for infrastructure modernization-including digital transformation and ESG-aligned projects-will create new service lines and revenue streams, likely boosting top-line and margin growth.

- The ongoing strategic review and potential divestment/consolidation of the airport portfolio could unlock significant capital, reduce leverage, and enable reinvestment into high-return assets, positively impacting free cash flow, balance sheet strength, and overall shareholder value.

Motiva Infraestrutura de Mobilidade Future Earnings and Revenue Growth

Assumptions

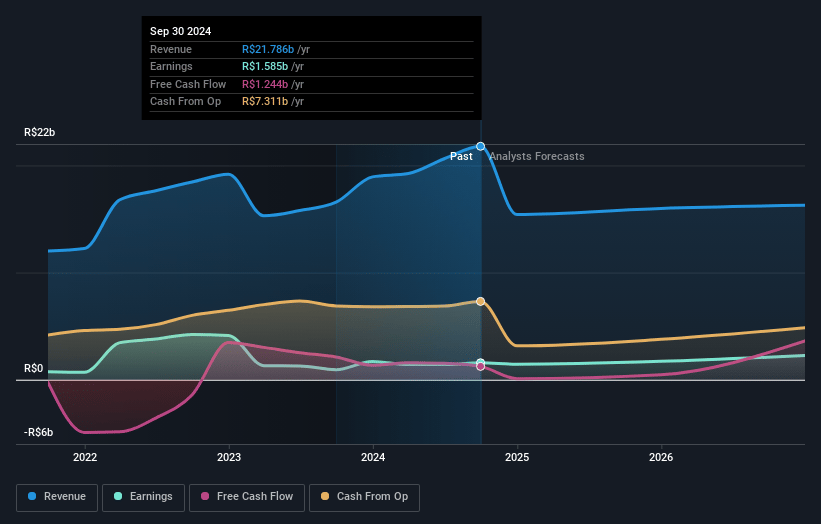

How have these above catalysts been quantified?- Analysts are assuming Motiva Infraestrutura de Mobilidade's revenue will decrease by 4.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 6.7% today to 15.2% in 3 years time.

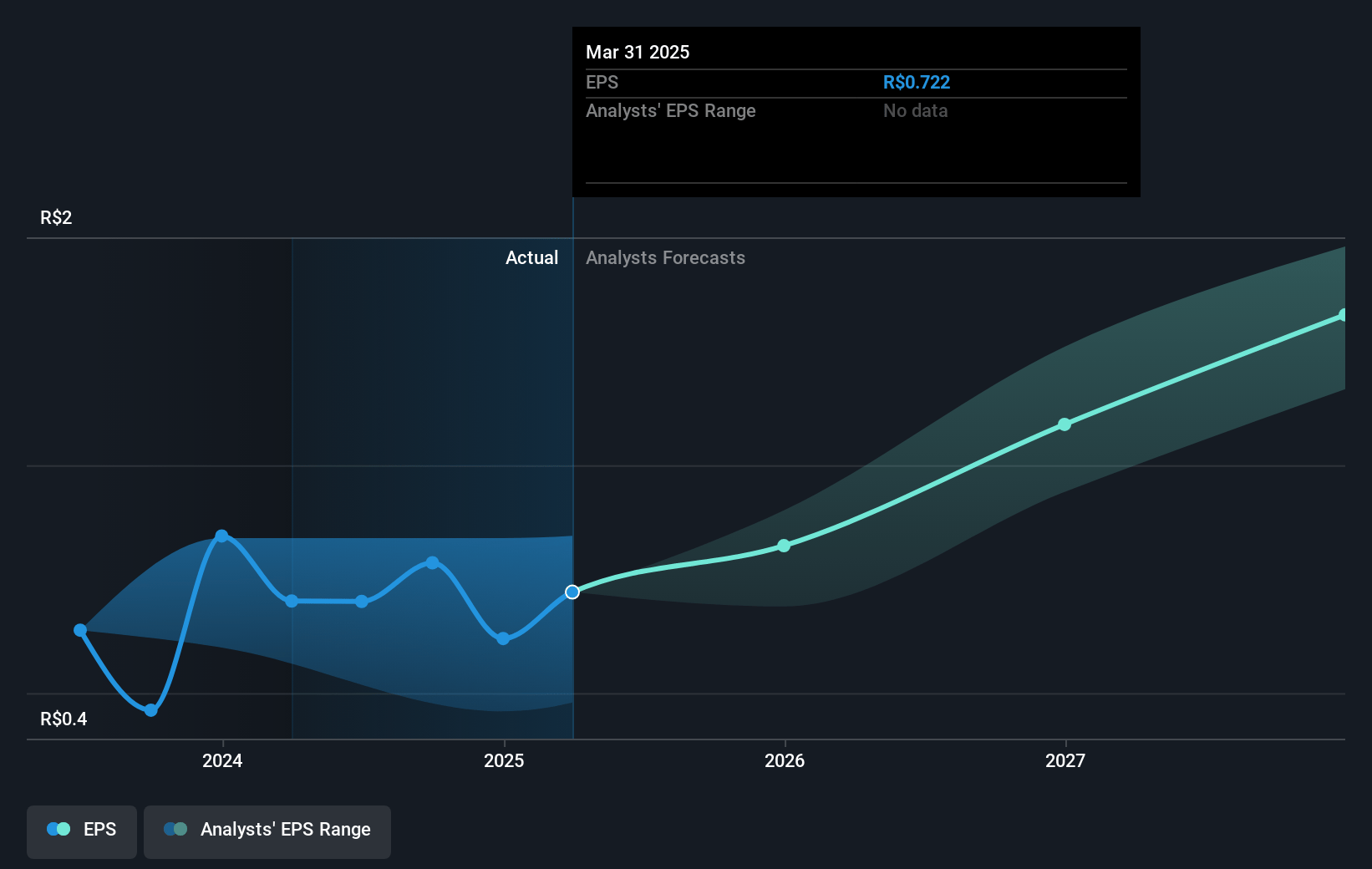

- Analysts expect earnings to reach R$2.9 billion (and earnings per share of R$1.45) by about July 2028, up from R$1.5 billion today. However, there is some disagreement amongst the analysts with the more bearish ones expecting earnings as low as R$2.4 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 21.3x on those 2028 earnings, up from 18.3x today. This future PE is greater than the current PE for the BR Infrastructure industry at 14.3x.

- Analysts expect the number of shares outstanding to decline by 0.39% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 24.07%, as per the Simply Wall St company report.

Motiva Infraestrutura de Mobilidade Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Rising indebtedness (net debt up 29% YoY, leverage now at 3.6x EBITDA, above company's preferred 2.5–3.5x range) could constrain future investment capacity and subject Motiva to higher refinancing costs, directly impacting net income and financial flexibility.

- Dependence on government contracts, regulatory approvals, and tariff adjustments for both toll roads and rails exposes the company to political and regulatory risk; adverse changes or delays may reduce revenue certainty and compress net margins.

- Increased competitive pressure in upcoming auctions-especially in priority markets like São Paulo and Paraná-alongside Motiva's selective approach, may limit its ability to grow the portfolio or sustain annuity-like revenues, threatening long-term top-line growth and market share.

- Persistent exposure to macroeconomic volatility, including fluctuations in IPCA inflation (which affects debt cost) and potential cyclical downturns in passenger or freight volumes, may diminish earnings stability and erode EBITDA margins.

- Strategic uncertainty around asset recycling (postponed until more favorable macro conditions) and potential complexity in airport portfolio divestiture could delay planned deleveraging, introduce earnings volatility, and heighten execution risk related to the company's long-term capital allocation plans.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of R$16.317 for Motiva Infraestrutura de Mobilidade based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of R$18.5, and the most bearish reporting a price target of just R$12.4.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be R$19.2 billion, earnings will come to R$2.9 billion, and it would be trading on a PE ratio of 21.3x, assuming you use a discount rate of 24.1%.

- Given the current share price of R$13.24, the analyst price target of R$16.32 is 18.9% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.